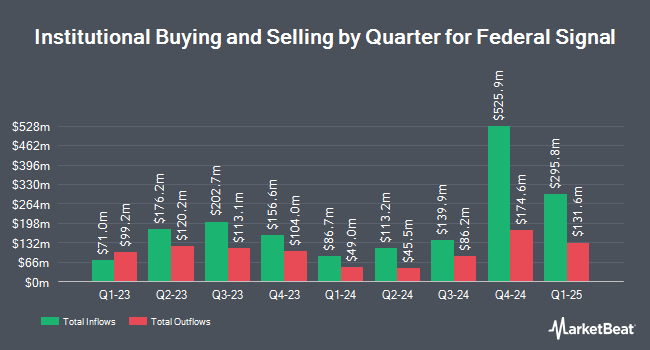

Axiom Investors LLC DE reduced its position in Federal Signal Co. (NYSE:FSS - Free Report) by 2.3% during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 184,375 shares of the conglomerate's stock after selling 4,300 shares during the period. Axiom Investors LLC DE owned 0.30% of Federal Signal worth $17,034,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors also recently bought and sold shares of the company. Norges Bank acquired a new stake in Federal Signal in the fourth quarter worth about $78,192,000. Raymond James Financial Inc. purchased a new position in shares of Federal Signal in the fourth quarter worth $36,636,000. ArrowMark Colorado Holdings LLC acquired a new stake in shares of Federal Signal during the third quarter worth $28,863,000. Geode Capital Management LLC raised its stake in Federal Signal by 17.6% in the 3rd quarter. Geode Capital Management LLC now owns 1,601,774 shares of the conglomerate's stock worth $149,727,000 after acquiring an additional 239,789 shares during the last quarter. Finally, JPMorgan Chase & Co. increased its holdings in shares of Federal Signal by 79.9% in the fourth quarter. JPMorgan Chase & Co. now owns 304,711 shares of the conglomerate's stock valued at $28,152,000 after purchasing an additional 135,359 shares during the period. Hedge funds and other institutional investors own 92.73% of the company's stock.

Insiders Place Their Bets

In other Federal Signal news, CEO Jennifer L. Sherman acquired 1,250 shares of the business's stock in a transaction that occurred on Friday, February 28th. The stock was purchased at an average cost of $82.32 per share, with a total value of $102,900.00. Following the transaction, the chief executive officer now owns 559,183 shares of the company's stock, valued at $46,031,944.56. This trade represents a 0.22 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Corporate insiders own 3.30% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages recently weighed in on FSS. Raymond James reiterated an "outperform" rating and issued a $110.00 price target on shares of Federal Signal in a report on Tuesday, December 24th. StockNews.com lowered Federal Signal from a "buy" rating to a "hold" rating in a report on Saturday, March 1st.

Check Out Our Latest Stock Analysis on Federal Signal

Federal Signal Price Performance

FSS stock traded down $1.27 during mid-day trading on Friday, reaching $71.68. 327,558 shares of the company's stock were exchanged, compared to its average volume of 398,285. The company has a market cap of $4.38 billion, a price-to-earnings ratio of 20.77, a price-to-earnings-growth ratio of 1.85 and a beta of 1.02. Federal Signal Co. has a 12-month low of $67.80 and a 12-month high of $102.18. The stock's 50 day moving average is $86.86 and its 200 day moving average is $90.59. The company has a debt-to-equity ratio of 0.19, a current ratio of 2.83 and a quick ratio of 1.36.

Federal Signal (NYSE:FSS - Get Free Report) last posted its quarterly earnings data on Wednesday, February 26th. The conglomerate reported $0.87 earnings per share for the quarter, hitting analysts' consensus estimates of $0.87. The company had revenue of $472.00 million during the quarter, compared to analysts' expectations of $481.90 million. Federal Signal had a net margin of 11.57% and a return on equity of 18.46%. On average, research analysts expect that Federal Signal Co. will post 3.34 EPS for the current year.

Federal Signal Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, March 27th. Shareholders of record on Friday, March 14th were paid a dividend of $0.14 per share. This represents a $0.56 annualized dividend and a yield of 0.78%. The ex-dividend date of this dividend was Friday, March 14th. This is a boost from Federal Signal's previous quarterly dividend of $0.12. Federal Signal's payout ratio is 15.95%.

Federal Signal Company Profile

(

Free Report)

Federal Signal Corp. engages in the design and manufacture of products and integrated solutions for municipal, governmental, industrial, and commercial customers. It operates through the Environmental Solutions Group and Safety and Security Systems Group segments. The Environment Solutions Group segment is involved in the manufacture and supply of street sweeper vehicles, sewer cleaners, vacuum loader trucks, hydro-excavation trucks, and water blasting equipment.

Featured Articles

Before you consider Federal Signal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Signal wasn't on the list.

While Federal Signal currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.