Fiera Capital Corp acquired a new position in shares of Confluent, Inc. (NASDAQ:CFLT - Free Report) in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 1,036,657 shares of the company's stock, valued at approximately $21,127,000. Fiera Capital Corp owned about 0.32% of Confluent as of its most recent filing with the SEC.

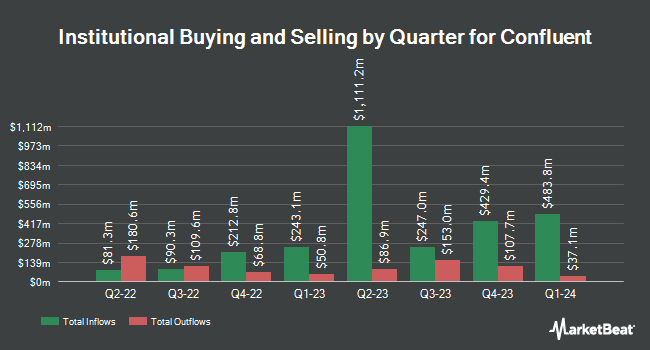

Other large investors have also made changes to their positions in the company. William Blair Investment Management LLC acquired a new position in Confluent in the second quarter worth $193,403,000. 1832 Asset Management L.P. purchased a new position in Confluent in the 1st quarter worth about $181,075,000. Champlain Investment Partners LLC purchased a new position in Confluent during the 1st quarter valued at about $144,563,000. Price T Rowe Associates Inc. MD increased its holdings in Confluent by 17.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 17,581,914 shares of the company's stock worth $536,601,000 after buying an additional 2,587,169 shares during the last quarter. Finally, Bank of New York Mellon Corp increased its holdings in Confluent by 60.0% in the second quarter. Bank of New York Mellon Corp now owns 3,510,483 shares of the company's stock worth $103,665,000 after buying an additional 1,316,804 shares during the last quarter. Hedge funds and other institutional investors own 78.09% of the company's stock.

Confluent Stock Performance

NASDAQ CFLT traded down $1.06 during trading on Friday, hitting $26.50. 3,513,930 shares of the company traded hands, compared to its average volume of 4,018,995. Confluent, Inc. has a 12 month low of $16.69 and a 12 month high of $35.07. The business has a fifty day simple moving average of $21.62 and a 200 day simple moving average of $24.64. The company has a debt-to-equity ratio of 1.17, a current ratio of 4.24 and a quick ratio of 4.24.

Confluent (NASDAQ:CFLT - Get Free Report) last announced its earnings results on Wednesday, October 30th. The company reported ($0.21) EPS for the quarter, topping the consensus estimate of ($0.24) by $0.03. The business had revenue of $250.20 million for the quarter, compared to the consensus estimate of $243.98 million. Confluent had a negative return on equity of 34.05% and a negative net margin of 38.35%. As a group, analysts expect that Confluent, Inc. will post -0.9 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

CFLT has been the topic of a number of recent analyst reports. Piper Sandler reduced their target price on Confluent from $37.00 to $32.00 and set an "overweight" rating on the stock in a report on Thursday, August 1st. UBS Group upped their target price on Confluent from $23.00 to $26.00 and gave the company a "neutral" rating in a research report on Thursday, October 31st. Mizuho upped their price objective on Confluent from $29.00 to $31.00 and gave the stock an "outperform" rating in a research report on Thursday, October 31st. Bank of America lowered their target price on Confluent from $32.00 to $26.00 and set an "underperform" rating for the company in a report on Thursday, August 1st. Finally, Canaccord Genuity Group reduced their price objective on shares of Confluent from $35.00 to $34.00 and set a "buy" rating on the stock in a research note on Thursday, August 1st. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating, nineteen have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $30.88.

Check Out Our Latest Stock Report on Confluent

Insider Activity at Confluent

In related news, CEO Edward Jay Kreps sold 232,500 shares of Confluent stock in a transaction on Wednesday, August 14th. The shares were sold at an average price of $21.13, for a total transaction of $4,912,725.00. Following the completion of the transaction, the chief executive officer now owns 452,488 shares of the company's stock, valued at $9,561,071.44. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, CEO Edward Jay Kreps sold 232,500 shares of the business's stock in a transaction dated Wednesday, August 14th. The shares were sold at an average price of $21.13, for a total transaction of $4,912,725.00. Following the completion of the sale, the chief executive officer now directly owns 452,488 shares of the company's stock, valued at $9,561,071.44. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Matthew Craig Miller sold 1,067,242 shares of the business's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $27.51, for a total transaction of $29,359,827.42. The disclosure for this sale can be found here. Insiders have sold 2,274,395 shares of company stock valued at $58,230,922 over the last three months. 13.82% of the stock is owned by insiders.

Confluent Company Profile

(

Free Report)

Confluent, Inc operates a data streaming platform in the United States and internationally. The company provides platforms that allow customers to connect their applications, systems, and data layers, such as Confluent Cloud, a managed cloud-native software-as-a-service; and Confluent Platform, an enterprise-grade self-managed software.

See Also

Before you consider Confluent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Confluent wasn't on the list.

While Confluent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.