Fiera Capital Corp trimmed its holdings in shares of ACI Worldwide, Inc. (NASDAQ:ACIW - Free Report) by 3.1% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 868,593 shares of the technology company's stock after selling 28,041 shares during the quarter. Fiera Capital Corp owned approximately 0.83% of ACI Worldwide worth $44,211,000 at the end of the most recent quarter.

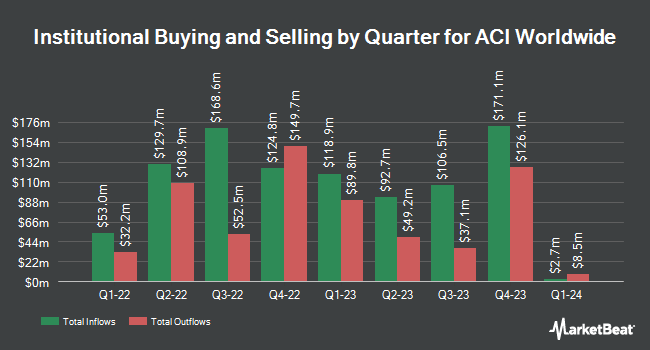

A number of other institutional investors also recently bought and sold shares of ACIW. Swedbank AB bought a new position in ACI Worldwide during the first quarter valued at approximately $3,321,000. GSA Capital Partners LLP bought a new position in ACI Worldwide in the first quarter worth approximately $846,000. CANADA LIFE ASSURANCE Co lifted its stake in shares of ACI Worldwide by 26.7% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 109,169 shares of the technology company's stock worth $3,623,000 after purchasing an additional 22,992 shares during the last quarter. ClariVest Asset Management LLC grew its position in shares of ACI Worldwide by 140.3% in the 1st quarter. ClariVest Asset Management LLC now owns 62,112 shares of the technology company's stock worth $2,063,000 after buying an additional 36,261 shares during the last quarter. Finally, Global Alpha Capital Management Ltd. grew its holdings in ACI Worldwide by 9.3% in the first quarter. Global Alpha Capital Management Ltd. now owns 2,112,828 shares of the technology company's stock worth $70,167,000 after purchasing an additional 180,600 shares during the last quarter. 94.74% of the stock is owned by institutional investors.

ACI Worldwide Stock Down 2.0 %

NASDAQ ACIW traded down $1.19 on Friday, hitting $58.01. 1,332,111 shares of the stock traded hands, compared to its average volume of 652,019. The company has a market capitalization of $6.07 billion, a P/E ratio of 35.03 and a beta of 1.19. ACI Worldwide, Inc. has a twelve month low of $24.76 and a twelve month high of $59.60. The stock has a 50-day moving average of $50.16 and a 200 day moving average of $43.23. The company has a current ratio of 1.32, a quick ratio of 1.32 and a debt-to-equity ratio of 0.79.

ACI Worldwide (NASDAQ:ACIW - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The technology company reported $0.89 earnings per share for the quarter, beating the consensus estimate of $0.52 by $0.37. ACI Worldwide had a return on equity of 19.18% and a net margin of 12.01%. The business had revenue of $451.75 million during the quarter, compared to analyst estimates of $404.80 million. As a group, analysts expect that ACI Worldwide, Inc. will post 1.96 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on ACIW shares. Stephens downgraded shares of ACI Worldwide from an "overweight" rating to an "equal weight" rating in a research note on Friday, October 18th. Needham & Company LLC reissued a "hold" rating on shares of ACI Worldwide in a report on Friday, August 2nd. StockNews.com lowered shares of ACI Worldwide from a "buy" rating to a "hold" rating in a research note on Saturday, August 3rd. DA Davidson lowered shares of ACI Worldwide from a "buy" rating to a "neutral" rating and boosted their target price for the company from $57.00 to $60.00 in a report on Friday. Finally, Canaccord Genuity Group boosted their price objective on shares of ACI Worldwide from $40.00 to $60.00 and gave the company a "buy" rating in a report on Friday, August 2nd. Four investment analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $49.50.

Read Our Latest Report on ACI Worldwide

ACI Worldwide Profile

(

Free Report)

ACI Worldwide, Inc, a software company, develops, markets, installs, and supports a range of software products and solutions for facilitating digital payments in the United States and internationally. The company operates in three segments: Banks, Merchants, and Billers. The company offers ACI Acquiring, a solution to process credit, debit, and prepaid card transactions, deliver digital innovation, and fraud prevention; ACI Issuing, a digital payment issuing solution for new payment offering; and ACI Enterprise Payments Platform that provides payment processing and orchestration capabilities for digital payments.

Featured Stories

Before you consider ACI Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACI Worldwide wasn't on the list.

While ACI Worldwide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.