Finepoint Capital LP trimmed its holdings in Ascendis Pharma A/S (NASDAQ:ASND - Free Report) by 2.7% during the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 184,872 shares of the biotechnology company's stock after selling 5,200 shares during the period. Ascendis Pharma A/S comprises about 1.6% of Finepoint Capital LP's investment portfolio, making the stock its 7th biggest position. Finepoint Capital LP owned about 0.30% of Ascendis Pharma A/S worth $25,451,000 at the end of the most recent quarter.

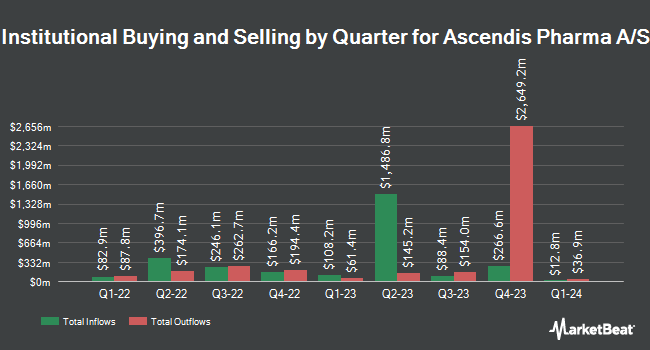

A number of other hedge funds have also recently made changes to their positions in ASND. Wilmington Savings Fund Society FSB purchased a new position in Ascendis Pharma A/S in the 3rd quarter worth approximately $30,000. Jones Financial Companies Lllp lifted its holdings in shares of Ascendis Pharma A/S by 394.0% in the fourth quarter. Jones Financial Companies Lllp now owns 247 shares of the biotechnology company's stock worth $34,000 after buying an additional 197 shares in the last quarter. Blue Trust Inc. boosted its position in shares of Ascendis Pharma A/S by 415.2% during the fourth quarter. Blue Trust Inc. now owns 407 shares of the biotechnology company's stock worth $56,000 after acquiring an additional 328 shares during the last quarter. Groupama Asset Managment purchased a new position in Ascendis Pharma A/S during the third quarter valued at $60,000. Finally, GAMMA Investing LLC increased its holdings in Ascendis Pharma A/S by 58.0% in the 4th quarter. GAMMA Investing LLC now owns 583 shares of the biotechnology company's stock valued at $80,000 after acquiring an additional 214 shares during the last quarter.

Ascendis Pharma A/S Price Performance

Shares of ASND traded up $5.94 during mid-day trading on Friday, reaching $149.27. 122,240 shares of the company's stock traded hands, compared to its average volume of 477,006. Ascendis Pharma A/S has a 12 month low of $111.09 and a 12 month high of $169.37. The stock has a market cap of $9.06 billion, a P/E ratio of -21.07 and a beta of 0.54. The stock's 50-day moving average is $147.75 and its two-hundred day moving average is $137.67.

Ascendis Pharma A/S (NASDAQ:ASND - Get Free Report) last released its earnings results on Wednesday, February 12th. The biotechnology company reported ($0.68) earnings per share for the quarter, topping the consensus estimate of ($1.32) by $0.64. Research analysts predict that Ascendis Pharma A/S will post -4.34 earnings per share for the current year.

Wall Street Analyst Weigh In

Several research analysts have commented on the stock. Evercore ISI increased their price objective on shares of Ascendis Pharma A/S from $220.00 to $260.00 and gave the company an "outperform" rating in a report on Tuesday, February 18th. JPMorgan Chase & Co. increased their price target on Ascendis Pharma A/S from $168.00 to $200.00 and gave the company an "overweight" rating in a research note on Tuesday, March 18th. The Goldman Sachs Group lifted their price objective on Ascendis Pharma A/S from $200.00 to $225.00 and gave the stock a "buy" rating in a research note on Thursday, February 13th. UBS Group started coverage on Ascendis Pharma A/S in a report on Tuesday, January 7th. They set a "buy" rating and a $196.00 price objective on the stock. Finally, Cantor Fitzgerald raised their target price on shares of Ascendis Pharma A/S from $170.00 to $200.00 and gave the company an "overweight" rating in a report on Tuesday, February 25th. Two research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $204.64.

Get Our Latest Stock Analysis on ASND

Ascendis Pharma A/S Company Profile

(

Free Report)

Ascendis Pharma A/S, a biopharmaceutical company, focuses on developing therapies for unmet medical needs. It offers SKYTROFA for treating patients with growth hormone deficiency (GHD). The company is also developing a pipeline of three independent endocrinology rare disease product candidates in clinical development, as well as focuses on advancing oncology therapeutic candidates.

Further Reading

Before you consider Ascendis Pharma A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ascendis Pharma A/S wasn't on the list.

While Ascendis Pharma A/S currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.