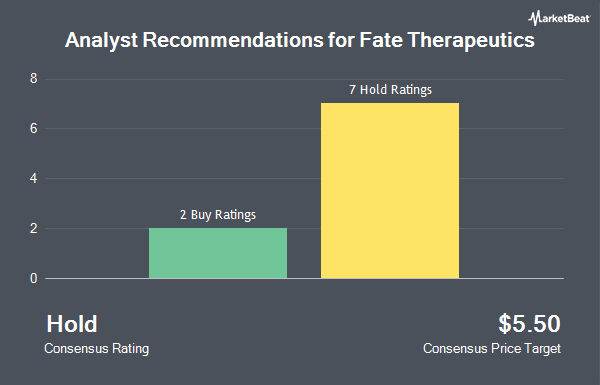

Fate Therapeutics, Inc. (NASDAQ:FATE - Get Free Report) has been given a consensus recommendation of "Hold" by the ten analysts that are presently covering the company, MarketBeat.com reports. Seven investment analysts have rated the stock with a hold rating and three have given a buy rating to the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $6.75.

Several research analysts have weighed in on the stock. Wedbush restated a "neutral" rating and set a $5.00 target price on shares of Fate Therapeutics in a research report on Tuesday, November 12th. Bank of America upgraded shares of Fate Therapeutics from an "underperform" rating to a "neutral" rating in a research report on Monday, November 18th. Needham & Company LLC restated a "hold" rating on shares of Fate Therapeutics in a research report on Tuesday, November 19th. Finally, HC Wainwright restated a "neutral" rating and set a $5.00 target price on shares of Fate Therapeutics in a research report on Thursday, August 22nd.

Check Out Our Latest Analysis on Fate Therapeutics

Fate Therapeutics Price Performance

Shares of NASDAQ:FATE traded down $0.33 on Tuesday, reaching $2.63. The company's stock had a trading volume of 3,489,556 shares, compared to its average volume of 4,034,855. Fate Therapeutics has a 52-week low of $1.96 and a 52-week high of $8.83. The stock's 50-day moving average is $2.84 and its two-hundred day moving average is $3.47.

Fate Therapeutics (NASDAQ:FATE - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The biopharmaceutical company reported ($0.40) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.42) by $0.02. The firm had revenue of $3.07 million during the quarter, compared to analysts' expectations of $0.88 million. Fate Therapeutics had a negative net margin of 1,325.43% and a negative return on equity of 45.88%. On average, analysts predict that Fate Therapeutics will post -1.72 EPS for the current year.

Hedge Funds Weigh In On Fate Therapeutics

A number of hedge funds have recently made changes to their positions in the business. Barclays PLC increased its stake in Fate Therapeutics by 245.3% during the third quarter. Barclays PLC now owns 424,277 shares of the biopharmaceutical company's stock valued at $1,485,000 after purchasing an additional 301,389 shares during the last quarter. Geode Capital Management LLC raised its stake in Fate Therapeutics by 0.5% during the third quarter. Geode Capital Management LLC now owns 2,258,246 shares of the biopharmaceutical company's stock worth $7,905,000 after acquiring an additional 10,863 shares during the period. Walleye Capital LLC raised its stake in Fate Therapeutics by 263.5% during the third quarter. Walleye Capital LLC now owns 67,609 shares of the biopharmaceutical company's stock worth $237,000 after acquiring an additional 49,009 shares during the period. BNP Paribas Financial Markets raised its stake in Fate Therapeutics by 1,307.6% during the third quarter. BNP Paribas Financial Markets now owns 174,148 shares of the biopharmaceutical company's stock worth $610,000 after acquiring an additional 161,776 shares during the period. Finally, FMR LLC raised its stake in Fate Therapeutics by 25.9% during the third quarter. FMR LLC now owns 227,981 shares of the biopharmaceutical company's stock worth $798,000 after acquiring an additional 46,892 shares during the period. Hedge funds and other institutional investors own 97.54% of the company's stock.

About Fate Therapeutics

(

Get Free ReportFate Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops programmed cellular immunotherapies for cancer and immune disorders worldwide. The company's chimeric antigen receptor (CAR)-targeted NK and T-cell product candidates include FT576 to treat multiple myeloma, and FT522, to treat lymphoma and autoimmune disorders.

See Also

Before you consider Fate Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fate Therapeutics wasn't on the list.

While Fate Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.