FIGS (NYSE:FIGS - Free Report) had its price objective cut by The Goldman Sachs Group from $5.00 to $4.50 in a report released on Tuesday morning,Benzinga reports. They currently have a sell rating on the stock.

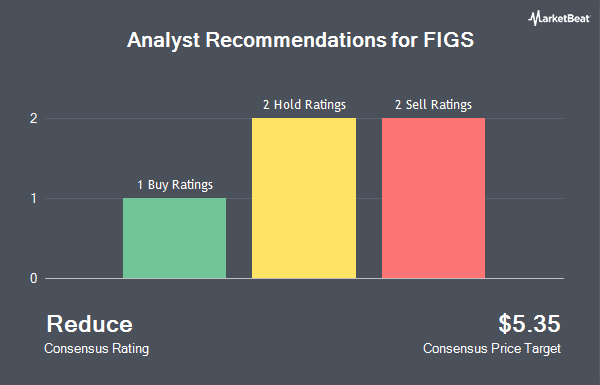

Several other equities research analysts have also commented on the stock. Telsey Advisory Group reissued a "market perform" rating and set a $7.00 price objective on shares of FIGS in a research note on Wednesday, November 13th. Barclays reduced their price objective on FIGS from $5.00 to $4.00 and set an "equal weight" rating for the company in a research report on Tuesday, November 12th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and one has issued a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $5.35.

Read Our Latest Stock Report on FIGS

FIGS Stock Performance

Shares of NYSE FIGS traded down $0.10 during midday trading on Tuesday, hitting $5.13. 1,600,474 shares of the company traded hands, compared to its average volume of 3,493,239. FIGS has a 12-month low of $4.30 and a 12-month high of $7.98. The firm has a market cap of $871.13 million, a P/E ratio of 87.08, a P/E/G ratio of 244.32 and a beta of 1.33. The stock has a 50-day moving average price of $5.80 and a 200 day moving average price of $5.68.

Institutional Inflows and Outflows

Hedge funds have recently made changes to their positions in the stock. Bamco Inc. NY grew its position in FIGS by 12.5% during the third quarter. Bamco Inc. NY now owns 30,030,078 shares of the company's stock valued at $205,406,000 after buying an additional 3,342,755 shares during the period. Geode Capital Management LLC grew its position in shares of FIGS by 3.8% during the 3rd quarter. Geode Capital Management LLC now owns 2,977,364 shares of the company's stock valued at $20,369,000 after acquiring an additional 109,979 shares during the period. State Street Corp increased its stake in shares of FIGS by 1.4% in the 3rd quarter. State Street Corp now owns 2,743,494 shares of the company's stock worth $18,765,000 after purchasing an additional 38,787 shares in the last quarter. Applied Fundamental Research LLC raised its holdings in FIGS by 6.1% in the 3rd quarter. Applied Fundamental Research LLC now owns 2,648,281 shares of the company's stock worth $18,114,000 after purchasing an additional 152,900 shares during the period. Finally, Bank of New York Mellon Corp lifted its position in FIGS by 16.2% during the second quarter. Bank of New York Mellon Corp now owns 2,307,304 shares of the company's stock valued at $12,298,000 after purchasing an additional 322,358 shares in the last quarter. 92.21% of the stock is owned by hedge funds and other institutional investors.

FIGS Company Profile

(

Get Free Report)

FIGS, Inc operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally. It designs and sells healthcare apparel and scrubwear and non-scrubwear offerings, such as outerwear, underscrubs, footwear, compression socks, lab coats, loungewear, and other apparel.

See Also

Before you consider FIGS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FIGS wasn't on the list.

While FIGS currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.