Federated Hermes Inc. trimmed its position in The Bancorp, Inc. (NASDAQ:TBBK - Free Report) by 96.6% in the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 1,076 shares of the bank's stock after selling 30,518 shares during the quarter. Federated Hermes Inc.'s holdings in Bancorp were worth $57,000 as of its most recent SEC filing.

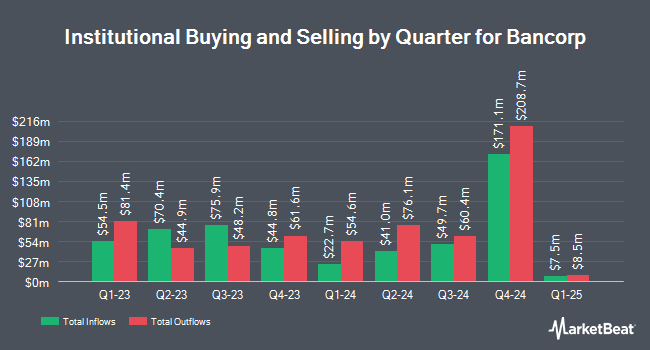

Several other institutional investors have also recently modified their holdings of TBBK. Lord Abbett & CO. LLC raised its position in Bancorp by 23.1% during the third quarter. Lord Abbett & CO. LLC now owns 303,239 shares of the bank's stock valued at $16,223,000 after acquiring an additional 56,959 shares in the last quarter. JPMorgan Chase & Co. lifted its stake in shares of Bancorp by 132.9% in the 3rd quarter. JPMorgan Chase & Co. now owns 383,784 shares of the bank's stock valued at $20,532,000 after purchasing an additional 219,020 shares during the last quarter. Principal Financial Group Inc. lifted its stake in shares of Bancorp by 3.3% in the 4th quarter. Principal Financial Group Inc. now owns 304,609 shares of the bank's stock valued at $16,032,000 after purchasing an additional 9,748 shares during the last quarter. Raymond James Financial Inc. acquired a new position in shares of Bancorp in the 4th quarter valued at $3,474,000. Finally, Sanctuary Advisors LLC lifted its stake in shares of Bancorp by 111.9% in the 4th quarter. Sanctuary Advisors LLC now owns 11,067 shares of the bank's stock valued at $638,000 after purchasing an additional 5,845 shares during the last quarter. 96.22% of the stock is currently owned by hedge funds and other institutional investors.

Bancorp Trading Up 0.6 %

TBBK stock traded up $0.29 during midday trading on Thursday, hitting $48.67. The stock had a trading volume of 82,686 shares, compared to its average volume of 583,091. The firm has a market cap of $2.33 billion, a PE ratio of 11.33 and a beta of 1.26. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.89 and a quick ratio of 0.86. The Bancorp, Inc. has a 12-month low of $29.92 and a 12-month high of $65.84. The company's 50-day moving average price is $51.12 and its 200 day moving average price is $54.00.

Bancorp (NASDAQ:TBBK - Get Free Report) last released its earnings results on Thursday, January 30th. The bank reported $1.15 EPS for the quarter, topping the consensus estimate of $1.13 by $0.02. Bancorp had a net margin of 30.97% and a return on equity of 27.33%. On average, equities research analysts predict that The Bancorp, Inc. will post 5.31 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on the company. Raymond James reaffirmed an "outperform" rating and issued a $67.00 price target (up previously from $60.00) on shares of Bancorp in a research note on Monday, February 3rd. Keefe, Bruyette & Woods lifted their target price on Bancorp from $66.00 to $72.00 and gave the company an "outperform" rating in a research report on Monday, February 3rd. Finally, StockNews.com upgraded shares of Bancorp from a "sell" rating to a "hold" rating in a report on Thursday, March 6th.

Read Our Latest Research Report on Bancorp

Bancorp Company Profile

(

Free Report)

The Bancorp, Inc operates as the bank holding company for The Bancorp Bank, National Association that provides banking products and services in the United States. It offers a range of deposit products and services, including checking, savings, time, money market, and commercial accounts; overdrafts; and certificates of deposit.

Featured Stories

Before you consider Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bancorp wasn't on the list.

While Bancorp currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.