RPg Family Wealth Advisory LLC decreased its position in Federal Signal Co. (NYSE:FSS - Free Report) by 99.4% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 505 shares of the conglomerate's stock after selling 86,419 shares during the quarter. RPg Family Wealth Advisory LLC's holdings in Federal Signal were worth $47,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

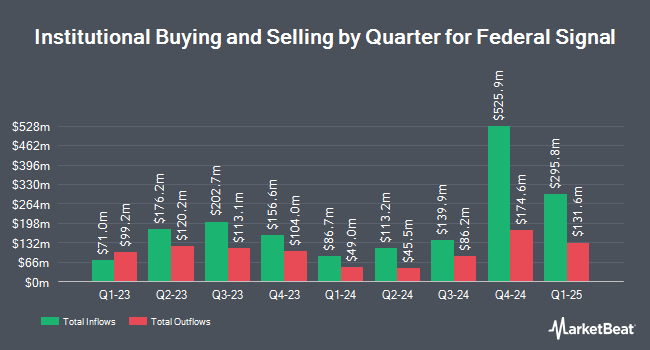

A number of other institutional investors and hedge funds have also bought and sold shares of FSS. SG Americas Securities LLC lifted its holdings in Federal Signal by 615.7% in the 2nd quarter. SG Americas Securities LLC now owns 40,292 shares of the conglomerate's stock worth $3,371,000 after buying an additional 34,662 shares during the period. Quest Partners LLC boosted its stake in Federal Signal by 4,025.9% in the 3rd quarter. Quest Partners LLC now owns 18,608 shares of the conglomerate's stock worth $1,739,000 after purchasing an additional 18,157 shares in the last quarter. Janus Henderson Group PLC increased its position in shares of Federal Signal by 197.5% during the first quarter. Janus Henderson Group PLC now owns 84,875 shares of the conglomerate's stock valued at $7,202,000 after acquiring an additional 56,347 shares in the last quarter. EULAV Asset Management boosted its position in shares of Federal Signal by 15.3% during the third quarter. EULAV Asset Management now owns 240,803 shares of the conglomerate's stock valued at $22,505,000 after buying an additional 32,000 shares during the last quarter. Finally, Vaughan Nelson Investment Management L.P. raised its holdings in shares of Federal Signal by 6.4% during the second quarter. Vaughan Nelson Investment Management L.P. now owns 413,263 shares of the conglomerate's stock valued at $34,578,000 after purchasing an additional 25,000 shares during the last quarter. 92.73% of the stock is currently owned by institutional investors.

Federal Signal Price Performance

Shares of FSS stock traded up $0.16 on Thursday, hitting $97.88. 312,755 shares of the stock traded hands, compared to its average volume of 534,036. The company has a debt-to-equity ratio of 0.19, a current ratio of 2.83 and a quick ratio of 1.36. The firm has a 50 day simple moving average of $90.41 and a two-hundred day simple moving average of $89.62. The firm has a market cap of $5.98 billion, a price-to-earnings ratio of 28.37 and a beta of 0.95. Federal Signal Co. has a 52 week low of $68.02 and a 52 week high of $102.18.

Federal Signal (NYSE:FSS - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The conglomerate reported $0.88 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.84 by $0.04. Federal Signal had a net margin of 11.57% and a return on equity of 18.46%. The company had revenue of $474.20 million for the quarter, compared to the consensus estimate of $481.71 million. During the same period in the previous year, the firm posted $0.71 EPS. Federal Signal's revenue for the quarter was up 6.2% compared to the same quarter last year. As a group, equities research analysts predict that Federal Signal Co. will post 3.34 earnings per share for the current fiscal year.

Federal Signal Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 2nd. Stockholders of record on Friday, November 15th will be issued a $0.12 dividend. The ex-dividend date is Friday, November 15th. This represents a $0.48 annualized dividend and a dividend yield of 0.49%. Federal Signal's dividend payout ratio (DPR) is presently 13.91%.

Analysts Set New Price Targets

Separately, DA Davidson cut their price target on Federal Signal from $94.00 to $90.00 and set a "neutral" rating for the company in a research note on Tuesday, November 5th.

Read Our Latest Report on FSS

Insider Buying and Selling at Federal Signal

In other Federal Signal news, Director Brenda Reichelderfer sold 25,685 shares of the firm's stock in a transaction on Friday, August 30th. The stock was sold at an average price of $92.99, for a total transaction of $2,388,448.15. Following the transaction, the director now directly owns 57,417 shares in the company, valued at $5,339,206.83. This trade represents a 30.91 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Company insiders own 3.10% of the company's stock.

Federal Signal Profile

(

Free Report)

Federal Signal Corp. engages in the design and manufacture of products and integrated solutions for municipal, governmental, industrial, and commercial customers. It operates through the Environmental Solutions Group and Safety and Security Systems Group segments. The Environment Solutions Group segment is involved in the manufacture and supply of street sweeper vehicles, sewer cleaners, vacuum loader trucks, hydro-excavation trucks, and water blasting equipment.

Featured Articles

Before you consider Federal Signal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Signal wasn't on the list.

While Federal Signal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.