First Business Financial Services Inc. lifted its holdings in First Business Financial Services, Inc. (NASDAQ:FBIZ - Free Report) by 3.4% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 365,912 shares of the financial services provider's stock after acquiring an additional 12,194 shares during the quarter. First Business Financial Services makes up approximately 1.7% of First Business Financial Services Inc.'s holdings, making the stock its 10th largest holding. First Business Financial Services Inc. owned about 4.41% of First Business Financial Services worth $16,682,000 at the end of the most recent quarter.

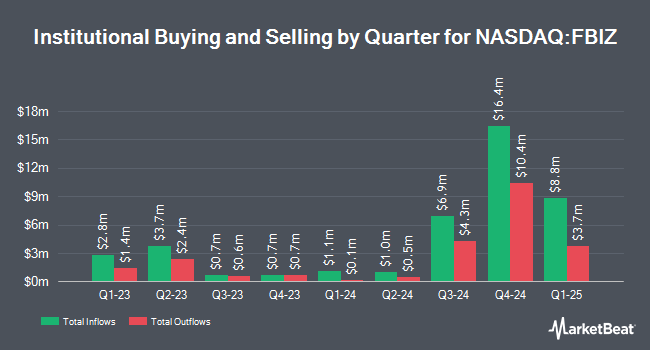

Other institutional investors and hedge funds have also modified their holdings of the company. Dimensional Fund Advisors LP lifted its holdings in First Business Financial Services by 1.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 537,808 shares of the financial services provider's stock worth $19,893,000 after buying an additional 7,871 shares in the last quarter. Vanguard Group Inc. lifted its holdings in First Business Financial Services by 2.1% during the 1st quarter. Vanguard Group Inc. now owns 361,070 shares of the financial services provider's stock worth $13,540,000 after buying an additional 7,499 shares in the last quarter. Bank of New York Mellon Corp lifted its holdings in First Business Financial Services by 5.6% during the 2nd quarter. Bank of New York Mellon Corp now owns 37,891 shares of the financial services provider's stock worth $1,402,000 after buying an additional 1,998 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its holdings in First Business Financial Services by 2.8% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 18,946 shares of the financial services provider's stock worth $711,000 after buying an additional 524 shares in the last quarter. Finally, GSA Capital Partners LLP lifted its holdings in First Business Financial Services by 38.3% during the 3rd quarter. GSA Capital Partners LLP now owns 9,900 shares of the financial services provider's stock worth $451,000 after buying an additional 2,740 shares in the last quarter. 60.07% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research analysts have recently weighed in on FBIZ shares. DA Davidson raised First Business Financial Services from a "neutral" rating to a "buy" rating and increased their price target for the company from $36.00 to $50.00 in a research note on Monday, August 5th. Keefe, Bruyette & Woods reissued an "outperform" rating and issued a $51.00 price target (up previously from $48.00) on shares of First Business Financial Services in a research note on Monday, July 29th. StockNews.com raised First Business Financial Services from a "hold" rating to a "buy" rating in a research note on Thursday, October 31st. Finally, Piper Sandler cut their price target on First Business Financial Services from $56.00 to $53.00 and set an "overweight" rating on the stock in a research note on Tuesday, October 29th. Five research analysts have rated the stock with a buy rating, According to MarketBeat.com, the company currently has an average rating of "Buy" and a consensus price target of $50.00.

Read Our Latest Stock Analysis on First Business Financial Services

First Business Financial Services Trading Down 0.2 %

First Business Financial Services stock traded down $0.11 during mid-day trading on Friday, hitting $49.82. 20,143 shares of the company's stock were exchanged, compared to its average volume of 16,286. The firm has a market capitalization of $413.51 million, a P/E ratio of 10.77 and a beta of 0.83. First Business Financial Services, Inc. has a fifty-two week low of $32.56 and a fifty-two week high of $51.92. The company has a quick ratio of 1.08, a current ratio of 1.09 and a debt-to-equity ratio of 1.16. The company's 50 day simple moving average is $44.71 and its 200-day simple moving average is $40.39.

First Business Financial Services (NASDAQ:FBIZ - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The financial services provider reported $1.24 EPS for the quarter, topping the consensus estimate of $1.20 by $0.04. The business had revenue of $66.39 million for the quarter, compared to the consensus estimate of $38.80 million. First Business Financial Services had a return on equity of 13.70% and a net margin of 15.46%. During the same quarter last year, the business posted $1.17 EPS. On average, equities analysts anticipate that First Business Financial Services, Inc. will post 4.78 earnings per share for the current year.

First Business Financial Services Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, November 20th. Shareholders of record on Thursday, November 7th will be issued a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a yield of 2.01%. The ex-dividend date of this dividend is Thursday, November 7th. First Business Financial Services's dividend payout ratio (DPR) is presently 21.46%.

Insiders Place Their Bets

In other news, CEO James Edward Hartlieb sold 6,344 shares of the firm's stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $43.15, for a total value of $273,743.60. Following the completion of the transaction, the chief executive officer now owns 28,162 shares in the company, valued at $1,215,190.30. This trade represents a 18.39 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Corey A. Chambas sold 40,000 shares of the firm's stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $48.81, for a total value of $1,952,400.00. Following the completion of the transaction, the chief executive officer now owns 112,750 shares of the company's stock, valued at $5,503,327.50. The trade was a 26.19 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 6.30% of the company's stock.

About First Business Financial Services

(

Free Report)

First Business Financial Services, Inc operates as the bank holding company for First Business Bank that provides commercial banking products and services for small and medium-sized businesses, business owners, executives, professionals, and high net worth individuals in Wisconsin, Kansas, and Missouri.

Read More

Before you consider First Business Financial Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Business Financial Services wasn't on the list.

While First Business Financial Services currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.