Impax Asset Management Group plc trimmed its holdings in Ferguson plc (NASDAQ:FERG - Free Report) by 64.3% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 68,632 shares of the company's stock after selling 123,875 shares during the quarter. Impax Asset Management Group plc's holdings in Ferguson were worth $13,628,000 at the end of the most recent quarter.

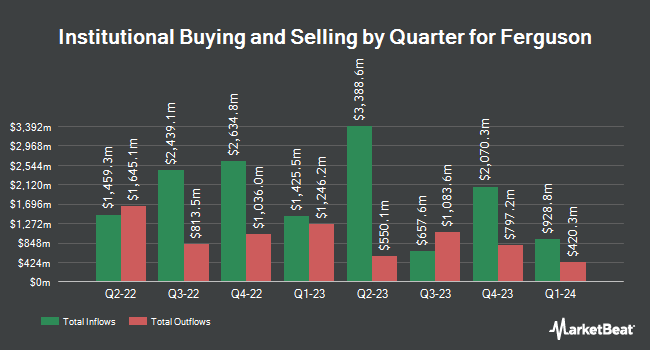

Several other institutional investors and hedge funds have also added to or reduced their stakes in the stock. CWM LLC lifted its position in shares of Ferguson by 303.7% during the third quarter. CWM LLC now owns 4,550 shares of the company's stock worth $904,000 after purchasing an additional 3,423 shares in the last quarter. Manning & Napier Advisors LLC acquired a new stake in Ferguson in the second quarter worth about $2,834,000. Swedbank AB acquired a new stake in Ferguson in the first quarter worth about $26,379,000. Acadian Asset Management LLC raised its holdings in Ferguson by 1,835.1% during the 1st quarter. Acadian Asset Management LLC now owns 7,779 shares of the company's stock worth $1,697,000 after purchasing an additional 7,377 shares during the last quarter. Finally, Bank of Montreal Can lifted its position in Ferguson by 380.6% during the 2nd quarter. Bank of Montreal Can now owns 159,411 shares of the company's stock valued at $32,309,000 after purchasing an additional 126,242 shares during the period. Institutional investors and hedge funds own 81.98% of the company's stock.

Insider Buying and Selling

In other Ferguson news, VP Michael Jacobs sold 2,624 shares of the business's stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $200.96, for a total transaction of $527,319.04. Following the transaction, the vice president now owns 1,116 shares of the company's stock, valued at $224,271.36. The trade was a 70.16 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CMO Victoria Morrissey sold 1,468 shares of the stock in a transaction that occurred on Monday, October 14th. The shares were sold at an average price of $201.20, for a total value of $295,361.60. Following the completion of the sale, the chief marketing officer now directly owns 5,205 shares of the company's stock, valued at approximately $1,047,246. The trade was a 22.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 12,313 shares of company stock worth $2,477,901. 0.16% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on FERG shares. Wells Fargo & Company boosted their price target on shares of Ferguson from $225.00 to $232.00 and gave the stock an "overweight" rating in a research note on Thursday, November 7th. Citigroup increased their price target on Ferguson from $203.00 to $221.00 and gave the company a "neutral" rating in a research note on Wednesday, September 18th. UBS Group raised their price target on Ferguson from $228.00 to $236.00 and gave the stock a "buy" rating in a research report on Wednesday, September 18th. Barclays increased their target price on Ferguson from $229.00 to $245.00 and gave the company an "overweight" rating in a research note on Wednesday, September 18th. Finally, Robert W. Baird boosted their target price on Ferguson from $225.00 to $230.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 16th. Two equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat, Ferguson currently has an average rating of "Moderate Buy" and an average price target of $233.38.

View Our Latest Analysis on FERG

Ferguson Stock Down 1.6 %

Shares of FERG stock traded down $3.28 during trading hours on Friday, hitting $199.94. 1,167,083 shares of the company were exchanged, compared to its average volume of 1,303,187. Ferguson plc has a 52 week low of $163.03 and a 52 week high of $225.63. The company has a current ratio of 1.80, a quick ratio of 1.00 and a debt-to-equity ratio of 0.89. The business has a 50 day moving average of $199.36 and a two-hundred day moving average of $203.19. The company has a market capitalization of $40.14 billion, a PE ratio of 23.43, a PEG ratio of 1.97 and a beta of 1.20.

Ferguson (NASDAQ:FERG - Get Free Report) last released its quarterly earnings results on Tuesday, September 17th. The company reported $2.98 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.86 by $0.12. The firm had revenue of $7.95 billion for the quarter, compared to the consensus estimate of $8.01 billion. Ferguson had a return on equity of 36.53% and a net margin of 5.85%. The company's revenue for the quarter was up 1.4% on a year-over-year basis. During the same quarter last year, the business posted $2.77 EPS. Analysts anticipate that Ferguson plc will post 9.77 earnings per share for the current fiscal year.

Ferguson Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, November 8th. Stockholders of record on Friday, September 27th were given a $0.79 dividend. This represents a $3.16 dividend on an annualized basis and a dividend yield of 1.58%. The ex-dividend date was Friday, September 27th. Ferguson's dividend payout ratio is presently 37.05%.

About Ferguson

(

Free Report)

Ferguson plc distributes plumbing and heating products in the United States and Canada. It offers plumbing and heating solutions to customers in the residential, commercial, civil/infrastructure, and industrial end markets. The company also provides expertise, solutions, and products, including infrastructure, plumbing, appliances, fire, fabrication, and others, as well as heating, ventilation, and air conditioning products under the Ferguson brand name.

Featured Articles

Before you consider Ferguson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ferguson wasn't on the list.

While Ferguson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.