Fermata Advisors LLC cut its stake in Eli Lilly and Company (NYSE:LLY - Free Report) by 27.8% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 913 shares of the company's stock after selling 351 shares during the quarter. Fermata Advisors LLC's holdings in Eli Lilly and Company were worth $705,000 as of its most recent SEC filing.

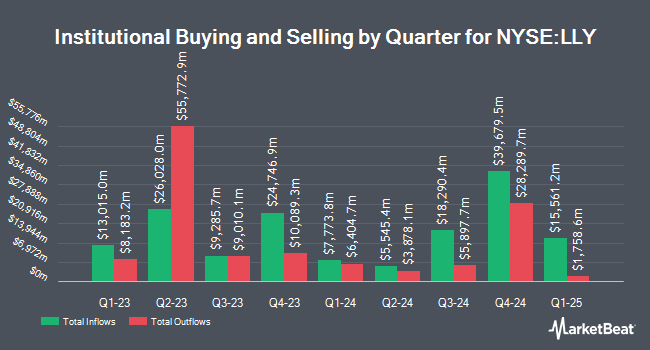

A number of other hedge funds have also bought and sold shares of the business. International Assets Investment Management LLC increased its holdings in Eli Lilly and Company by 87,091.7% in the 3rd quarter. International Assets Investment Management LLC now owns 12,463,182 shares of the company's stock valued at $11,041,631,000 after buying an additional 12,448,888 shares during the period. Pathway Financial Advisers LLC increased its holdings in Eli Lilly and Company by 92,759.9% in the 3rd quarter. Pathway Financial Advisers LLC now owns 1,022,388 shares of the company's stock valued at $905,774,000 after buying an additional 1,021,287 shares during the period. Integrated Investment Consultants LLC increased its holdings in Eli Lilly and Company by 37,140.7% in the 3rd quarter. Integrated Investment Consultants LLC now owns 694,167 shares of the company's stock valued at $614,990,000 after buying an additional 692,303 shares during the period. Comerica Bank increased its holdings in Eli Lilly and Company by 71.6% in the 2nd quarter. Comerica Bank now owns 1,512,983 shares of the company's stock valued at $1,369,825,000 after buying an additional 631,312 shares during the period. Finally, Assenagon Asset Management S.A. increased its holdings in Eli Lilly and Company by 100.7% in the 3rd quarter. Assenagon Asset Management S.A. now owns 1,165,696 shares of the company's stock valued at $1,032,737,000 after buying an additional 584,866 shares during the period. 82.53% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several equities analysts have commented on the stock. Deutsche Bank Aktiengesellschaft decreased their target price on shares of Eli Lilly and Company from $1,025.00 to $1,015.00 and set a "buy" rating on the stock in a report on Monday, November 4th. Truist Financial raised their target price on shares of Eli Lilly and Company from $1,000.00 to $1,033.00 and gave the company a "buy" rating in a report on Thursday, October 10th. Sanford C. Bernstein initiated coverage on shares of Eli Lilly and Company in a research note on Thursday, October 17th. They issued an "outperform" rating and a $1,100.00 price target on the stock. Wolfe Research initiated coverage on shares of Eli Lilly and Company in a research note on Friday, November 15th. They issued an "outperform" rating and a $1,000.00 price target on the stock. Finally, Redburn Atlantic upgraded shares of Eli Lilly and Company to a "hold" rating in a research note on Monday, November 4th. Four investment analysts have rated the stock with a hold rating and eighteen have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $1,002.22.

Get Our Latest Stock Analysis on Eli Lilly and Company

Eli Lilly and Company Trading Down 4.1 %

Eli Lilly and Company stock traded down $31.36 during mid-day trading on Friday, hitting $726.24. 5,497,108 shares of the stock were exchanged, compared to its average volume of 2,736,766. The company has a quick ratio of 0.97, a current ratio of 1.27 and a debt-to-equity ratio of 2.03. Eli Lilly and Company has a 12 month low of $612.70 and a 12 month high of $972.53. The firm's fifty day simple moving average is $783.25 and its two-hundred day simple moving average is $856.02. The stock has a market capitalization of $689.43 billion, a price-to-earnings ratio of 78.51, a PEG ratio of 1.66 and a beta of 0.41.

Eli Lilly and Company (NYSE:LLY - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported $1.18 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.52 by ($0.34). Eli Lilly and Company had a return on equity of 71.08% and a net margin of 20.48%. The firm had revenue of $11.44 billion for the quarter, compared to the consensus estimate of $12.09 billion. During the same quarter in the previous year, the business posted $0.10 EPS. The firm's revenue for the quarter was up 20.4% compared to the same quarter last year. Analysts forecast that Eli Lilly and Company will post 13.14 EPS for the current year.

Eli Lilly and Company Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, March 10th. Stockholders of record on Friday, February 14th will be paid a $1.50 dividend. The ex-dividend date is Friday, February 14th. This represents a $6.00 annualized dividend and a dividend yield of 0.83%. This is a positive change from Eli Lilly and Company's previous quarterly dividend of $1.30. Eli Lilly and Company's payout ratio is currently 56.22%.

Eli Lilly and Company announced that its Board of Directors has approved a share buyback plan on Monday, December 9th that allows the company to buyback $15.00 billion in shares. This buyback authorization allows the company to reacquire up to 2% of its stock through open market purchases. Stock buyback plans are generally a sign that the company's management believes its stock is undervalued.

Insider Activity

In other news, CAO Donald A. Zakrowski sold 900 shares of Eli Lilly and Company stock in a transaction on Friday, November 8th. The shares were sold at an average price of $803.38, for a total value of $723,042.00. Following the completion of the sale, the chief accounting officer now owns 5,480 shares in the company, valued at $4,402,522.40. The trade was a 14.11 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 0.13% of the stock is currently owned by company insiders.

About Eli Lilly and Company

(

Free Report)

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

Recommended Stories

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report