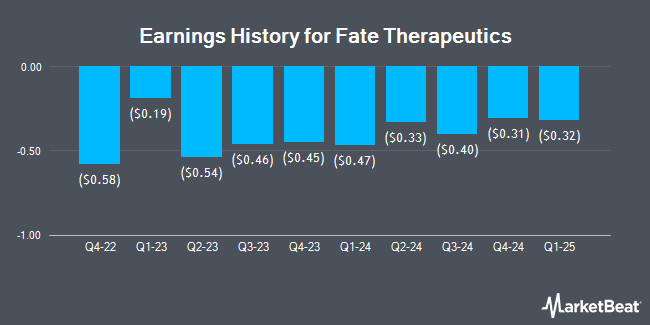

Fate Therapeutics (NASDAQ:FATE - Get Free Report) announced its quarterly earnings data on Wednesday. The biopharmaceutical company reported ($0.31) earnings per share for the quarter, beating the consensus estimate of ($0.44) by $0.13, Zacks reports. Fate Therapeutics had a negative return on equity of 45.88% and a negative net margin of 1,325.43%. The company had revenue of $1.86 million during the quarter, compared to analysts' expectations of $1.57 million.

Fate Therapeutics Stock Down 2.9 %

Shares of FATE traded down $0.03 during trading hours on Friday, hitting $1.01. The company had a trading volume of 1,919,180 shares, compared to its average volume of 2,571,885. The business has a fifty day moving average of $1.36 and a 200-day moving average of $2.36. The firm has a market cap of $115.74 million, a price-to-earnings ratio of -0.61 and a beta of 2.26. Fate Therapeutics has a 12 month low of $0.88 and a 12 month high of $8.74.

Insider Buying and Selling

In other news, Director Redmile Group, Llc purchased 397,964 shares of the company's stock in a transaction that occurred on Friday, December 20th. The stock was acquired at an average cost of $1.68 per share, with a total value of $668,579.52. Following the acquisition, the director now owns 12,884,277 shares in the company, valued at approximately $21,645,585.36. This trade represents a 3.19 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 5.00% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of research firms have weighed in on FATE. Wedbush restated a "neutral" rating and issued a $5.00 price target on shares of Fate Therapeutics in a research note on Thursday. Stifel Nicolaus lowered their target price on shares of Fate Therapeutics from $5.00 to $3.00 and set a "hold" rating on the stock in a report on Thursday. Bank of America raised shares of Fate Therapeutics from an "underperform" rating to a "neutral" rating in a research report on Monday, November 18th. Wells Fargo & Company decreased their price objective on shares of Fate Therapeutics from $5.00 to $4.00 and set an "equal weight" rating for the company in a research report on Thursday. Finally, Needham & Company LLC reaffirmed a "hold" rating on shares of Fate Therapeutics in a report on Thursday. Eight research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, Fate Therapeutics presently has a consensus rating of "Hold" and an average target price of $5.50.

Check Out Our Latest Report on FATE

Fate Therapeutics Company Profile

(

Get Free Report)

Fate Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops programmed cellular immunotherapies for cancer and immune disorders worldwide. The company's chimeric antigen receptor (CAR)-targeted NK and T-cell product candidates include FT576 to treat multiple myeloma, and FT522, to treat lymphoma and autoimmune disorders.

Further Reading

Before you consider Fate Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fate Therapeutics wasn't on the list.

While Fate Therapeutics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.