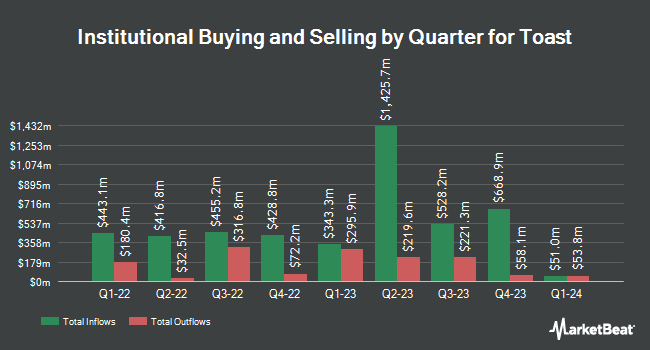

Fifth Third Wealth Advisors LLC bought a new stake in shares of Toast, Inc. (NYSE:TOST - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 67,527 shares of the company's stock, valued at approximately $1,912,000.

Several other hedge funds have also modified their holdings of the stock. KBC Group NV lifted its stake in Toast by 66.5% in the 3rd quarter. KBC Group NV now owns 42,838 shares of the company's stock worth $1,213,000 after acquiring an additional 17,106 shares in the last quarter. Stephens Investment Management Group LLC lifted its stake in Toast by 13.1% in the 3rd quarter. Stephens Investment Management Group LLC now owns 1,884,771 shares of the company's stock worth $53,358,000 after acquiring an additional 218,959 shares in the last quarter. Entropy Technologies LP purchased a new stake in Toast in the 3rd quarter worth about $894,000. QRG Capital Management Inc. lifted its stake in Toast by 39.7% in the 2nd quarter. QRG Capital Management Inc. now owns 84,967 shares of the company's stock worth $2,190,000 after acquiring an additional 24,164 shares in the last quarter. Finally, Epoch Investment Partners Inc. purchased a new stake in Toast in the 1st quarter worth about $633,000. 82.91% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several brokerages recently issued reports on TOST. Wedbush increased their price objective on Toast from $35.00 to $45.00 and gave the stock an "outperform" rating in a research note on Friday, November 8th. Morgan Stanley upped their target price on Toast from $30.00 to $33.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 22nd. Bank of America increased their price objective on Toast from $26.00 to $28.00 and gave the company a "neutral" rating in a report on Tuesday, September 17th. Piper Sandler increased their price objective on Toast from $25.00 to $35.00 and gave the company a "neutral" rating in a report on Monday, November 11th. Finally, JPMorgan Chase & Co. increased their price objective on Toast from $28.00 to $36.00 and gave the company a "neutral" rating in a report on Friday, November 8th. One investment analyst has rated the stock with a sell rating, ten have assigned a hold rating and eleven have given a buy rating to the stock. According to MarketBeat, Toast currently has a consensus rating of "Hold" and a consensus price target of $33.86.

Check Out Our Latest Stock Report on Toast

Insider Activity

In related news, Director Richard Kent Bennett sold 100,000 shares of the business's stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $36.67, for a total value of $3,667,000.00. Following the completion of the sale, the director now directly owns 418,591 shares in the company, valued at approximately $15,349,731.97. The trade was a 19.28 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, President Stephen Fredette sold 211,686 shares of the company's stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $23.57, for a total value of $4,989,439.02. Following the sale, the president now owns 2,638,023 shares of the company's stock, valued at $62,178,202.11. The trade was a 7.43 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 1,475,651 shares of company stock valued at $43,037,212. 13.32% of the stock is owned by insiders.

Toast Price Performance

NYSE TOST traded down $0.01 during trading on Wednesday, reaching $42.49. 10,952,535 shares of the company's stock were exchanged, compared to its average volume of 7,346,083. Toast, Inc. has a fifty-two week low of $13.77 and a fifty-two week high of $42.85. The business has a 50 day moving average price of $30.45 and a 200-day moving average price of $26.83. The stock has a market capitalization of $20.01 billion, a P/E ratio of -326.92, a PEG ratio of 51.74 and a beta of 1.74.

Toast Company Profile

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

Recommended Stories

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.