Financial Enhancement Group LLC bought a new position in FMC Co. (NYSE:FMC - Free Report) during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor bought 59,751 shares of the basic materials company's stock, valued at approximately $3,940,000.

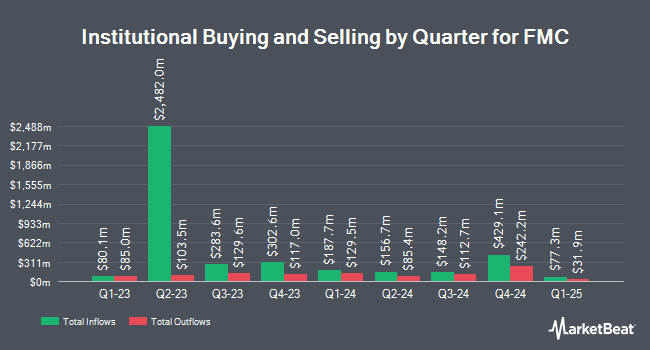

Other institutional investors and hedge funds have also bought and sold shares of the company. Mather Group LLC. lifted its stake in FMC by 250.6% in the 3rd quarter. Mather Group LLC. now owns 554 shares of the basic materials company's stock worth $37,000 after purchasing an additional 396 shares in the last quarter. LRI Investments LLC purchased a new stake in FMC in the 1st quarter worth approximately $39,000. UMB Bank n.a. raised its position in shares of FMC by 56.9% during the 2nd quarter. UMB Bank n.a. now owns 678 shares of the basic materials company's stock valued at $39,000 after buying an additional 246 shares in the last quarter. Sentry Investment Management LLC purchased a new stake in shares of FMC during the 1st quarter valued at $45,000. Finally, EntryPoint Capital LLC raised its position in shares of FMC by 1,282.3% during the 1st quarter. EntryPoint Capital LLC now owns 857 shares of the basic materials company's stock valued at $55,000 after buying an additional 795 shares in the last quarter. 91.86% of the stock is currently owned by hedge funds and other institutional investors.

FMC Trading Down 0.1 %

FMC stock traded down $0.09 during trading hours on Thursday, reaching $60.84. The stock had a trading volume of 1,372,575 shares, compared to its average volume of 1,690,530. The stock has a market cap of $7.60 billion, a PE ratio of 5.24, a PEG ratio of 1.67 and a beta of 0.85. FMC Co. has a 52 week low of $49.49 and a 52 week high of $68.72. The company has a debt-to-equity ratio of 0.65, a current ratio of 1.48 and a quick ratio of 1.09. The company has a fifty day simple moving average of $63.06 and a 200-day simple moving average of $61.04.

FMC (NYSE:FMC - Get Free Report) last posted its earnings results on Tuesday, October 29th. The basic materials company reported $0.69 EPS for the quarter, topping the consensus estimate of $0.49 by $0.20. FMC had a net margin of 34.93% and a return on equity of 7.68%. The firm had revenue of $1.07 billion during the quarter, compared to analysts' expectations of $1.04 billion. During the same period last year, the company posted $0.44 EPS. The company's quarterly revenue was up 8.5% compared to the same quarter last year. Analysts forecast that FMC Co. will post 3.35 EPS for the current fiscal year.

Analyst Ratings Changes

Several analysts have recently weighed in on the stock. Mizuho raised their price objective on shares of FMC from $64.00 to $70.00 and gave the company a "neutral" rating in a research report on Friday, November 1st. JPMorgan Chase & Co. raised their price objective on shares of FMC from $50.00 to $59.00 and gave the company a "neutral" rating in a research report on Monday, August 12th. Redburn Atlantic upgraded shares of FMC from a "hold" rating to a "strong-buy" rating in a research report on Friday, July 19th. Barclays increased their target price on shares of FMC from $62.00 to $65.00 and gave the company an "equal weight" rating in a report on Monday, August 5th. Finally, Royal Bank of Canada increased their target price on shares of FMC from $78.00 to $81.00 and gave the company an "outperform" rating in a report on Friday, November 1st. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating, four have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, FMC presently has a consensus rating of "Hold" and an average target price of $68.00.

View Our Latest Analysis on FMC

About FMC

(

Free Report)

FMC Corporation, an agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products, which are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases, as well as in non-agricultural markets for pest control.

Read More

Before you consider FMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FMC wasn't on the list.

While FMC currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.