Fiduciary Trust Co raised its position in D.R. Horton, Inc. (NYSE:DHI - Free Report) by 207.4% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 11,424 shares of the construction company's stock after acquiring an additional 7,708 shares during the quarter. Fiduciary Trust Co's holdings in D.R. Horton were worth $2,179,000 at the end of the most recent reporting period.

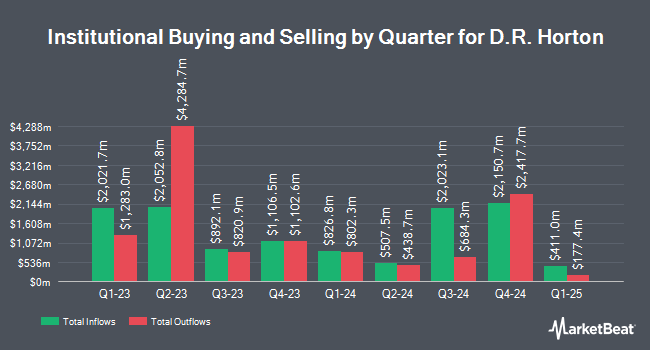

A number of other hedge funds and other institutional investors also recently modified their holdings of the company. CreativeOne Wealth LLC boosted its stake in shares of D.R. Horton by 10.5% during the 3rd quarter. CreativeOne Wealth LLC now owns 3,896 shares of the construction company's stock worth $743,000 after acquiring an additional 371 shares during the period. Healthcare of Ontario Pension Plan Trust Fund acquired a new stake in D.R. Horton during the 3rd quarter valued at $4,617,000. Glenmede Trust Co. NA boosted its position in D.R. Horton by 2.6% during the third quarter. Glenmede Trust Co. NA now owns 10,206 shares of the construction company's stock worth $1,947,000 after purchasing an additional 262 shares during the period. Soros Capital Management LLC acquired a new position in shares of D.R. Horton in the third quarter valued at $9,901,000. Finally, Townsquare Capital LLC raised its position in shares of D.R. Horton by 36.5% in the third quarter. Townsquare Capital LLC now owns 7,698 shares of the construction company's stock valued at $1,469,000 after purchasing an additional 2,057 shares during the period. Institutional investors own 90.63% of the company's stock.

Insider Transactions at D.R. Horton

In other news, Director Barbara K. Allen sold 5,650 shares of the stock in a transaction on Thursday, November 21st. The stock was sold at an average price of $163.10, for a total value of $921,515.00. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Company insiders own 1.74% of the company's stock.

D.R. Horton Price Performance

Shares of NYSE DHI traded down $0.65 during trading hours on Friday, hitting $168.78. 1,148,800 shares of the stock were exchanged, compared to its average volume of 2,507,221. D.R. Horton, Inc. has a 1-year low of $125.43 and a 1-year high of $199.85. The company has a market cap of $54.21 billion, a PE ratio of 11.76, a price-to-earnings-growth ratio of 0.62 and a beta of 1.74. The company has a debt-to-equity ratio of 0.23, a quick ratio of 1.61 and a current ratio of 7.32. The company's fifty day simple moving average is $177.29 and its two-hundred day simple moving average is $168.07.

D.R. Horton (NYSE:DHI - Get Free Report) last issued its quarterly earnings results on Tuesday, October 29th. The construction company reported $3.92 earnings per share (EPS) for the quarter, missing the consensus estimate of $4.17 by ($0.25). D.R. Horton had a net margin of 12.93% and a return on equity of 19.24%. The business had revenue of $10 billion during the quarter, compared to the consensus estimate of $10.22 billion. During the same quarter in the previous year, the business posted $4.45 EPS. The company's revenue for the quarter was down 4.7% on a year-over-year basis. On average, sell-side analysts predict that D.R. Horton, Inc. will post 14.4 EPS for the current year.

D.R. Horton Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, November 19th. Stockholders of record on Tuesday, November 12th were issued a $0.40 dividend. The ex-dividend date was Tuesday, November 12th. This represents a $1.60 dividend on an annualized basis and a dividend yield of 0.95%. This is a boost from D.R. Horton's previous quarterly dividend of $0.30. D.R. Horton's dividend payout ratio is 11.14%.

Wall Street Analysts Forecast Growth

Several analysts recently commented on the stock. Wedbush raised shares of D.R. Horton from an "underperform" rating to a "neutral" rating and set a $165.00 target price for the company in a report on Tuesday, October 15th. Bank of America upped their target price on D.R. Horton from $196.00 to $215.00 and gave the company a "buy" rating in a research report on Thursday, September 19th. Evercore ISI dropped their price target on D.R. Horton from $218.00 to $204.00 and set an "outperform" rating for the company in a report on Wednesday, October 30th. Citigroup decreased their price objective on D.R. Horton from $186.00 to $185.00 and set a "neutral" rating on the stock in a report on Wednesday, October 30th. Finally, Barclays lowered their price objective on D.R. Horton from $200.00 to $192.00 and set an "overweight" rating on the stock in a research report on Thursday, October 31st. One research analyst has rated the stock with a sell rating, seven have given a hold rating and nine have given a buy rating to the stock. According to data from MarketBeat.com, D.R. Horton currently has a consensus rating of "Hold" and an average target price of $185.87.

Read Our Latest Analysis on DHI

About D.R. Horton

(

Free Report)

D.R. Horton, Inc operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States. It engages in the acquisition and development of land; and construction and sale of residential homes in 118 markets across 33 states under the names of D.R.

Featured Stories

Before you consider D.R. Horton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and D.R. Horton wasn't on the list.

While D.R. Horton currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.