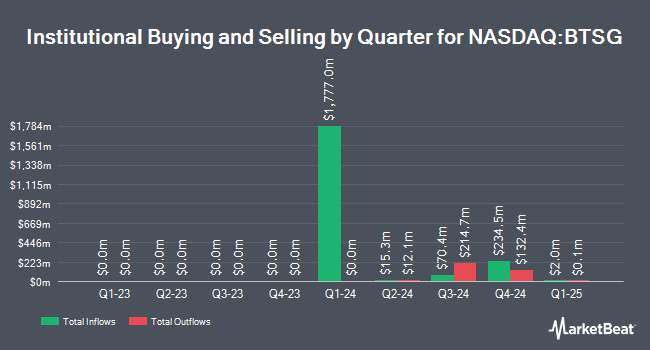

Federated Hermes Inc. boosted its stake in shares of BrightSpring Health Services, Inc. (NASDAQ:BTSG - Free Report) by 80.2% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 572,436 shares of the company's stock after purchasing an additional 254,811 shares during the period. Federated Hermes Inc. owned about 0.33% of BrightSpring Health Services worth $9,749,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. R Squared Ltd purchased a new position in shares of BrightSpring Health Services during the 4th quarter worth $74,000. Envestnet Asset Management Inc. bought a new position in BrightSpring Health Services in the 4th quarter worth $188,000. KLP Kapitalforvaltning AS purchased a new position in BrightSpring Health Services during the fourth quarter valued at $206,000. Teacher Retirement System of Texas bought a new stake in BrightSpring Health Services during the fourth quarter valued at about $234,000. Finally, BNP Paribas Financial Markets increased its position in BrightSpring Health Services by 5.0% in the third quarter. BNP Paribas Financial Markets now owns 21,329 shares of the company's stock worth $313,000 after buying an additional 1,011 shares in the last quarter.

Analyst Upgrades and Downgrades

A number of research firms have recently weighed in on BTSG. UBS Group lifted their price objective on BrightSpring Health Services from $22.00 to $30.00 and gave the company a "buy" rating in a research report on Wednesday, January 29th. Morgan Stanley lifted their price target on shares of BrightSpring Health Services from $19.00 to $20.00 and gave the company an "overweight" rating in a report on Tuesday, December 17th. One analyst has rated the stock with a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $21.67.

View Our Latest Stock Report on BrightSpring Health Services

BrightSpring Health Services Price Performance

BTSG traded up $0.05 during trading on Wednesday, reaching $17.13. 193,325 shares of the company traded hands, compared to its average volume of 1,276,604. The company has a market cap of $3.00 billion, a P/E ratio of -65.92 and a beta of 2.02. The company has a debt-to-equity ratio of 1.63, a quick ratio of 0.97 and a current ratio of 1.35. BrightSpring Health Services, Inc. has a 12-month low of $10.15 and a 12-month high of $24.82. The firm has a fifty day simple moving average of $18.69 and a 200 day simple moving average of $18.31.

BrightSpring Health Services Profile

(

Free Report)

BrightSpring Health Services, Inc operates a home and community-based healthcare services platform in the United States. The company's platform focuses on delivering pharmacy and provider services, including clinical and supportive care in home and community settings to Medicare, Medicaid, and insured populations.

Further Reading

Before you consider BrightSpring Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightSpring Health Services wasn't on the list.

While BrightSpring Health Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.