Federal Realty Investment Trust (NYSE:FRT - Get Free Report) issued an update on its FY 2025 earnings guidance on Thursday morning. The company provided EPS guidance of 7.100-7.220 for the period, compared to the consensus EPS estimate of 7.140. The company issued revenue guidance of -.

Federal Realty Investment Trust Price Performance

Shares of NYSE FRT traded down $6.79 during mid-day trading on Monday, reaching $105.03. The company's stock had a trading volume of 1,771,952 shares, compared to its average volume of 671,837. The firm has a market capitalization of $8.71 billion, a PE ratio of 30.53, a P/E/G ratio of 2.34 and a beta of 1.24. The company has a debt-to-equity ratio of 1.48, a current ratio of 1.56 and a quick ratio of 1.56. The stock has a fifty day moving average of $108.88 and a two-hundred day moving average of $112.07. Federal Realty Investment Trust has a 52 week low of $95.97 and a 52 week high of $118.34.

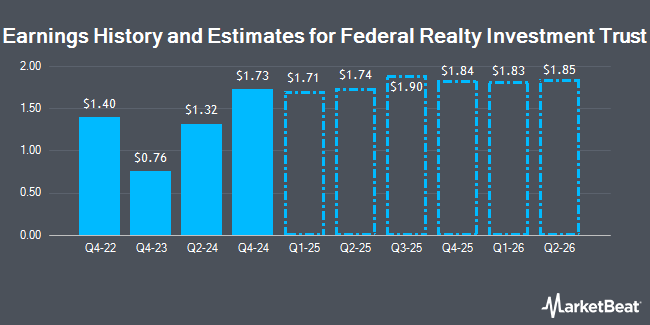

Federal Realty Investment Trust (NYSE:FRT - Get Free Report) last released its quarterly earnings data on Thursday, February 13th. The real estate investment trust reported $1.73 earnings per share for the quarter, hitting analysts' consensus estimates of $1.73. The firm had revenue of $311.44 million during the quarter, compared to analyst estimates of $311.85 million. Federal Realty Investment Trust had a return on equity of 10.01% and a net margin of 24.67%. As a group, sell-side analysts anticipate that Federal Realty Investment Trust will post 6.77 EPS for the current fiscal year.

Federal Realty Investment Trust Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Tuesday, April 1st will be paid a $1.10 dividend. This represents a $4.40 dividend on an annualized basis and a dividend yield of 4.19%. The ex-dividend date is Tuesday, April 1st. Federal Realty Investment Trust's dividend payout ratio (DPR) is 127.91%.

Analyst Ratings Changes

A number of equities analysts have recently weighed in on FRT shares. JPMorgan Chase & Co. raised Federal Realty Investment Trust from a "neutral" rating to an "overweight" rating and upped their price objective for the stock from $122.00 to $125.00 in a research note on Friday, December 20th. Scotiabank boosted their target price on Federal Realty Investment Trust from $119.00 to $126.00 and gave the stock a "sector outperform" rating in a research report on Monday, November 25th. StockNews.com upgraded Federal Realty Investment Trust from a "sell" rating to a "hold" rating in a research report on Wednesday, February 12th. Wells Fargo & Company decreased their target price on Federal Realty Investment Trust from $126.00 to $125.00 and set an "overweight" rating on the stock in a research report on Wednesday, January 29th. Finally, Stifel Nicolaus decreased their target price on Federal Realty Investment Trust from $115.75 to $115.00 and set a "hold" rating on the stock in a research report on Friday. Three investment analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $123.46.

View Our Latest Research Report on Federal Realty Investment Trust

Federal Realty Investment Trust Company Profile

(

Get Free Report)

Federal Realty Investment Trust is an equity real estate investment trust, which engages in the provision of ownership, management, and redevelopment of retail and mixed-use properties located primarily in communities where demand exceeds supply in strategically selected metropolitan markets. The company was founded in 1962 and is headquartered in North Bethesda, MD.

See Also

Before you consider Federal Realty Investment Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Realty Investment Trust wasn't on the list.

While Federal Realty Investment Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.