StockNews.com cut shares of Fifth Third Bancorp (NASDAQ:FITB - Free Report) from a hold rating to a sell rating in a research report released on Wednesday morning.

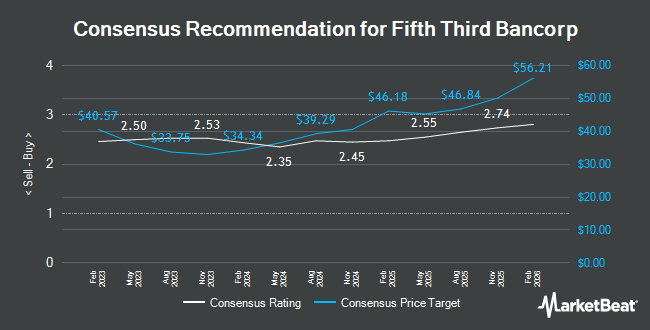

A number of other analysts also recently weighed in on the stock. Evercore ISI raised their price target on shares of Fifth Third Bancorp from $46.00 to $47.00 and gave the stock an "in-line" rating in a research report on Wednesday, October 2nd. Baird R W downgraded shares of Fifth Third Bancorp from a "strong-buy" rating to a "hold" rating in a research report on Monday, October 21st. Bank of America raised their price target on shares of Fifth Third Bancorp from $42.00 to $45.00 and gave the stock a "buy" rating in a research report on Monday, July 22nd. Barclays raised their price target on shares of Fifth Third Bancorp from $43.00 to $51.00 and gave the stock an "overweight" rating in a research report on Monday, October 21st. Finally, Royal Bank of Canada raised their price target on shares of Fifth Third Bancorp from $38.00 to $43.00 and gave the stock an "outperform" rating in a research report on Monday, July 22nd. One analyst has rated the stock with a sell rating, eight have given a hold rating and nine have given a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $42.28.

View Our Latest Stock Analysis on Fifth Third Bancorp

Fifth Third Bancorp Stock Up 8.6 %

Shares of FITB traded up $3.71 during mid-day trading on Wednesday, reaching $46.87. 11,547,892 shares of the stock traded hands, compared to its average volume of 4,643,521. The firm has a market cap of $31.72 billion, a price-to-earnings ratio of 15.57, a P/E/G ratio of 2.07 and a beta of 1.21. The stock has a fifty day simple moving average of $42.95 and a 200 day simple moving average of $39.89. Fifth Third Bancorp has a 12-month low of $24.64 and a 12-month high of $46.90. The company has a quick ratio of 0.82, a current ratio of 0.82 and a debt-to-equity ratio of 0.92.

Fifth Third Bancorp (NASDAQ:FITB - Get Free Report) last posted its quarterly earnings data on Friday, October 18th. The financial services provider reported $0.78 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.83 by ($0.05). Fifth Third Bancorp had a net margin of 16.58% and a return on equity of 14.58%. The firm had revenue of $2.19 billion for the quarter, compared to analysts' expectations of $2.16 billion. During the same quarter in the prior year, the business earned $0.92 EPS. The company's revenue for the quarter was up 1.2% on a year-over-year basis. Sell-side analysts expect that Fifth Third Bancorp will post 3.33 EPS for the current fiscal year.

Fifth Third Bancorp Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were paid a dividend of $0.37 per share. This is a boost from Fifth Third Bancorp's previous quarterly dividend of $0.35. This represents a $1.48 dividend on an annualized basis and a dividend yield of 3.16%. The ex-dividend date of this dividend was Monday, September 30th. Fifth Third Bancorp's payout ratio is currently 49.17%.

Insider Activity at Fifth Third Bancorp

In related news, EVP Kristine R. Garrett sold 7,500 shares of Fifth Third Bancorp stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $43.67, for a total transaction of $327,525.00. Following the sale, the executive vice president now directly owns 55,913 shares in the company, valued at $2,441,720.71. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In related news, EVP Kristine R. Garrett sold 7,500 shares of Fifth Third Bancorp stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $43.67, for a total transaction of $327,525.00. Following the sale, the executive vice president now directly owns 55,913 shares in the company, valued at $2,441,720.71. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Jude Schramm sold 20,000 shares of the business's stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $42.00, for a total transaction of $840,000.00. Following the completion of the sale, the executive vice president now owns 114,422 shares in the company, valued at approximately $4,805,724. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.50% of the company's stock.

Institutional Trading of Fifth Third Bancorp

A number of hedge funds have recently bought and sold shares of FITB. OneDigital Investment Advisors LLC boosted its stake in Fifth Third Bancorp by 1.1% in the 3rd quarter. OneDigital Investment Advisors LLC now owns 20,505 shares of the financial services provider's stock worth $878,000 after purchasing an additional 222 shares during the period. Quent Capital LLC boosted its stake in Fifth Third Bancorp by 9.9% in the 3rd quarter. Quent Capital LLC now owns 2,745 shares of the financial services provider's stock worth $118,000 after purchasing an additional 248 shares during the period. Diversified Trust Co boosted its stake in Fifth Third Bancorp by 2.6% in the 3rd quarter. Diversified Trust Co now owns 10,098 shares of the financial services provider's stock worth $433,000 after purchasing an additional 259 shares during the period. Metis Global Partners LLC boosted its stake in Fifth Third Bancorp by 1.2% in the 3rd quarter. Metis Global Partners LLC now owns 21,749 shares of the financial services provider's stock worth $932,000 after purchasing an additional 260 shares during the period. Finally, Bailard Inc. boosted its stake in Fifth Third Bancorp by 0.5% in the 2nd quarter. Bailard Inc. now owns 51,657 shares of the financial services provider's stock worth $1,885,000 after purchasing an additional 264 shares during the period. 83.79% of the stock is owned by hedge funds and other institutional investors.

About Fifth Third Bancorp

(

Get Free Report)

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Featured Articles

Before you consider Fifth Third Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fifth Third Bancorp wasn't on the list.

While Fifth Third Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.