Fifth Third Wealth Advisors LLC grew its holdings in UnitedHealth Group Incorporated (NYSE:UNH - Free Report) by 15.3% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 12,018 shares of the healthcare conglomerate's stock after buying an additional 1,594 shares during the quarter. Fifth Third Wealth Advisors LLC's holdings in UnitedHealth Group were worth $7,027,000 as of its most recent SEC filing.

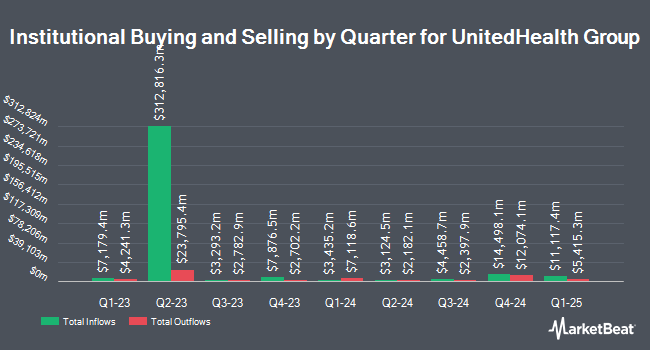

A number of other institutional investors have also recently made changes to their positions in the company. International Assets Investment Management LLC boosted its stake in UnitedHealth Group by 78,814.4% during the third quarter. International Assets Investment Management LLC now owns 5,296,737 shares of the healthcare conglomerate's stock worth $3,096,896,000 after buying an additional 5,290,025 shares during the last quarter. Swedbank AB purchased a new stake in shares of UnitedHealth Group in the 1st quarter valued at $1,117,462,000. Lone Pine Capital LLC purchased a new stake in UnitedHealth Group during the 2nd quarter worth about $480,903,000. Dimensional Fund Advisors LP increased its holdings in UnitedHealth Group by 30.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 3,816,254 shares of the healthcare conglomerate's stock worth $1,942,956,000 after purchasing an additional 880,183 shares during the period. Finally, Baillie Gifford & Co. boosted its position in shares of UnitedHealth Group by 1,125.4% during the 2nd quarter. Baillie Gifford & Co. now owns 894,006 shares of the healthcare conglomerate's stock worth $455,281,000 after acquiring an additional 821,050 shares in the last quarter. 87.86% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of research firms recently issued reports on UNH. Stephens dropped their price target on UnitedHealth Group from $632.00 to $605.00 and set an "overweight" rating on the stock in a research note on Wednesday, October 16th. Bank of America reduced their price objective on UnitedHealth Group from $675.00 to $650.00 and set a "buy" rating for the company in a report on Wednesday, October 16th. UBS Group reduced their price objective on UnitedHealth Group from $680.00 to $650.00 and set a "buy" rating for the company in a report on Wednesday, October 16th. KeyCorp began coverage on UnitedHealth Group in a report on Friday, October 11th. They set an "overweight" rating and a $675.00 price objective for the company. Finally, StockNews.com raised UnitedHealth Group from a "hold" rating to a "buy" rating in a report on Tuesday, November 12th. Three equities research analysts have rated the stock with a hold rating, eighteen have issued a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $615.53.

View Our Latest Report on UNH

UnitedHealth Group Stock Down 1.4 %

Shares of NYSE UNH traded down $8.38 on Tuesday, hitting $581.27. The company had a trading volume of 1,396,286 shares, compared to its average volume of 3,871,520. UnitedHealth Group Incorporated has a 12-month low of $436.38 and a 12-month high of $630.73. The business has a 50 day moving average of $582.75 and a two-hundred day moving average of $550.66. The company has a quick ratio of 0.91, a current ratio of 0.91 and a debt-to-equity ratio of 0.74. The firm has a market capitalization of $534.93 billion, a P/E ratio of 37.84, a PEG ratio of 1.74 and a beta of 0.58.

UnitedHealth Group (NYSE:UNH - Get Free Report) last released its quarterly earnings results on Tuesday, October 15th. The healthcare conglomerate reported $7.15 EPS for the quarter, topping the consensus estimate of $7.00 by $0.15. UnitedHealth Group had a return on equity of 26.37% and a net margin of 3.63%. The business had revenue of $100.82 billion for the quarter, compared to analysts' expectations of $99.14 billion. During the same quarter in the previous year, the firm posted $6.56 earnings per share. The company's revenue was up 9.2% compared to the same quarter last year. As a group, equities research analysts forecast that UnitedHealth Group Incorporated will post 27.6 earnings per share for the current fiscal year.

UnitedHealth Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 17th. Shareholders of record on Monday, December 9th will be paid a dividend of $2.10 per share. This represents a $8.40 annualized dividend and a yield of 1.45%. The ex-dividend date is Monday, December 9th. UnitedHealth Group's payout ratio is currently 54.72%.

About UnitedHealth Group

(

Free Report)

UnitedHealth Group Incorporated operates as a diversified health care company in the United States. The company operates through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The UnitedHealthcare segment offers consumer-oriented health benefit plans and services for national employers, public sector employers, mid-sized employers, small businesses, and individuals; health care coverage, and health and well-being services to individuals age 50 and older addressing their needs; Medicaid plans, children's health insurance and health care programs; and health and dental benefits, and hospital and clinical services, as well as health care benefits products and services to state programs caring for the economically disadvantaged, medically underserved, and those without the benefit of employer-funded health care coverage.

Further Reading

Before you consider UnitedHealth Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UnitedHealth Group wasn't on the list.

While UnitedHealth Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.