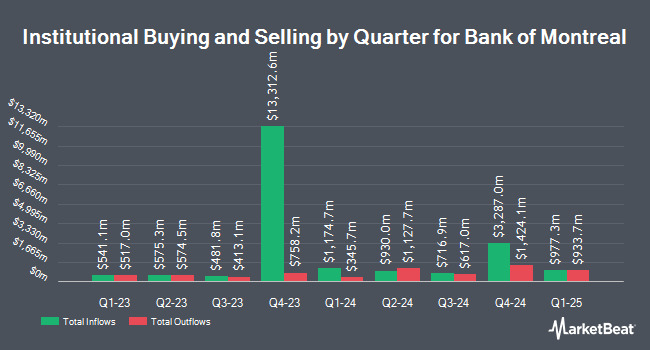

Federated Hermes Inc. grew its stake in Bank of Montreal (NYSE:BMO - Free Report) TSE: BMO by 1,527.7% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,160,494 shares of the bank's stock after purchasing an additional 1,089,199 shares during the quarter. Federated Hermes Inc. owned about 0.16% of Bank of Montreal worth $112,626,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. BNP Paribas Financial Markets increased its stake in shares of Bank of Montreal by 47.9% in the 3rd quarter. BNP Paribas Financial Markets now owns 4,057 shares of the bank's stock worth $366,000 after acquiring an additional 1,314 shares in the last quarter. Benjamin Edwards Inc. purchased a new position in shares of Bank of Montreal during the third quarter valued at approximately $357,000. Quantinno Capital Management LP boosted its position in shares of Bank of Montreal by 9.6% in the 3rd quarter. Quantinno Capital Management LP now owns 9,122 shares of the bank's stock worth $823,000 after purchasing an additional 802 shares in the last quarter. Stifel Financial Corp grew its stake in shares of Bank of Montreal by 2.4% in the 3rd quarter. Stifel Financial Corp now owns 146,232 shares of the bank's stock worth $13,190,000 after buying an additional 3,496 shares during the last quarter. Finally, Wellington Management Group LLP raised its position in shares of Bank of Montreal by 80.0% in the 3rd quarter. Wellington Management Group LLP now owns 125,572 shares of the bank's stock worth $11,344,000 after purchasing an additional 55,823 shares during the last quarter. 45.82% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts recently weighed in on the stock. Royal Bank of Canada raised their price target on shares of Bank of Montreal from $161.00 to $163.00 and gave the company an "outperform" rating in a research report on Wednesday, February 26th. StockNews.com raised Bank of Montreal from a "sell" rating to a "hold" rating in a report on Friday, February 28th. CIBC cut Bank of Montreal from a "sector outperform" rating to a "neutral" rating in a research note on Friday, April 4th. Finally, Cibc World Mkts cut Bank of Montreal from a "strong-buy" rating to a "hold" rating in a research report on Friday, April 4th. Nine research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, Bank of Montreal has a consensus rating of "Hold" and an average price target of $128.40.

Get Our Latest Report on Bank of Montreal

Bank of Montreal Stock Performance

NYSE:BMO traded up $1.65 on Friday, hitting $90.63. The stock had a trading volume of 444,773 shares, compared to its average volume of 862,661. Bank of Montreal has a 52-week low of $76.98 and a 52-week high of $106.00. The stock has a market cap of $65.89 billion, a price-to-earnings ratio of 12.98, a price-to-earnings-growth ratio of 1.43 and a beta of 0.95. The company has a quick ratio of 0.98, a current ratio of 0.98 and a debt-to-equity ratio of 0.11. The business's 50-day simple moving average is $97.55 and its two-hundred day simple moving average is $96.17.

Bank of Montreal (NYSE:BMO - Get Free Report) TSE: BMO last posted its quarterly earnings data on Tuesday, February 25th. The bank reported $3.04 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.68 by $1.36. Bank of Montreal had a net margin of 9.22% and a return on equity of 10.18%. The company had revenue of $9.27 billion for the quarter, compared to the consensus estimate of $8.58 billion. During the same quarter last year, the firm posted $2.56 earnings per share. The firm's revenue was up 20.8% compared to the same quarter last year. As a group, research analysts predict that Bank of Montreal will post 7.71 earnings per share for the current year.

Bank of Montreal Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, May 27th. Stockholders of record on Tuesday, April 29th will be paid a $1.1094 dividend. The ex-dividend date is Tuesday, April 29th. This represents a $4.44 annualized dividend and a dividend yield of 4.90%. Bank of Montreal's dividend payout ratio (DPR) is 57.09%.

About Bank of Montreal

(

Free Report)

Bank of Montreal provides diversified financial services primarily in North America. It operates through Canadian P&C, U.S P&C, BMO Wealth Management, and BMO Capital Markets segments. The company's personal banking products and services include deposits, mortgages, home lending, consumer credit, small business lending, credit cards, cash management, financial and investment advice, and other banking services; and commercial banking products and services comprise various of financing options and treasury and payment solutions, as well as risk management products.

Further Reading

Before you consider Bank of Montreal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of Montreal wasn't on the list.

While Bank of Montreal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.