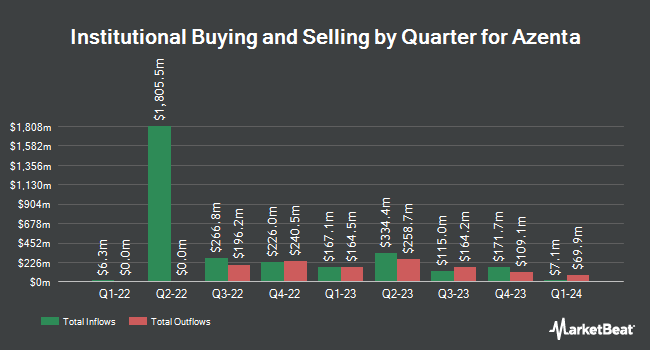

First Eagle Investment Management LLC acquired a new position in Azenta, Inc. (NASDAQ:AZTA - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 97,500 shares of the company's stock, valued at approximately $4,875,000. First Eagle Investment Management LLC owned approximately 0.21% of Azenta as of its most recent SEC filing.

Several other large investors also recently made changes to their positions in the business. State Street Corp boosted its stake in shares of Azenta by 0.4% in the third quarter. State Street Corp now owns 1,686,993 shares of the company's stock valued at $81,718,000 after purchasing an additional 6,398 shares during the period. Conestoga Capital Advisors LLC boosted its stake in shares of Azenta by 65.0% in the fourth quarter. Conestoga Capital Advisors LLC now owns 1,577,881 shares of the company's stock valued at $78,894,000 after purchasing an additional 621,830 shares during the period. Allspring Global Investments Holdings LLC boosted its stake in shares of Azenta by 1.4% in the fourth quarter. Allspring Global Investments Holdings LLC now owns 1,317,385 shares of the company's stock valued at $65,922,000 after purchasing an additional 18,529 shares during the period. Charles Schwab Investment Management Inc. boosted its stake in shares of Azenta by 11.6% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 461,603 shares of the company's stock valued at $23,080,000 after purchasing an additional 48,064 shares during the period. Finally, Systematic Financial Management LP boosted its stake in shares of Azenta by 8.7% in the third quarter. Systematic Financial Management LP now owns 434,597 shares of the company's stock valued at $21,052,000 after purchasing an additional 34,849 shares during the period. Institutional investors and hedge funds own 99.08% of the company's stock.

Azenta Trading Up 2.7 %

NASDAQ AZTA traded up $1.01 during trading hours on Thursday, reaching $37.79. 633,405 shares of the company traded hands, compared to its average volume of 582,550. Azenta, Inc. has a 12 month low of $35.56 and a 12 month high of $63.58. The stock has a market capitalization of $1.73 billion, a PE ratio of -12.68 and a beta of 1.52. The company has a 50 day moving average of $47.27 and a two-hundred day moving average of $46.79.

Azenta (NASDAQ:AZTA - Get Free Report) last posted its quarterly earnings data on Wednesday, February 5th. The company reported $0.08 EPS for the quarter, beating analysts' consensus estimates of $0.05 by $0.03. Azenta had a negative net margin of 24.91% and a positive return on equity of 1.25%. On average, equities research analysts anticipate that Azenta, Inc. will post 0.53 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on AZTA. Stephens restated an "overweight" rating and issued a $60.00 target price on shares of Azenta in a research note on Thursday, January 2nd. Evercore ISI upped their target price on shares of Azenta from $50.00 to $52.00 and gave the company an "in-line" rating in a research note on Thursday, February 6th. Needham & Company LLC increased their price objective on shares of Azenta from $55.00 to $59.00 and gave the company a "buy" rating in a research note on Thursday, February 6th. Finally, TD Cowen upgraded shares of Azenta to a "hold" rating in a research note on Thursday, February 27th. Three investment analysts have rated the stock with a hold rating and two have issued a buy rating to the company. According to MarketBeat, Azenta currently has a consensus rating of "Hold" and a consensus price target of $58.75.

Get Our Latest Analysis on Azenta

Azenta Company Profile

(

Free Report)

Azenta, Inc provides biological and chemical compound sample exploration and management solutions for the life sciences market in North America, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally. The company operates in two reportable segments, Life Sciences Products and Life Sciences Services.

Further Reading

Before you consider Azenta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Azenta wasn't on the list.

While Azenta currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.