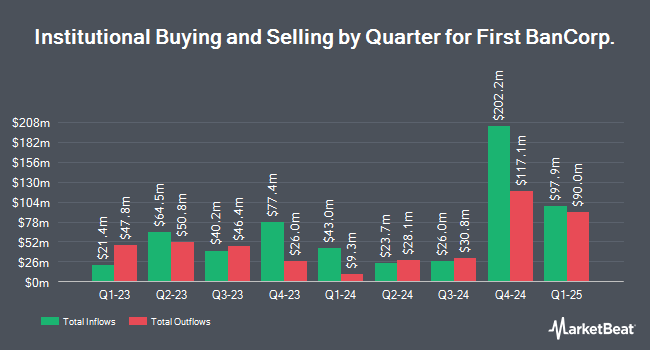

Victory Capital Management Inc. decreased its holdings in shares of First BanCorp. (NYSE:FBP - Free Report) by 5.5% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 1,075,910 shares of the bank's stock after selling 62,023 shares during the quarter. Victory Capital Management Inc. owned about 0.66% of First BanCorp. worth $22,777,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors have also recently added to or reduced their stakes in the company. Vanguard Group Inc. lifted its stake in shares of First BanCorp. by 2.0% during the first quarter. Vanguard Group Inc. now owns 22,414,701 shares of the bank's stock worth $393,154,000 after purchasing an additional 448,845 shares in the last quarter. LSV Asset Management boosted its holdings in First BanCorp. by 22.9% in the 2nd quarter. LSV Asset Management now owns 1,619,842 shares of the bank's stock worth $29,627,000 after acquiring an additional 301,443 shares during the period. Panagora Asset Management Inc. grew its position in First BanCorp. by 55.8% in the second quarter. Panagora Asset Management Inc. now owns 656,855 shares of the bank's stock valued at $12,014,000 after acquiring an additional 235,156 shares in the last quarter. X Square Capital LLC grew its position in First BanCorp. by 45.2% in the second quarter. X Square Capital LLC now owns 351,170 shares of the bank's stock valued at $6,423,000 after acquiring an additional 109,340 shares in the last quarter. Finally, Intech Investment Management LLC purchased a new stake in shares of First BanCorp. during the second quarter valued at approximately $1,490,000. 97.91% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other news, EVP Nayda Rivera sold 25,000 shares of the business's stock in a transaction that occurred on Friday, November 8th. The stock was sold at an average price of $21.19, for a total transaction of $529,750.00. Following the completion of the transaction, the executive vice president now directly owns 236,490 shares in the company, valued at approximately $5,011,223.10. The trade was a 9.56 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, EVP Michael Mcdonald sold 1,944 shares of the firm's stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $21.51, for a total value of $41,815.44. Following the completion of the sale, the executive vice president now owns 87,476 shares in the company, valued at approximately $1,881,608.76. This represents a 2.17 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 34,556 shares of company stock worth $736,365 in the last three months. 2.50% of the stock is owned by insiders.

Wall Street Analyst Weigh In

A number of research firms recently weighed in on FBP. Piper Sandler lowered their price target on shares of First BanCorp. from $22.00 to $21.00 and set a "neutral" rating for the company in a report on Thursday, October 24th. Hovde Group lowered their price objective on First BanCorp. from $25.00 to $24.00 and set an "outperform" rating for the company in a research note on Friday, October 25th. Finally, Wells Fargo & Company decreased their price target on shares of First BanCorp. from $22.00 to $20.00 and set an "equal weight" rating for the company in a research report on Thursday, October 24th. Two equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $21.40.

View Our Latest Report on FBP

First BanCorp. Stock Performance

Shares of FBP stock traded down $0.26 on Tuesday, hitting $20.54. 910,416 shares of the stock traded hands, compared to its average volume of 1,038,871. The company has a market capitalization of $3.37 billion, a PE ratio of 11.35, a PEG ratio of 1.89 and a beta of 1.11. First BanCorp. has a 1-year low of $14.72 and a 1-year high of $22.40. The company's fifty day moving average is $20.43 and its 200 day moving average is $19.60. The company has a debt-to-equity ratio of 0.36, a current ratio of 0.78 and a quick ratio of 0.78.

First BanCorp. (NYSE:FBP - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The bank reported $0.45 earnings per share for the quarter, topping the consensus estimate of $0.41 by $0.04. First BanCorp. had a net margin of 24.94% and a return on equity of 19.91%. The firm had revenue of $234.57 million for the quarter, compared to analyst estimates of $238.51 million. During the same quarter in the prior year, the business earned $0.46 earnings per share. First BanCorp.'s quarterly revenue was up 2.0% on a year-over-year basis. On average, equities research analysts predict that First BanCorp. will post 1.76 earnings per share for the current fiscal year.

First BanCorp. Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 29th will be given a dividend of $0.16 per share. The ex-dividend date of this dividend is Friday, November 29th. This represents a $0.64 dividend on an annualized basis and a yield of 3.12%. First BanCorp.'s dividend payout ratio is currently 35.36%.

About First BanCorp.

(

Free Report)

First BanCorp. operates as a bank holding company for FirstBank Puerto Rico that provides a range of financial products and services to consumers and commercial customers. The company operates through six segments: Commercial and Corporate Banking, Mortgage Banking, Consumer (Retail) Banking, Treasury and Investments, United States Operations, and Virgin Islands Operations.

Read More

Before you consider First BanCorp., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First BanCorp. wasn't on the list.

While First BanCorp. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.