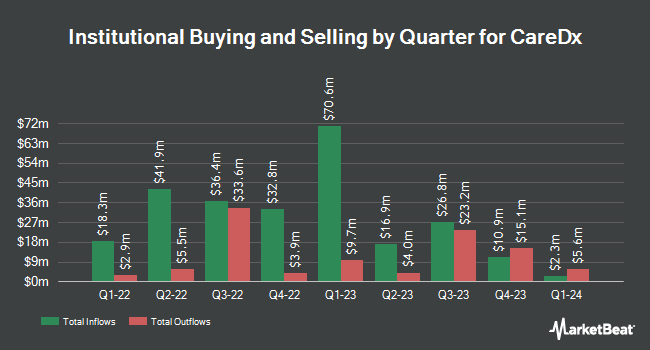

Family Office Research LLC acquired a new stake in shares of CareDx, Inc (NASDAQ:CDNA - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 89,930 shares of the company's stock, valued at approximately $1,925,000. CareDx comprises about 0.8% of Family Office Research LLC's holdings, making the stock its 21st largest holding. Family Office Research LLC owned 0.17% of CareDx at the end of the most recent reporting period.

Other hedge funds have also made changes to their positions in the company. Lord Abbett & CO. LLC bought a new position in CareDx during the 3rd quarter valued at $10,873,000. Vanguard Group Inc. lifted its holdings in CareDx by 7.1% in the 4th quarter. Vanguard Group Inc. now owns 4,859,732 shares of the company's stock worth $104,047,000 after purchasing an additional 323,554 shares during the last quarter. Renaissance Technologies LLC lifted its position in shares of CareDx by 15.9% during the 4th quarter. Renaissance Technologies LLC now owns 1,432,198 shares of the company's stock worth $30,663,000 after purchasing an additional 196,298 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. grew its stake in shares of CareDx by 25.6% in the fourth quarter. Connor Clark & Lunn Investment Management Ltd. now owns 875,197 shares of the company's stock worth $18,738,000 after acquiring an additional 178,304 shares during the last quarter. Finally, JPMorgan Chase & Co. raised its position in shares of CareDx by 720.0% during the fourth quarter. JPMorgan Chase & Co. now owns 197,912 shares of the company's stock valued at $4,237,000 after buying an additional 173,776 shares during the last quarter.

CareDx Price Performance

NASDAQ CDNA traded down $0.92 during trading hours on Wednesday, reaching $18.24. 147,667 shares of the stock traded hands, compared to its average volume of 854,437. The company has a market cap of $1.01 billion, a price-to-earnings ratio of -6.76 and a beta of 2.18. CareDx, Inc has a 1 year low of $7.42 and a 1 year high of $34.84. The stock has a 50 day simple moving average of $20.06 and a two-hundred day simple moving average of $22.59.

CareDx (NASDAQ:CDNA - Get Free Report) last announced its quarterly earnings results on Wednesday, February 26th. The company reported $1.51 EPS for the quarter, topping analysts' consensus estimates of $0.05 by $1.46. The company had revenue of $86.58 million during the quarter, compared to analyst estimates of $84.56 million. CareDx had a negative return on equity of 53.70% and a negative net margin of 45.90%. On average, sell-side analysts forecast that CareDx, Inc will post -0.9 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several analysts have weighed in on CDNA shares. StockNews.com raised shares of CareDx from a "hold" rating to a "buy" rating in a research note on Wednesday, February 26th. Stephens reaffirmed an "overweight" rating and issued a $40.00 target price on shares of CareDx in a research report on Thursday, February 27th. Wells Fargo & Company raised shares of CareDx from an "underweight" rating to an "equal weight" rating and dropped their price objective for the company from $28.00 to $24.00 in a research report on Wednesday, January 15th. Finally, HC Wainwright lowered their price objective on CareDx from $26.00 to $25.00 and set a "neutral" rating on the stock in a research note on Monday, March 3rd. Three analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $31.83.

View Our Latest Analysis on CareDx

CareDx Company Profile

(

Free Report)

CareDx, Inc engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally. It also provides AlloSure Kidney, a donor-derived cell-free DNA (dd-cfDNA) solution for kidney transplant patients; AlloMap Heart, a gene expression solution for heart transplant patients; AlloSure Heart, a dd-cfDNA solution for heart transplant patients; and AlloSure Lung, a dd-cfDNA solution for lung transplant patients.

See Also

Before you consider CareDx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CareDx wasn't on the list.

While CareDx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.