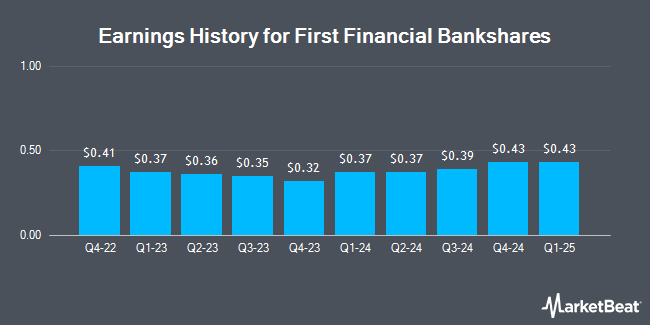

First Financial Bankshares (NASDAQ:FFIN - Get Free Report) is projected to post its quarterly earnings results before the market opens on Thursday, January 23rd. Analysts expect First Financial Bankshares to post earnings of $0.40 per share and revenue of $144,490.00 billion for the quarter.

First Financial Bankshares (NASDAQ:FFIN - Get Free Report) last released its quarterly earnings results on Thursday, October 17th. The bank reported $0.39 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.39. First Financial Bankshares had a net margin of 28.76% and a return on equity of 13.43%. The firm had revenue of $142.10 million for the quarter, compared to the consensus estimate of $140.25 million. On average, analysts expect First Financial Bankshares to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

First Financial Bankshares Trading Down 0.2 %

NASDAQ FFIN traded down $0.07 during mid-day trading on Thursday, reaching $36.79. 334,267 shares of the company's stock traded hands, compared to its average volume of 539,677. The company has a fifty day simple moving average of $39.16 and a 200-day simple moving average of $36.90. First Financial Bankshares has a 1-year low of $27.06 and a 1-year high of $44.66. The company has a market cap of $5.26 billion, a price-to-earnings ratio of 25.37 and a beta of 0.83.

First Financial Bankshares Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, January 2nd. Investors of record on Friday, December 13th were issued a $0.18 dividend. The ex-dividend date of this dividend was Friday, December 13th. This represents a $0.72 annualized dividend and a yield of 1.96%. First Financial Bankshares's dividend payout ratio is presently 49.66%.

Insiders Place Their Bets

In related news, Director Michael B. Denny sold 7,000 shares of the company's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $41.12, for a total transaction of $287,840.00. Following the completion of the transaction, the director now directly owns 101,085 shares in the company, valued at $4,156,615.20. This represents a 6.48 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO F Scott Dueser sold 25,000 shares of the firm's stock in a transaction on Thursday, December 12th. The shares were sold at an average price of $40.73, for a total value of $1,018,250.00. Following the completion of the sale, the chief executive officer now owns 471,004 shares in the company, valued at $19,183,992.92. The trade was a 5.04 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 4.22% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

FFIN has been the subject of several research analyst reports. Hovde Group boosted their target price on shares of First Financial Bankshares from $34.50 to $40.00 and gave the stock a "market perform" rating in a research report on Monday, October 21st. Stephens boosted their price objective on First Financial Bankshares from $37.00 to $40.00 and gave the company an "equal weight" rating in a report on Friday, October 18th. Keefe, Bruyette & Woods upped their price objective on First Financial Bankshares from $36.00 to $40.00 and gave the company a "market perform" rating in a research note on Wednesday, December 4th. Finally, Truist Financial upped their price target on First Financial Bankshares from $39.00 to $40.00 and gave the company a "hold" rating in a research report on Friday, September 20th.

Check Out Our Latest Analysis on First Financial Bankshares

About First Financial Bankshares

(

Get Free Report)

First Financial Bankshares, Inc, through its subsidiaries, provides commercial banking products and services in Texas. The company offers checking, savings and time deposits; automated teller machines, drive-in, and night deposit services; safe deposit facilities, remote deposit capture, internet banking, mobile banking, payroll cards, funds transfer, and performing other customary commercial banking services; securities brokerage services; and trust and wealth management services, including wealth management, estates administration, oil and gas management, testamentary trusts, revocable and irrevocable trusts, and agency accounts.

Read More

Before you consider First Financial Bankshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Financial Bankshares wasn't on the list.

While First Financial Bankshares currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.