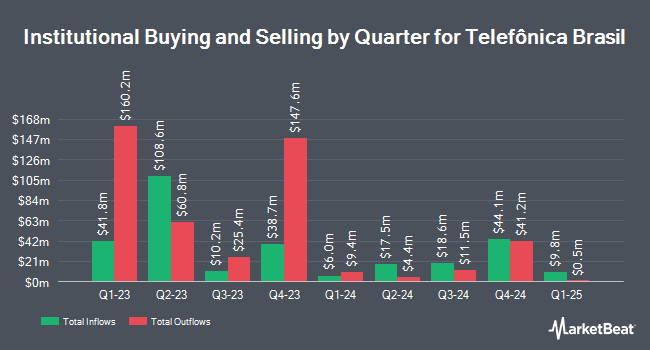

Federated Hermes Inc. cut its holdings in shares of Telefônica Brasil S.A. (NYSE:VIV - Free Report) by 31.4% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 421,073 shares of the Wireless communications provider's stock after selling 192,559 shares during the period. Federated Hermes Inc.'s holdings in Telefônica Brasil were worth $3,179,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also made changes to their positions in the company. GAMMA Investing LLC raised its stake in Telefônica Brasil by 67.8% during the 4th quarter. GAMMA Investing LLC now owns 3,818 shares of the Wireless communications provider's stock valued at $29,000 after acquiring an additional 1,543 shares in the last quarter. Allworth Financial LP increased its holdings in shares of Telefônica Brasil by 86.4% during the fourth quarter. Allworth Financial LP now owns 4,169 shares of the Wireless communications provider's stock valued at $31,000 after purchasing an additional 1,933 shares during the period. R Squared Ltd bought a new stake in shares of Telefônica Brasil during the fourth quarter valued at about $37,000. Blue Trust Inc. lifted its holdings in Telefônica Brasil by 46.4% in the fourth quarter. Blue Trust Inc. now owns 8,823 shares of the Wireless communications provider's stock worth $67,000 after purchasing an additional 2,797 shares during the period. Finally, DAVENPORT & Co LLC bought a new position in Telefônica Brasil in the 4th quarter valued at about $78,000. 5.16% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on the stock. The Goldman Sachs Group reduced their price target on shares of Telefônica Brasil from $10.60 to $9.20 and set a "buy" rating for the company in a research note on Thursday, December 19th. Barclays upgraded Telefônica Brasil from an "equal weight" rating to an "overweight" rating and cut their target price for the stock from $11.80 to $11.50 in a research report on Monday, March 3rd. Scotiabank lowered their price target on Telefônica Brasil from $10.40 to $9.20 and set a "sector perform" rating on the stock in a research report on Thursday, February 27th. Finally, StockNews.com raised Telefônica Brasil from a "buy" rating to a "strong-buy" rating in a research note on Friday, March 7th. Two equities research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $9.97.

Read Our Latest Report on Telefônica Brasil

Telefônica Brasil Price Performance

VIV stock traded down $0.04 on Tuesday, hitting $8.62. 467,554 shares of the company's stock traded hands, compared to its average volume of 843,883. The company has a current ratio of 0.96, a quick ratio of 0.91 and a debt-to-equity ratio of 0.19. The stock has a market cap of $14.24 billion, a price-to-earnings ratio of 13.67, a P/E/G ratio of 0.84 and a beta of 0.60. Telefônica Brasil S.A. has a 1-year low of $7.47 and a 1-year high of $10.41. The stock has a fifty day moving average of $8.75 and a 200-day moving average of $8.72.

Telefônica Brasil shares are scheduled to reverse split on the morning of Wednesday, April 16th. The 1-2 reverse split was announced on Tuesday, April 15th. The number of shares owned by shareholders will be adjusted after the closing bell on Tuesday, April 15th.

Telefônica Brasil (NYSE:VIV - Get Free Report) last posted its quarterly earnings data on Tuesday, February 25th. The Wireless communications provider reported $0.18 EPS for the quarter, beating analysts' consensus estimates of $0.17 by $0.01. The company had revenue of $2.50 billion during the quarter, compared to analyst estimates of $2.39 billion. Telefônica Brasil had a net margin of 9.78% and a return on equity of 7.77%. On average, analysts forecast that Telefônica Brasil S.A. will post 0.6 EPS for the current fiscal year.

Telefônica Brasil Increases Dividend

The company also recently disclosed a dividend, which was paid on Tuesday, March 25th. Shareholders of record on Tuesday, March 25th were given a dividend of $0.0215 per share. This is a boost from Telefônica Brasil's previous dividend of $0.02. The ex-dividend date of this dividend was Tuesday, March 25th. Telefônica Brasil's payout ratio is presently 49.18%.

About Telefônica Brasil

(

Free Report)

Telefônica Brasil SA, together with its subsidiaries, operates as a mobile telecommunications company in Brazil. Its fixed line services portfolio includes local, domestic long-distance, and international long-distance calls; and mobile portfolio comprises voice and broadband internet access through 3G, 4G, 4.5G, and 5G, as well as mobile value-added and wireless roaming services.

Read More

Before you consider Telefônica Brasil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Telefônica Brasil wasn't on the list.

While Telefônica Brasil currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.