Jennison Associates LLC reduced its holdings in First Bancorp (NASDAQ:FBNC - Free Report) by 2.5% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 490,267 shares of the financial services provider's stock after selling 12,421 shares during the period. Jennison Associates LLC owned about 1.19% of First Bancorp worth $20,390,000 at the end of the most recent quarter.

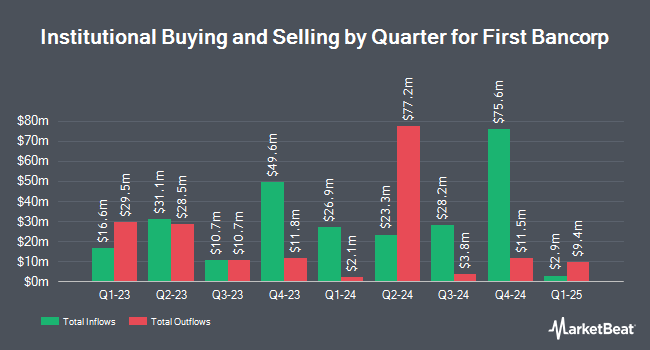

A number of other hedge funds and other institutional investors have also recently made changes to their positions in FBNC. Envestnet Asset Management Inc. boosted its holdings in First Bancorp by 8.5% in the second quarter. Envestnet Asset Management Inc. now owns 84,596 shares of the financial services provider's stock valued at $2,700,000 after purchasing an additional 6,628 shares during the last quarter. Truist Financial Corp boosted its stake in shares of First Bancorp by 165.2% in the second quarter. Truist Financial Corp now owns 34,911 shares of the financial services provider's stock worth $1,114,000 after buying an additional 21,749 shares during the last quarter. CANADA LIFE ASSURANCE Co grew its holdings in First Bancorp by 1.2% during the first quarter. CANADA LIFE ASSURANCE Co now owns 33,399 shares of the financial services provider's stock worth $1,204,000 after acquiring an additional 394 shares during the period. Pinnacle Associates Ltd. raised its position in First Bancorp by 28.4% during the third quarter. Pinnacle Associates Ltd. now owns 83,923 shares of the financial services provider's stock valued at $3,490,000 after acquiring an additional 18,543 shares in the last quarter. Finally, Dimensional Fund Advisors LP lifted its holdings in First Bancorp by 6.9% in the second quarter. Dimensional Fund Advisors LP now owns 2,104,258 shares of the financial services provider's stock valued at $67,166,000 after acquiring an additional 136,002 shares during the period. Institutional investors and hedge funds own 68.36% of the company's stock.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut shares of First Bancorp from a "hold" rating to a "sell" rating in a research note on Thursday, October 24th.

Get Our Latest Analysis on FBNC

Insider Activity

In related news, Director Suzanne S. Deferie sold 2,036 shares of the firm's stock in a transaction dated Monday, September 23rd. The shares were sold at an average price of $43.77, for a total value of $89,115.72. Following the transaction, the director now directly owns 65,618 shares of the company's stock, valued at approximately $2,872,099.86. This trade represents a 3.01 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Insiders own 3.65% of the company's stock.

First Bancorp Price Performance

Shares of First Bancorp stock traded up $1.43 during trading hours on Friday, reaching $48.12. The stock had a trading volume of 181,930 shares, compared to its average volume of 193,234. First Bancorp has a twelve month low of $29.53 and a twelve month high of $48.21. The company has a current ratio of 0.83, a quick ratio of 0.82 and a debt-to-equity ratio of 0.06. The firm has a market capitalization of $1.99 billion, a PE ratio of 19.40 and a beta of 1.02. The stock's 50 day moving average is $43.27 and its 200 day moving average is $38.43.

First Bancorp (NASDAQ:FBNC - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The financial services provider reported $0.70 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.70. The company had revenue of $144.99 million for the quarter, compared to the consensus estimate of $97.00 million. First Bancorp had a return on equity of 8.00% and a net margin of 17.98%. Equities analysts expect that First Bancorp will post 2.72 earnings per share for the current fiscal year.

First Bancorp Profile

(

Free Report)

First Bancorp operates as the bank holding company for First Bank that provides banking products and services for individuals and small to medium-sized businesses. The company accepts deposit products, such as checking, savings, and money market accounts, as well as time deposits, including certificate of deposits and individual retirement accounts.

Further Reading

Before you consider First Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Bancorp wasn't on the list.

While First Bancorp currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.