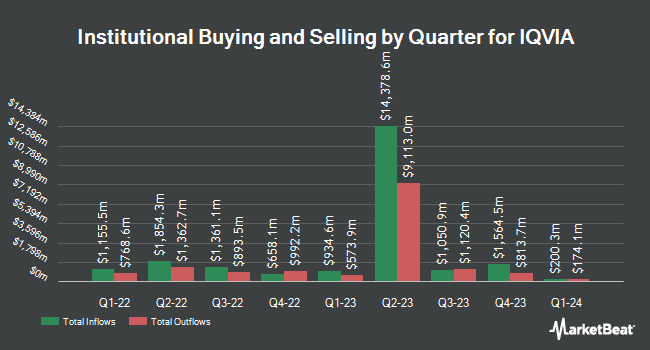

FIL Ltd reduced its position in shares of IQVIA Holdings Inc. (NYSE:IQV - Free Report) by 17.3% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 603,094 shares of the medical research company's stock after selling 125,837 shares during the period. FIL Ltd owned 0.33% of IQVIA worth $118,514,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also bought and sold shares of the company. Synergy Asset Management LLC acquired a new stake in shares of IQVIA in the fourth quarter valued at about $33,000. Lee Danner & Bass Inc. acquired a new stake in IQVIA in the 4th quarter valued at approximately $44,000. Zions Bancorporation N.A. increased its position in IQVIA by 55.2% in the 4th quarter. Zions Bancorporation N.A. now owns 239 shares of the medical research company's stock worth $47,000 after buying an additional 85 shares during the period. Versant Capital Management Inc lifted its holdings in shares of IQVIA by 46.0% during the fourth quarter. Versant Capital Management Inc now owns 295 shares of the medical research company's stock worth $58,000 after buying an additional 93 shares during the last quarter. Finally, SBI Securities Co. Ltd. bought a new stake in shares of IQVIA in the fourth quarter valued at approximately $60,000. 89.62% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several equities analysts recently commented on IQV shares. StockNews.com cut shares of IQVIA from a "buy" rating to a "hold" rating in a research note on Wednesday, March 12th. Royal Bank of Canada reiterated an "outperform" rating and issued a $270.00 target price on shares of IQVIA in a research note on Monday, February 10th. Stifel Nicolaus lowered their price target on IQVIA from $273.00 to $261.00 and set a "buy" rating on the stock in a research note on Friday, February 7th. Truist Financial reduced their price objective on IQVIA from $263.00 to $216.00 and set a "buy" rating for the company in a research report on Thursday. Finally, Barclays restated an "equal weight" rating and set a $170.00 price objective (down from $235.00) on shares of IQVIA in a research report on Thursday. Six analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $241.50.

Get Our Latest Stock Report on IQV

IQVIA Price Performance

Shares of NYSE:IQV traded up $5.12 during trading on Monday, reaching $150.67. The stock had a trading volume of 532,227 shares, compared to its average volume of 1,381,304. The stock has a market capitalization of $26.57 billion, a PE ratio of 20.09, a P/E/G ratio of 1.99 and a beta of 1.46. IQVIA Holdings Inc. has a 52 week low of $135.97 and a 52 week high of $252.88. The business's 50-day moving average price is $182.32 and its 200 day moving average price is $199.38. The company has a debt-to-equity ratio of 2.12, a current ratio of 0.84 and a quick ratio of 0.84.

IQVIA (NYSE:IQV - Get Free Report) last posted its quarterly earnings data on Thursday, February 6th. The medical research company reported $2.90 EPS for the quarter, missing analysts' consensus estimates of $3.11 by ($0.21). IQVIA had a return on equity of 28.81% and a net margin of 8.91%. As a group, equities analysts predict that IQVIA Holdings Inc. will post 10.84 earnings per share for the current year.

IQVIA Profile

(

Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Articles

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.