Tidal Investments LLC raised its position in F5, Inc. (NASDAQ:FFIV - Free Report) by 22.1% in the third quarter, according to its most recent disclosure with the SEC. The firm owned 12,825 shares of the network technology company's stock after acquiring an additional 2,325 shares during the period. Tidal Investments LLC's holdings in F5 were worth $2,824,000 as of its most recent filing with the SEC.

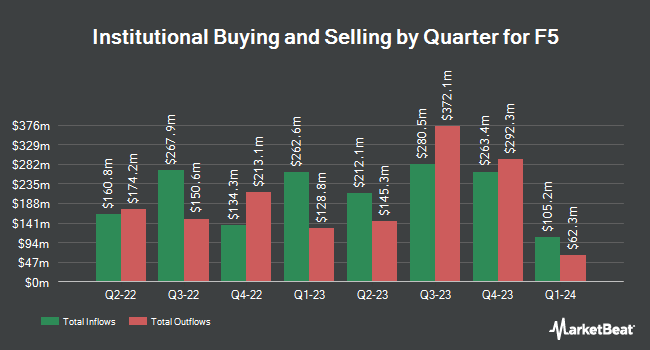

Several other hedge funds and other institutional investors have also recently modified their holdings of FFIV. Family Firm Inc. bought a new stake in F5 during the 2nd quarter worth approximately $25,000. Northwest Investment Counselors LLC bought a new stake in F5 during the third quarter worth $28,000. Quest Partners LLC raised its position in F5 by 9,100.0% in the 2nd quarter. Quest Partners LLC now owns 184 shares of the network technology company's stock valued at $32,000 after buying an additional 182 shares during the last quarter. Kathleen S. Wright Associates Inc. bought a new position in F5 during the 3rd quarter valued at $32,000. Finally, Blue Trust Inc. boosted its holdings in F5 by 49.7% during the 2nd quarter. Blue Trust Inc. now owns 241 shares of the network technology company's stock worth $46,000 after acquiring an additional 80 shares during the last quarter. Institutional investors own 90.66% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have recently commented on the stock. JPMorgan Chase & Co. increased their target price on shares of F5 from $225.00 to $250.00 and gave the company a "neutral" rating in a report on Tuesday, October 29th. Barclays lifted their target price on shares of F5 from $214.00 to $246.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 29th. StockNews.com upgraded F5 from a "buy" rating to a "strong-buy" rating in a research note on Tuesday, October 29th. Royal Bank of Canada increased their price target on F5 from $205.00 to $240.00 and gave the company a "sector perform" rating in a research report on Tuesday, October 29th. Finally, Piper Sandler upped their price objective on F5 from $186.00 to $246.00 and gave the company a "neutral" rating in a research note on Tuesday, October 29th. Seven equities research analysts have rated the stock with a hold rating, two have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, F5 has a consensus rating of "Hold" and a consensus target price of $233.56.

View Our Latest Research Report on F5

F5 Stock Performance

FFIV stock traded up $1.55 during midday trading on Monday, reaching $263.36. 501,079 shares of the company's stock traded hands, compared to its average volume of 534,198. F5, Inc. has a 52 week low of $159.01 and a 52 week high of $264.50. The company has a 50-day moving average price of $237.40 and a two-hundred day moving average price of $205.85. The firm has a market capitalization of $15.44 billion, a PE ratio of 27.39, a price-to-earnings-growth ratio of 3.52 and a beta of 1.06.

F5 (NASDAQ:FFIV - Get Free Report) last announced its quarterly earnings results on Monday, October 28th. The network technology company reported $3.67 earnings per share for the quarter, beating the consensus estimate of $3.45 by $0.22. The firm had revenue of $747.00 million for the quarter, compared to analysts' expectations of $730.43 million. F5 had a return on equity of 20.80% and a net margin of 20.13%. The company's revenue was up 5.7% on a year-over-year basis. During the same period in the prior year, the business posted $2.76 earnings per share. As a group, analysts predict that F5, Inc. will post 11.01 EPS for the current fiscal year.

F5 declared that its Board of Directors has initiated a share repurchase plan on Monday, October 28th that allows the company to buyback $1.00 billion in outstanding shares. This buyback authorization allows the network technology company to reacquire up to 7.9% of its stock through open market purchases. Stock buyback plans are often an indication that the company's board of directors believes its shares are undervalued.

Insider Buying and Selling

In other news, Director Alan Higginson sold 825 shares of the company's stock in a transaction dated Tuesday, November 19th. The stock was sold at an average price of $239.77, for a total value of $197,810.25. Following the completion of the transaction, the director now directly owns 9,882 shares in the company, valued at approximately $2,369,407.14. This represents a 7.71 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Francis J. Pelzer sold 600 shares of the stock in a transaction on Friday, September 20th. The shares were sold at an average price of $217.50, for a total transaction of $130,500.00. Following the transaction, the chief financial officer now directly owns 30,425 shares in the company, valued at approximately $6,617,437.50. This represents a 1.93 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 3,475 shares of company stock worth $775,389 over the last ninety days. 0.58% of the stock is owned by corporate insiders.

About F5

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

Further Reading

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.