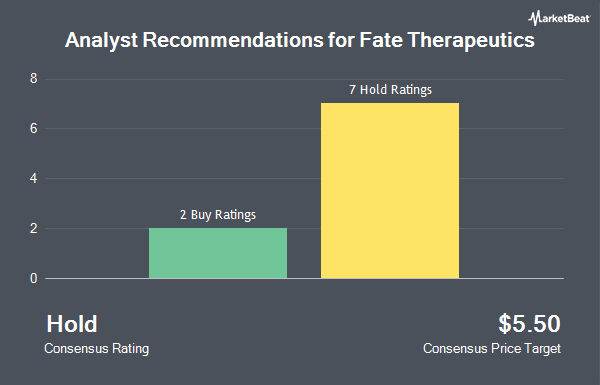

Fate Therapeutics, Inc. (NASDAQ:FATE - Get Free Report) has been assigned an average recommendation of "Hold" from the twelve ratings firms that are currently covering the company, Marketbeat.com reports. One investment analyst has rated the stock with a sell recommendation, seven have assigned a hold recommendation and four have issued a buy recommendation on the company. The average 1 year target price among analysts that have updated their coverage on the stock in the last year is $6.90.

FATE has been the topic of several research reports. HC Wainwright reissued a "neutral" rating and issued a $5.00 price target on shares of Fate Therapeutics in a research report on Thursday, August 22nd. Needham & Company LLC reissued a "hold" rating on shares of Fate Therapeutics in a report on Wednesday, August 14th.

Read Our Latest Stock Analysis on FATE

Fate Therapeutics Stock Performance

NASDAQ:FATE traded down $0.14 on Friday, reaching $2.41. The company's stock had a trading volume of 820,811 shares, compared to its average volume of 2,182,081. The business's 50-day moving average price is $3.27 and its two-hundred day moving average price is $3.67. Fate Therapeutics has a 1-year low of $1.91 and a 1-year high of $8.83. The firm has a market cap of $274.45 million, a PE ratio of -1.49 and a beta of 1.88.

Fate Therapeutics (NASDAQ:FATE - Get Free Report) last released its quarterly earnings data on Tuesday, August 13th. The biopharmaceutical company reported ($0.33) earnings per share for the quarter, beating the consensus estimate of ($0.47) by $0.14. The company had revenue of $6.77 million for the quarter, compared to the consensus estimate of $1.47 million. Fate Therapeutics had a negative return on equity of 44.09% and a negative net margin of 1,426.67%. As a group, sell-side analysts expect that Fate Therapeutics will post -1.73 EPS for the current year.

Institutional Trading of Fate Therapeutics

Large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. boosted its holdings in Fate Therapeutics by 6.6% in the first quarter. Vanguard Group Inc. now owns 9,911,007 shares of the biopharmaceutical company's stock worth $72,747,000 after purchasing an additional 617,644 shares in the last quarter. Deerfield Management Company L.P. Series C increased its stake in shares of Fate Therapeutics by 62.3% in the 2nd quarter. Deerfield Management Company L.P. Series C now owns 3,555,871 shares of the biopharmaceutical company's stock valued at $11,663,000 after purchasing an additional 1,365,463 shares during the last quarter. Assenagon Asset Management S.A. raised its stake in Fate Therapeutics by 1.0% during the second quarter. Assenagon Asset Management S.A. now owns 2,574,703 shares of the biopharmaceutical company's stock worth $8,445,000 after buying an additional 26,399 shares during the last quarter. Dimensional Fund Advisors LP lifted its position in shares of Fate Therapeutics by 100.4% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,130,280 shares of the biopharmaceutical company's stock valued at $6,987,000 after acquiring an additional 1,067,101 shares during the period. Finally, Acadian Asset Management LLC raised its position in shares of Fate Therapeutics by 17.2% during the second quarter. Acadian Asset Management LLC now owns 2,008,862 shares of the biopharmaceutical company's stock worth $6,587,000 after purchasing an additional 294,738 shares during the period. 97.54% of the stock is currently owned by institutional investors and hedge funds.

About Fate Therapeutics

(

Get Free ReportFate Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops programmed cellular immunotherapies for cancer and immune disorders worldwide. The company's chimeric antigen receptor (CAR)-targeted NK and T-cell product candidates include FT576 to treat multiple myeloma, and FT522, to treat lymphoma and autoimmune disorders.

Read More

Before you consider Fate Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fate Therapeutics wasn't on the list.

While Fate Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.