Conestoga Capital Advisors LLC reduced its position in Federal Signal Co. (NYSE:FSS - Free Report) by 0.7% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,379,632 shares of the conglomerate's stock after selling 9,413 shares during the quarter. Federal Signal accounts for approximately 1.7% of Conestoga Capital Advisors LLC's holdings, making the stock its 26th biggest holding. Conestoga Capital Advisors LLC owned approximately 2.26% of Federal Signal worth $127,464,000 at the end of the most recent quarter.

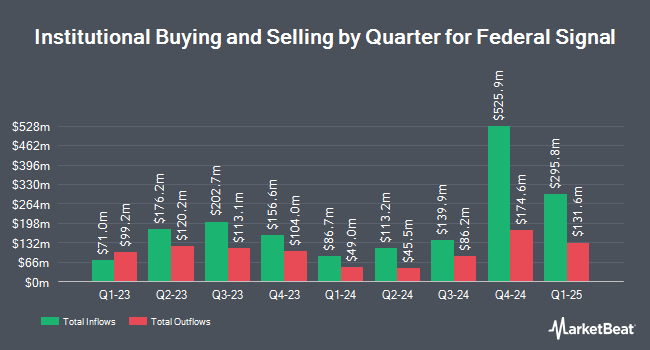

Several other hedge funds and other institutional investors have also recently modified their holdings of the business. V Square Quantitative Management LLC purchased a new stake in shares of Federal Signal in the third quarter valued at approximately $29,000. Quarry LP grew its stake in Federal Signal by 73.5% during the 3rd quarter. Quarry LP now owns 432 shares of the conglomerate's stock worth $40,000 after buying an additional 183 shares during the last quarter. Wilmington Savings Fund Society FSB purchased a new stake in shares of Federal Signal during the third quarter worth about $46,000. Millburn Ridgefield Corp acquired a new position in Federal Signal during the 3rd quarter valued at approximately $70,000. Finally, CWM LLC increased its position in shares of Federal Signal by 23.1% in the 3rd quarter. CWM LLC now owns 1,171 shares of the conglomerate's stock valued at $109,000 after acquiring an additional 220 shares during the period. 92.73% of the stock is currently owned by hedge funds and other institutional investors.

Federal Signal Stock Performance

Federal Signal stock traded up $0.03 during mid-day trading on Thursday, hitting $97.75. The company had a trading volume of 344,025 shares, compared to its average volume of 381,284. The company has a current ratio of 2.83, a quick ratio of 1.36 and a debt-to-equity ratio of 0.19. The company's fifty day moving average is $95.94 and its 200-day moving average is $92.89. Federal Signal Co. has a 12-month low of $76.03 and a 12-month high of $102.18. The company has a market capitalization of $5.97 billion, a price-to-earnings ratio of 28.33 and a beta of 1.01.

Analyst Upgrades and Downgrades

A number of equities research analysts recently commented on the company. DA Davidson dropped their target price on Federal Signal from $94.00 to $90.00 and set a "neutral" rating on the stock in a research report on Tuesday, November 5th. Raymond James reaffirmed an "outperform" rating and issued a $110.00 price objective on shares of Federal Signal in a report on Tuesday, December 24th. Finally, StockNews.com cut shares of Federal Signal from a "buy" rating to a "hold" rating in a report on Monday.

View Our Latest Stock Analysis on Federal Signal

About Federal Signal

(

Free Report)

Federal Signal Corp. engages in the design and manufacture of products and integrated solutions for municipal, governmental, industrial, and commercial customers. It operates through the Environmental Solutions Group and Safety and Security Systems Group segments. The Environment Solutions Group segment is involved in the manufacture and supply of street sweeper vehicles, sewer cleaners, vacuum loader trucks, hydro-excavation trucks, and water blasting equipment.

Read More

Before you consider Federal Signal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Signal wasn't on the list.

While Federal Signal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.