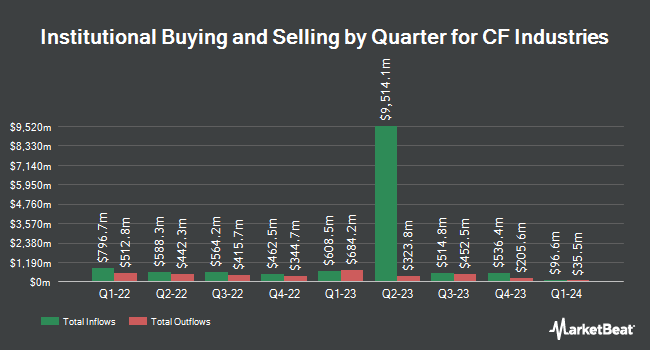

Federated Hermes Inc. lessened its holdings in CF Industries Holdings, Inc. (NYSE:CF - Free Report) by 21.9% during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 163,122 shares of the basic materials company's stock after selling 45,788 shares during the quarter. Federated Hermes Inc. owned about 0.09% of CF Industries worth $13,918,000 at the end of the most recent reporting period.

A number of other institutional investors also recently bought and sold shares of the business. Central Pacific Bank Trust Division purchased a new position in shares of CF Industries during the fourth quarter worth $74,000. Korea Investment CORP raised its stake in shares of CF Industries by 88.5% during the 4th quarter. Korea Investment CORP now owns 150,374 shares of the basic materials company's stock valued at $12,830,000 after buying an additional 70,585 shares during the last quarter. National Pension Service raised its stake in shares of CF Industries by 2,848.4% during the 4th quarter. National Pension Service now owns 290,384 shares of the basic materials company's stock valued at $24,776,000 after buying an additional 280,535 shares during the last quarter. SBI Securities Co. Ltd. acquired a new position in shares of CF Industries in the 4th quarter valued at about $51,000. Finally, Charles Schwab Investment Management Inc. raised its position in CF Industries by 4.0% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 5,792,339 shares of the basic materials company's stock valued at $494,202,000 after acquiring an additional 225,109 shares in the last quarter. 93.06% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, EVP Susan L. Menzel sold 1,500 shares of the business's stock in a transaction dated Wednesday, January 15th. The stock was sold at an average price of $96.00, for a total value of $144,000.00. Following the transaction, the executive vice president now owns 92,486 shares in the company, valued at $8,878,656. The trade was a 1.60 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at the SEC website. 0.42% of the stock is currently owned by insiders.

CF Industries Stock Up 0.6 %

CF traded up $0.40 on Tuesday, reaching $72.81. The company's stock had a trading volume of 641,118 shares, compared to its average volume of 2,093,827. The stock has a 50 day moving average of $77.57 and a two-hundred day moving average of $84.32. CF Industries Holdings, Inc. has a fifty-two week low of $67.34 and a fifty-two week high of $98.25. The company has a quick ratio of 2.52, a current ratio of 3.08 and a debt-to-equity ratio of 0.39. The company has a market capitalization of $12.34 billion, a price-to-earnings ratio of 10.76, a P/E/G ratio of 0.37 and a beta of 0.84.

CF Industries (NYSE:CF - Get Free Report) last posted its earnings results on Wednesday, February 19th. The basic materials company reported $1.89 earnings per share for the quarter, beating the consensus estimate of $1.49 by $0.40. The business had revenue of $1.52 billion during the quarter, compared to the consensus estimate of $1.50 billion. CF Industries had a return on equity of 15.50% and a net margin of 20.52%. As a group, analysts forecast that CF Industries Holdings, Inc. will post 5.83 EPS for the current fiscal year.

CF Industries Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, February 28th. Stockholders of record on Friday, February 14th were issued a $0.50 dividend. The ex-dividend date of this dividend was Friday, February 14th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 2.75%. CF Industries's payout ratio is 29.54%.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the stock. Morgan Stanley cut their target price on shares of CF Industries from $85.00 to $80.00 and set an "equal weight" rating for the company in a report on Friday. Bank of America upgraded CF Industries from an "underperform" rating to a "neutral" rating and set a $84.00 price target on the stock in a research report on Monday, February 24th. Scotiabank upgraded shares of CF Industries from a "sector underperform" rating to a "sector perform" rating and set a $81.00 price target for the company in a research report on Wednesday, April 9th. Oppenheimer reduced their target price on shares of CF Industries from $114.00 to $111.00 and set an "outperform" rating for the company in a research report on Tuesday, January 28th. Finally, The Goldman Sachs Group began coverage on shares of CF Industries in a research note on Thursday, March 13th. They set a "neutral" rating and a $86.00 price objective for the company. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating, four have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, CF Industries presently has an average rating of "Hold" and a consensus price target of $89.20.

Check Out Our Latest Report on CF Industries

CF Industries Profile

(

Free Report)

CF Industries Holdings, Inc, together with its subsidiaries, engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally. It operates through Ammonia, Granular Urea, UAN, AN, and Other segments.

Featured Stories

Before you consider CF Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CF Industries wasn't on the list.

While CF Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.