Fiera Capital Corp decreased its position in shares of NexGen Energy Ltd. (NYSE:NXE - Free Report) by 39.8% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 432,870 shares of the company's stock after selling 286,099 shares during the quarter. Fiera Capital Corp owned 0.08% of NexGen Energy worth $2,827,000 at the end of the most recent reporting period.

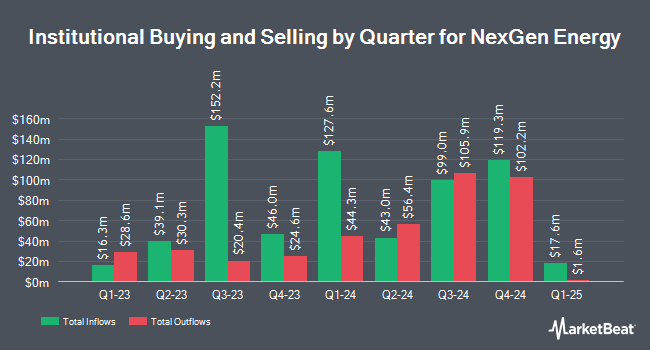

Several other institutional investors and hedge funds have also bought and sold shares of NXE. Vanguard Group Inc. lifted its position in NexGen Energy by 5,020.5% during the first quarter. Vanguard Group Inc. now owns 16,222,256 shares of the company's stock worth $126,047,000 after purchasing an additional 15,905,444 shares during the period. MMCAP International Inc. SPC lifted its holdings in shares of NexGen Energy by 1,627.2% in the first quarter. MMCAP International Inc. SPC now owns 3,564,665 shares of the company's stock worth $27,697,000 after acquiring an additional 3,358,278 shares during the last quarter. Van ECK Associates Corp lifted its holdings in shares of NexGen Energy by 50.5% in the third quarter. Van ECK Associates Corp now owns 4,718,270 shares of the company's stock worth $30,810,000 after acquiring an additional 1,582,705 shares during the last quarter. L1 Capital Pty Ltd lifted its holdings in shares of NexGen Energy by 6.3% in the first quarter. L1 Capital Pty Ltd now owns 24,083,310 shares of the company's stock worth $187,127,000 after acquiring an additional 1,423,317 shares during the last quarter. Finally, Mackenzie Financial Corp lifted its holdings in shares of NexGen Energy by 411.2% in the second quarter. Mackenzie Financial Corp now owns 1,530,574 shares of the company's stock worth $10,675,000 after acquiring an additional 1,231,144 shares during the last quarter. Institutional investors own 42.43% of the company's stock.

NexGen Energy Stock Performance

Shares of NexGen Energy stock traded down $0.01 on Friday, hitting $7.38. The stock had a trading volume of 9,093,309 shares, compared to its average volume of 5,534,106. The stock has a 50 day moving average of $6.75 and a 200 day moving average of $6.88. NexGen Energy Ltd. has a twelve month low of $4.95 and a twelve month high of $8.88. The firm has a market capitalization of $4.17 billion, a P/E ratio of 49.20 and a beta of 1.90.

NexGen Energy (NYSE:NXE - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The company reported ($0.04) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.03) by ($0.01). During the same quarter in the prior year, the business earned ($0.04) earnings per share. Equities analysts expect that NexGen Energy Ltd. will post -0.09 earnings per share for the current year.

Analyst Ratings Changes

Separately, National Bank Financial raised shares of NexGen Energy to a "strong-buy" rating in a report on Tuesday, September 3rd. Two analysts have rated the stock with a buy rating and three have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, NexGen Energy presently has an average rating of "Strong Buy" and an average target price of $11.00.

Get Our Latest Report on NXE

NexGen Energy Company Profile

(

Free Report)

NexGen Energy Ltd., an exploration and development stage company, engages in the acquisition, exploration, and evaluation and development of uranium properties in Canada. It holds a 100% interest in the Rook I project that consists of 32 contiguous mineral claims totaling an area of 35,065 hectares located in the southwestern Athabasca Basin of Saskatchewan.

Featured Stories

Before you consider NexGen Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexGen Energy wasn't on the list.

While NexGen Energy currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.