Fastly (NYSE:FSLY - Get Free Report) had its target price raised by equities researchers at Craig Hallum from $6.00 to $8.00 in a research note issued on Thursday,Benzinga reports. The brokerage presently has a "hold" rating on the stock. Craig Hallum's target price suggests a potential upside of 1.65% from the stock's previous close.

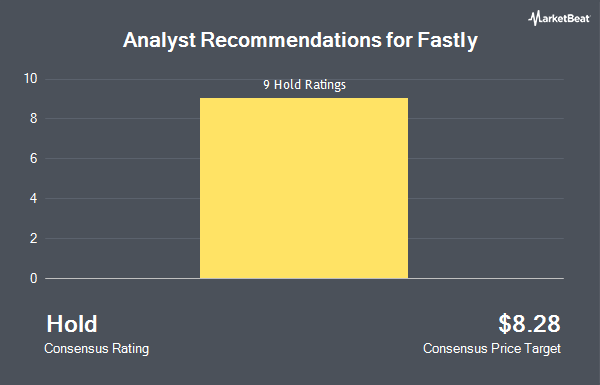

FSLY has been the subject of a number of other research reports. Piper Sandler upped their price objective on Fastly from $6.00 to $8.00 and gave the company a "neutral" rating in a research note on Thursday. Royal Bank of Canada raised their target price on Fastly from $6.00 to $7.00 and gave the stock a "sector perform" rating in a research report on Thursday. Robert W. Baird lifted their price objective on Fastly from $7.00 to $8.00 and gave the stock a "neutral" rating in a report on Thursday. Raymond James cut Fastly from a "strong-buy" rating to a "market perform" rating in a research report on Tuesday, October 1st. Finally, Morgan Stanley reduced their target price on Fastly from $12.00 to $7.00 and set an "equal weight" rating for the company in a research report on Tuesday, August 27th. One analyst has rated the stock with a sell rating and eight have assigned a hold rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $7.94.

Read Our Latest Analysis on FSLY

Fastly Price Performance

NYSE FSLY traded down $0.29 on Thursday, hitting $7.87. 3,600,033 shares of the company's stock were exchanged, compared to its average volume of 3,544,247. The stock has a 50-day moving average of $7.01 and a 200-day moving average of $7.64. The stock has a market cap of $1.09 billion, a price-to-earnings ratio of -6.35 and a beta of 1.24. The company has a current ratio of 4.13, a quick ratio of 4.13 and a debt-to-equity ratio of 0.35. Fastly has a 52 week low of $5.52 and a 52 week high of $25.87.

Fastly (NYSE:FSLY - Get Free Report) last announced its quarterly earnings data on Wednesday, August 7th. The company reported ($0.07) EPS for the quarter, topping the consensus estimate of ($0.08) by $0.01. The company had revenue of $132.37 million during the quarter, compared to the consensus estimate of $131.62 million. Fastly had a negative net margin of 31.02% and a negative return on equity of 15.22%. The company's quarterly revenue was up 7.8% on a year-over-year basis. During the same quarter last year, the firm posted ($0.32) EPS. Analysts expect that Fastly will post -0.96 earnings per share for the current year.

Insiders Place Their Bets

In other Fastly news, CFO Ronald W. Kisling sold 7,449 shares of the company's stock in a transaction that occurred on Wednesday, October 16th. The shares were sold at an average price of $7.24, for a total value of $53,930.76. Following the completion of the transaction, the chief financial officer now directly owns 558,564 shares in the company, valued at $4,044,003.36. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. In other news, CEO Todd Nightingale sold 12,163 shares of the stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $6.25, for a total value of $76,018.75. Following the sale, the chief executive officer now owns 1,650,789 shares of the company's stock, valued at approximately $10,317,431.25. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CFO Ronald W. Kisling sold 7,449 shares of the firm's stock in a transaction dated Wednesday, October 16th. The stock was sold at an average price of $7.24, for a total transaction of $53,930.76. Following the completion of the sale, the chief financial officer now directly owns 558,564 shares of the company's stock, valued at approximately $4,044,003.36. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 143,450 shares of company stock valued at $891,093. Company insiders own 6.70% of the company's stock.

Hedge Funds Weigh In On Fastly

Hedge funds have recently added to or reduced their stakes in the stock. Point72 DIFC Ltd purchased a new position in shares of Fastly in the 2nd quarter valued at approximately $38,000. Cambridge Trust Co. acquired a new position in shares of Fastly in the 1st quarter valued at about $39,000. Cape Investment Advisory Inc. grew its stake in shares of Fastly by 27,666.7% during the 1st quarter. Cape Investment Advisory Inc. now owns 4,165 shares of the company's stock worth $54,000 after purchasing an additional 4,150 shares during the period. EMC Capital Management grew its holdings in Fastly by 400.0% in the second quarter. EMC Capital Management now owns 7,500 shares of the company's stock valued at $54,000 after purchasing an additional 6,000 shares during the period. Finally, Daiwa Securities Group Inc. boosted its holdings in Fastly by 95.3% in the 2nd quarter. Daiwa Securities Group Inc. now owns 8,849 shares of the company's stock worth $65,000 after buying an additional 4,318 shares during the last quarter. 79.71% of the stock is currently owned by institutional investors.

About Fastly

(

Get Free Report)

Fastly, Inc operates an edge cloud platform for processing, serving, and securing its customer's applications in the United States, the Asia Pacific, Europe, and internationally. The edge cloud is a category of Infrastructure as a Service that enables developers to build, secure, and deliver digital experiences at the edge of the internet.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fastly, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fastly wasn't on the list.

While Fastly currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.