Fernwood Investment Management LLC acquired a new stake in shares of Comstock Resources, Inc. (NYSE:CRK - Free Report) during the fourth quarter, according to its most recent filing with the SEC. The fund acquired 52,630 shares of the oil and gas producer's stock, valued at approximately $959,000.

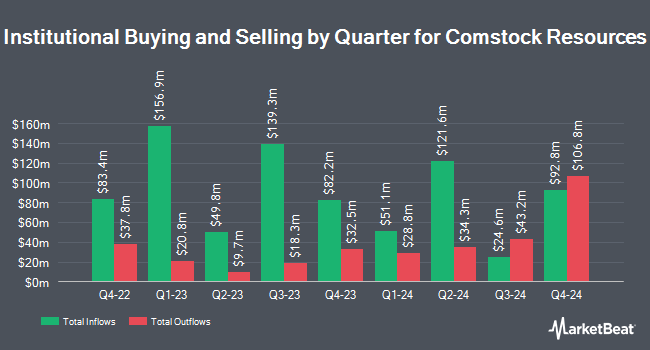

Other large investors have also added to or reduced their stakes in the company. VSM Wealth Advisory LLC bought a new position in Comstock Resources in the 4th quarter worth about $27,000. Sunbelt Securities Inc. raised its position in shares of Comstock Resources by 140.0% during the 3rd quarter. Sunbelt Securities Inc. now owns 2,400 shares of the oil and gas producer's stock valued at $27,000 after buying an additional 1,400 shares in the last quarter. Smartleaf Asset Management LLC lifted its holdings in shares of Comstock Resources by 225.2% during the 4th quarter. Smartleaf Asset Management LLC now owns 3,359 shares of the oil and gas producer's stock worth $64,000 after acquiring an additional 2,326 shares during the last quarter. KBC Group NV grew its position in Comstock Resources by 46.8% in the fourth quarter. KBC Group NV now owns 6,480 shares of the oil and gas producer's stock worth $118,000 after acquiring an additional 2,066 shares in the last quarter. Finally, Blue Trust Inc. increased its stake in Comstock Resources by 56.4% in the fourth quarter. Blue Trust Inc. now owns 10,502 shares of the oil and gas producer's stock valued at $191,000 after acquiring an additional 3,787 shares during the last quarter. Institutional investors own 36.13% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently commented on the company. Piper Sandler increased their price objective on Comstock Resources from $5.00 to $6.00 and gave the company an "underweight" rating in a research report on Wednesday, January 29th. StockNews.com upgraded shares of Comstock Resources to a "sell" rating in a report on Friday, April 4th. Williams Trading set a $13.00 target price on shares of Comstock Resources in a research report on Wednesday, March 5th. Mizuho upgraded shares of Comstock Resources from an "underperform" rating to a "neutral" rating and upped their price target for the company from $10.00 to $18.00 in a research report on Monday, December 16th. Finally, Morgan Stanley reiterated a "cautious" rating and issued a $22.00 price objective (up previously from $21.00) on shares of Comstock Resources in a report on Wednesday, March 26th. Five equities research analysts have rated the stock with a sell rating, seven have given a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat, Comstock Resources has an average rating of "Hold" and an average target price of $13.73.

Check Out Our Latest Stock Report on Comstock Resources

Comstock Resources Trading Down 1.4 %

CRK stock traded down $0.27 during trading on Monday, reaching $19.10. The company had a trading volume of 489,090 shares, compared to its average volume of 2,713,676. The company has a debt-to-equity ratio of 1.27, a current ratio of 0.46 and a quick ratio of 0.60. Comstock Resources, Inc. has a 52 week low of $7.74 and a 52 week high of $22.06. The business has a 50 day moving average of $18.84 and a 200 day moving average of $16.62. The company has a market cap of $5.59 billion, a P/E ratio of -25.13, a PEG ratio of 1.65 and a beta of 0.42.

Comstock Resources (NYSE:CRK - Get Free Report) last released its earnings results on Tuesday, February 18th. The oil and gas producer reported $0.16 EPS for the quarter, beating analysts' consensus estimates of $0.02 by $0.14. The company had revenue of $366.51 million during the quarter, compared to analysts' expectations of $370.62 million. Comstock Resources had a negative return on equity of 3.10% and a negative net margin of 18.32%. As a group, sell-side analysts forecast that Comstock Resources, Inc. will post 0.54 earnings per share for the current fiscal year.

About Comstock Resources

(

Free Report)

Comstock Resources, Inc, an independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States. Its assets are located in the Haynesville and Bossier shales located in North Louisiana and East Texas. The company was incorporated in 1919 and is headquartered in Frisco, Texas.

Further Reading

Before you consider Comstock Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comstock Resources wasn't on the list.

While Comstock Resources currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.