FIL Ltd cut its holdings in shares of American Financial Group, Inc. (NYSE:AFG - Free Report) by 0.7% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 411,680 shares of the insurance provider's stock after selling 2,875 shares during the quarter. FIL Ltd owned about 0.49% of American Financial Group worth $56,371,000 as of its most recent SEC filing.

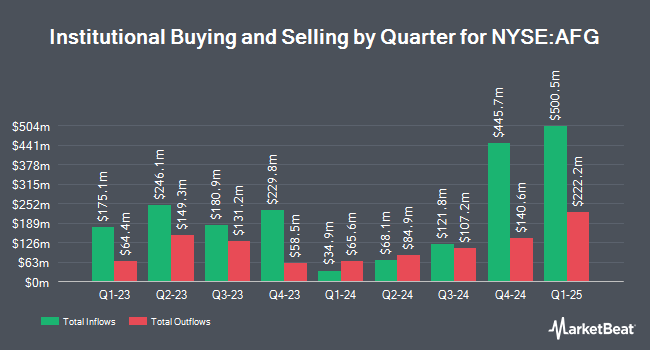

Several other hedge funds also recently modified their holdings of AFG. Intech Investment Management LLC boosted its holdings in American Financial Group by 57.1% in the 4th quarter. Intech Investment Management LLC now owns 38,623 shares of the insurance provider's stock valued at $5,289,000 after purchasing an additional 14,045 shares during the period. Sumitomo Mitsui Trust Group Inc. increased its stake in American Financial Group by 2.6% during the fourth quarter. Sumitomo Mitsui Trust Group Inc. now owns 151,771 shares of the insurance provider's stock valued at $20,782,000 after acquiring an additional 3,911 shares during the period. Sumitomo Mitsui DS Asset Management Company Ltd raised its holdings in American Financial Group by 55.2% in the 4th quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 7,837 shares of the insurance provider's stock valued at $1,073,000 after acquiring an additional 2,789 shares in the last quarter. JPMorgan Chase & Co. raised its holdings in American Financial Group by 78.3% in the 3rd quarter. JPMorgan Chase & Co. now owns 333,078 shares of the insurance provider's stock valued at $44,832,000 after acquiring an additional 146,237 shares in the last quarter. Finally, Franklin Resources Inc. lifted its position in shares of American Financial Group by 17.4% in the 3rd quarter. Franklin Resources Inc. now owns 49,796 shares of the insurance provider's stock worth $6,833,000 after acquiring an additional 7,365 shares during the period. 64.37% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, Keefe, Bruyette & Woods lowered their price target on shares of American Financial Group from $144.00 to $126.00 and set a "market perform" rating on the stock in a report on Wednesday, April 9th.

Check Out Our Latest Research Report on AFG

American Financial Group Price Performance

Shares of American Financial Group stock remained flat at $127.71 during midday trading on Tuesday. The company had a trading volume of 45,914 shares, compared to its average volume of 543,992. The firm has a 50 day simple moving average of $125.40 and a 200 day simple moving average of $132.87. American Financial Group, Inc. has a 1-year low of $114.73 and a 1-year high of $150.19. The company has a market capitalization of $10.69 billion, a price-to-earnings ratio of 12.08 and a beta of 0.59. The company has a debt-to-equity ratio of 0.31, a quick ratio of 0.53 and a current ratio of 0.53.

American Financial Group (NYSE:AFG - Get Free Report) last issued its quarterly earnings data on Tuesday, February 4th. The insurance provider reported $3.12 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.15 by ($0.03). American Financial Group had a net margin of 10.66% and a return on equity of 20.30%. Equities research analysts expect that American Financial Group, Inc. will post 10.5 earnings per share for the current year.

American Financial Group Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, April 25th. Investors of record on Tuesday, April 15th will be issued a dividend of $0.80 per share. The ex-dividend date is Tuesday, April 15th. This represents a $3.20 dividend on an annualized basis and a yield of 2.51%. American Financial Group's dividend payout ratio is 30.27%.

Insiders Place Their Bets

In related news, Director Gregory G. Joseph purchased 3,000 shares of the firm's stock in a transaction dated Thursday, February 20th. The shares were acquired at an average cost of $121.00 per share, with a total value of $363,000.00. Following the completion of the purchase, the director now directly owns 57,477 shares of the company's stock, valued at $6,954,717. This trade represents a 5.51 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 14.50% of the company's stock.

About American Financial Group

(

Free Report)

American Financial Group, Inc, an insurance holding company, provides specialty property and casualty insurance products in the United States. The company offers property and transportation insurance products, such as physical damage and liability coverage for buses and trucks, inland and ocean marine, agricultural-related products, and other commercial property and specialty transportation coverages; specialty casualty insurance, including primarily excess and surplus, executive and professional liability, general liability, umbrella and excess liability, and specialty coverage in targeted markets, as well as customized programs for small to mid-sized businesses and workers' compensation insurance; and specialty financial insurance products comprising risk management insurance programs for lending and leasing institutions, fidelity and surety products, and trade credit insurance.

Featured Articles

Before you consider American Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Financial Group wasn't on the list.

While American Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.