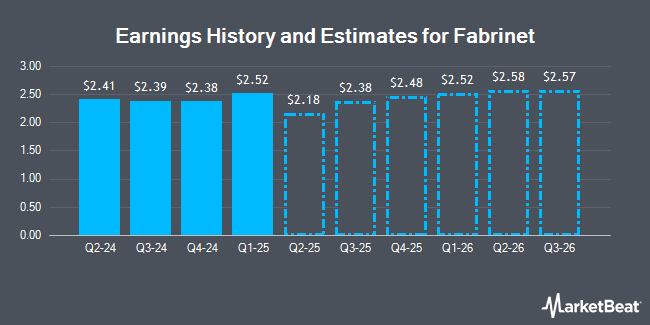

Fabrinet (NYSE:FN - Get Free Report) issued an update on its third quarter 2025 earnings guidance on Tuesday morning. The company provided earnings per share guidance of 2.430-2.510 for the period, compared to the consensus earnings per share estimate of 2.700. The company issued revenue guidance of -.

Fabrinet Stock Performance

NYSE:FN traded down $11.02 during mid-day trading on Friday, reaching $195.58. 895,717 shares of the company's stock were exchanged, compared to its average volume of 570,520. The firm has a market capitalization of $7.09 billion, a PE ratio of 21.88 and a beta of 0.89. Fabrinet has a one year low of $159.69 and a one year high of $281.79. The business's fifty day simple moving average is $216.64 and its two-hundred day simple moving average is $230.21.

Fabrinet (NYSE:FN - Get Free Report) last released its earnings results on Monday, February 3rd. The technology company reported $2.38 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.48 by ($0.10). Fabrinet had a return on equity of 18.48% and a net margin of 10.44%. As a group, equities research analysts forecast that Fabrinet will post 9.4 EPS for the current year.

Analyst Ratings Changes

Several research firms have weighed in on FN. Fox Advisors started coverage on Fabrinet in a research note on Tuesday, February 18th. They set an "overweight" rating and a $270.00 target price for the company. Rosenblatt Securities reaffirmed a "buy" rating and issued a $285.00 price objective on shares of Fabrinet in a research note on Friday, March 14th. Needham & Company LLC reissued a "buy" rating and set a $280.00 target price on shares of Fabrinet in a research note on Monday, March 17th. JPMorgan Chase & Co. reduced their price target on shares of Fabrinet from $275.00 to $265.00 and set a "neutral" rating on the stock in a research note on Tuesday, February 4th. Finally, Barclays dropped their price objective on shares of Fabrinet from $292.00 to $245.00 and set an "equal weight" rating for the company in a research note on Tuesday, February 4th. One analyst has rated the stock with a sell rating, three have assigned a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Hold" and an average target price of $250.43.

Check Out Our Latest Stock Analysis on FN

Fabrinet Company Profile

(

Get Free Report)

Fabrinet provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services in North America, the Asia-Pacific, and Europe. The company offers a range of advanced optical and electro-mechanical capabilities in the manufacturing process, including process design and engineering, supply chain management, manufacturing, printed circuit board assembly, advanced packaging, integration, final assembly, and testing.

Featured Stories

Before you consider Fabrinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fabrinet wasn't on the list.

While Fabrinet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.