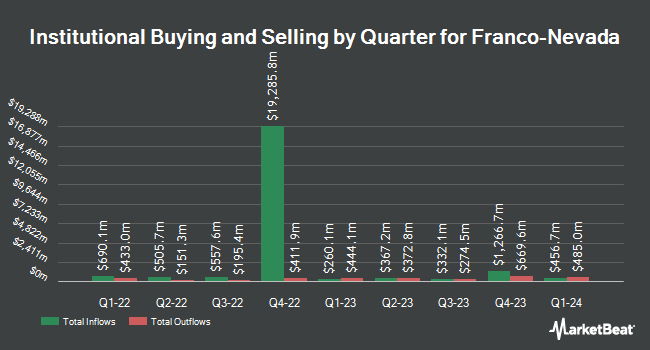

Fiera Capital Corp reduced its position in shares of Franco-Nevada Co. (NYSE:FNV - Free Report) TSE: FNV by 9.6% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 353,438 shares of the basic materials company's stock after selling 37,700 shares during the period. Fiera Capital Corp owned about 0.18% of Franco-Nevada worth $43,955,000 at the end of the most recent quarter.

A number of other institutional investors have also made changes to their positions in the business. Mechanics Financial Corp grew its position in Franco-Nevada by 150.0% during the second quarter. Mechanics Financial Corp now owns 250 shares of the basic materials company's stock worth $30,000 after buying an additional 150 shares in the last quarter. Mather Group LLC. acquired a new position in shares of Franco-Nevada in the 2nd quarter worth approximately $33,000. Kings Path Partners LLC bought a new stake in shares of Franco-Nevada during the 2nd quarter valued at about $36,000. Sunbelt Securities Inc. increased its stake in shares of Franco-Nevada by 3,333.3% in the 2nd quarter. Sunbelt Securities Inc. now owns 412 shares of the basic materials company's stock valued at $49,000 after acquiring an additional 400 shares in the last quarter. Finally, Hillsdale Investment Management Inc. boosted its position in shares of Franco-Nevada by 33.3% during the 1st quarter. Hillsdale Investment Management Inc. now owns 440 shares of the basic materials company's stock worth $52,000 after purchasing an additional 110 shares in the last quarter. Institutional investors own 77.06% of the company's stock.

Franco-Nevada Stock Performance

NYSE:FNV traded down $3.91 during trading hours on Friday, reaching $122.50. The company's stock had a trading volume of 877,351 shares, compared to its average volume of 655,913. The stock has a 50 day moving average price of $126.65 and a two-hundred day moving average price of $124.10. Franco-Nevada Co. has a 12 month low of $102.29 and a 12 month high of $137.60. The company has a market capitalization of $23.58 billion, a P/E ratio of -38.75, a price-to-earnings-growth ratio of 22.08 and a beta of 0.75.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last released its quarterly earnings data on Wednesday, November 6th. The basic materials company reported $0.80 EPS for the quarter, missing the consensus estimate of $0.83 by ($0.03). Franco-Nevada had a negative net margin of 51.64% and a positive return on equity of 10.56%. The business had revenue of $275.70 million during the quarter, compared to analysts' expectations of $279.11 million. During the same period last year, the company earned $0.91 earnings per share. The firm's revenue was down 10.9% on a year-over-year basis. As a group, analysts predict that Franco-Nevada Co. will post 3.25 EPS for the current fiscal year.

Franco-Nevada Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Thursday, December 5th will be issued a $0.36 dividend. The ex-dividend date is Thursday, December 5th. This represents a $1.44 annualized dividend and a yield of 1.18%. Franco-Nevada's payout ratio is -45.57%.

Wall Street Analysts Forecast Growth

A number of analysts have commented on the company. StockNews.com raised Franco-Nevada from a "sell" rating to a "hold" rating in a report on Thursday, August 22nd. HC Wainwright increased their price target on shares of Franco-Nevada from $185.00 to $200.00 and gave the stock a "buy" rating in a report on Friday. TD Securities raised shares of Franco-Nevada from a "hold" rating to a "buy" rating in a report on Thursday, August 15th. Jefferies Financial Group lowered their price target on shares of Franco-Nevada from $137.00 to $136.00 and set a "hold" rating for the company in a research note on Thursday, October 17th. Finally, Bank of America cut Franco-Nevada from a "buy" rating to a "neutral" rating and cut their target price for the stock from $142.00 to $139.00 in a research note on Tuesday, October 1st. Four analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $156.57.

Check Out Our Latest Analysis on Franco-Nevada

Franco-Nevada Company Profile

(

Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Featured Stories

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.