Financial Management Network Inc. purchased a new stake in Merck & Co., Inc. (NYSE:MRK - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 3,515 shares of the company's stock, valued at approximately $348,000.

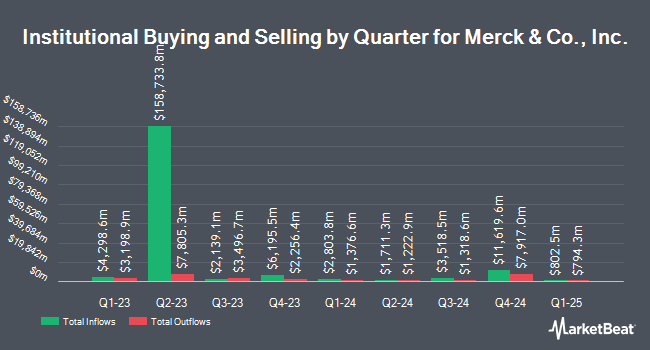

A number of other institutional investors and hedge funds have also recently bought and sold shares of the stock. State Street Corp raised its holdings in shares of Merck & Co., Inc. by 1.3% in the third quarter. State Street Corp now owns 119,026,412 shares of the company's stock valued at $13,606,360,000 after buying an additional 1,536,474 shares during the last quarter. Wellington Management Group LLP raised its holdings in shares of Merck & Co., Inc. by 4.6% in the third quarter. Wellington Management Group LLP now owns 75,809,383 shares of the company's stock valued at $8,608,914,000 after buying an additional 3,327,404 shares during the last quarter. Geode Capital Management LLC raised its holdings in shares of Merck & Co., Inc. by 3.7% in the third quarter. Geode Capital Management LLC now owns 59,155,004 shares of the company's stock valued at $6,696,060,000 after buying an additional 2,134,296 shares during the last quarter. Charles Schwab Investment Management Inc. raised its holdings in shares of Merck & Co., Inc. by 2.8% in the third quarter. Charles Schwab Investment Management Inc. now owns 18,807,293 shares of the company's stock valued at $2,135,785,000 after buying an additional 514,060 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its holdings in shares of Merck & Co., Inc. by 1.8% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 17,756,021 shares of the company's stock valued at $2,016,374,000 after buying an additional 309,656 shares during the last quarter. 76.07% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on MRK. TD Cowen cut shares of Merck & Co., Inc. from a "buy" rating to a "hold" rating and cut their price target for the stock from $121.00 to $100.00 in a report on Monday, February 10th. Leerink Partners cut their price target on shares of Merck & Co., Inc. from $136.00 to $119.00 and set an "outperform" rating for the company in a report on Monday, January 13th. Daiwa America cut shares of Merck & Co., Inc. from a "strong-buy" rating to a "hold" rating in a report on Monday, November 11th. Wolfe Research began coverage on shares of Merck & Co., Inc. in a report on Friday, November 15th. They set a "peer perform" rating for the company. Finally, Citigroup cut their price target on shares of Merck & Co., Inc. from $125.00 to $115.00 and set a "buy" rating for the company in a report on Wednesday, February 5th. One investment analyst has rated the stock with a sell rating, eleven have issued a hold rating, nine have given a buy rating and three have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Merck & Co., Inc. currently has a consensus rating of "Moderate Buy" and a consensus target price of $116.39.

Read Our Latest Analysis on MRK

Merck & Co., Inc. Price Performance

Shares of MRK stock traded up $1.72 during trading hours on Friday, hitting $89.40. The company's stock had a trading volume of 15,641,321 shares, compared to its average volume of 17,774,290. The business has a fifty day moving average of $95.46 and a 200-day moving average of $104.21. The stock has a market cap of $226.14 billion, a price-to-earnings ratio of 13.28, a P/E/G ratio of 0.77 and a beta of 0.38. Merck & Co., Inc. has a twelve month low of $81.04 and a twelve month high of $134.63. The company has a current ratio of 1.36, a quick ratio of 1.15 and a debt-to-equity ratio of 0.79.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last released its quarterly earnings results on Tuesday, February 4th. The company reported $1.72 EPS for the quarter, missing the consensus estimate of $1.85 by ($0.13). The business had revenue of $15.62 billion during the quarter, compared to analyst estimates of $15.51 billion. Merck & Co., Inc. had a net margin of 26.67% and a return on equity of 45.35%. The firm's revenue for the quarter was up 6.8% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.03 earnings per share. As a group, equities research analysts anticipate that Merck & Co., Inc. will post 9.01 EPS for the current year.

Merck & Co., Inc. Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, April 7th. Investors of record on Monday, March 17th will be paid a dividend of $0.81 per share. This represents a $3.24 annualized dividend and a dividend yield of 3.62%. The ex-dividend date is Monday, March 17th. Merck & Co., Inc.'s payout ratio is 48.14%.

Merck & Co., Inc. declared that its Board of Directors has authorized a stock buyback program on Tuesday, January 28th that authorizes the company to buyback $10.00 billion in shares. This buyback authorization authorizes the company to purchase up to 4.1% of its shares through open market purchases. Shares buyback programs are generally an indication that the company's board of directors believes its shares are undervalued.

Insider Activity at Merck & Co., Inc.

In other Merck & Co., Inc. news, insider Cristal N. Downing sold 2,361 shares of the stock in a transaction that occurred on Thursday, February 6th. The shares were sold at an average price of $88.76, for a total transaction of $209,562.36. Following the transaction, the insider now owns 7,085 shares of the company's stock, valued at $628,864.60. This trade represents a 24.99 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Inge G. Thulin bought 2,833 shares of the business's stock in a transaction dated Thursday, February 6th. The stock was acquired at an average cost of $88.25 per share, for a total transaction of $250,012.25. Following the purchase, the director now owns 2,933 shares in the company, valued at approximately $258,837.25. This trade represents a 2,833.00 % increase in their position. The disclosure for this purchase can be found here. Insiders own 0.09% of the company's stock.

About Merck & Co., Inc.

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

See Also

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report