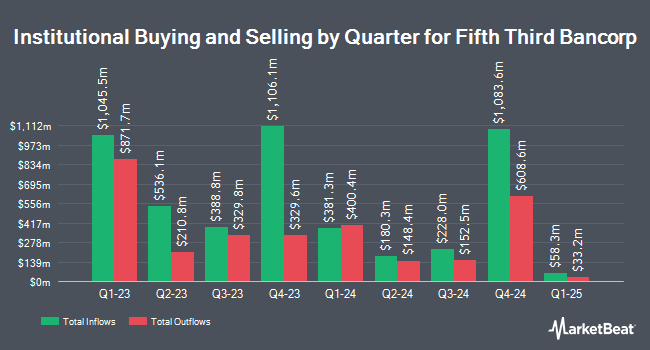

Vest Financial LLC grew its position in Fifth Third Bancorp (NASDAQ:FITB - Free Report) by 24.5% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 818,324 shares of the financial services provider's stock after buying an additional 160,889 shares during the quarter. Vest Financial LLC owned approximately 0.12% of Fifth Third Bancorp worth $34,599,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently made changes to their positions in the company. Charles Schwab Investment Management Inc. boosted its holdings in shares of Fifth Third Bancorp by 3.7% during the third quarter. Charles Schwab Investment Management Inc. now owns 20,774,462 shares of the financial services provider's stock worth $889,978,000 after purchasing an additional 732,651 shares during the period. Zurich Insurance Group Ltd FI acquired a new stake in shares of Fifth Third Bancorp during the third quarter worth approximately $28,490,000. Teachers Retirement System of The State of Kentucky boosted its holdings in shares of Fifth Third Bancorp by 76.2% during the third quarter. Teachers Retirement System of The State of Kentucky now owns 1,330,649 shares of the financial services provider's stock worth $57,005,000 after purchasing an additional 575,449 shares during the period. Franklin Resources Inc. boosted its holdings in shares of Fifth Third Bancorp by 8.1% during the third quarter. Franklin Resources Inc. now owns 5,476,374 shares of the financial services provider's stock worth $242,713,000 after purchasing an additional 409,292 shares during the period. Finally, Allspring Global Investments Holdings LLC boosted its holdings in shares of Fifth Third Bancorp by 4.8% during the third quarter. Allspring Global Investments Holdings LLC now owns 8,679,671 shares of the financial services provider's stock worth $371,837,000 after purchasing an additional 399,827 shares during the period. 83.79% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several analysts recently commented on FITB shares. Wells Fargo & Company raised their price target on shares of Fifth Third Bancorp from $52.00 to $54.00 and gave the stock an "overweight" rating in a report on Friday, November 15th. Truist Financial lifted their target price on shares of Fifth Third Bancorp from $51.00 to $52.00 and gave the company a "buy" rating in a research note on Wednesday, January 22nd. Baird R W cut shares of Fifth Third Bancorp from a "strong-buy" rating to a "hold" rating in a research note on Monday, October 21st. Citigroup lifted their target price on shares of Fifth Third Bancorp from $43.00 to $52.00 and gave the company a "neutral" rating in a research note on Friday, November 22nd. Finally, StockNews.com cut shares of Fifth Third Bancorp from a "hold" rating to a "sell" rating in a research note on Wednesday, November 6th. One research analyst has rated the stock with a sell rating, nine have given a hold rating and ten have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $46.75.

Check Out Our Latest Report on Fifth Third Bancorp

Fifth Third Bancorp Stock Performance

FITB stock traded down $0.57 on Wednesday, reaching $43.43. 4,406,428 shares of the company were exchanged, compared to its average volume of 4,711,312. Fifth Third Bancorp has a 12 month low of $32.29 and a 12 month high of $49.07. The stock's fifty day moving average price is $43.91 and its 200 day moving average price is $43.49. The firm has a market capitalization of $29.12 billion, a PE ratio of 13.83, a PEG ratio of 1.44 and a beta of 1.23. The company has a debt-to-equity ratio of 0.82, a current ratio of 0.80 and a quick ratio of 0.80.

Fifth Third Bancorp Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st were given a dividend of $0.37 per share. This represents a $1.48 dividend on an annualized basis and a yield of 3.41%. The ex-dividend date of this dividend was Tuesday, December 31st. Fifth Third Bancorp's dividend payout ratio (DPR) is currently 47.13%.

About Fifth Third Bancorp

(

Free Report)

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Further Reading

Before you consider Fifth Third Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fifth Third Bancorp wasn't on the list.

While Fifth Third Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.