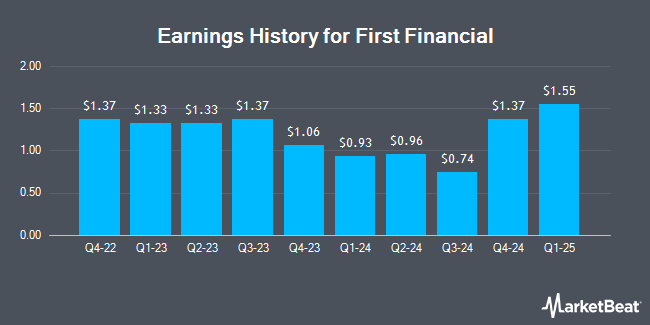

First Financial (NASDAQ:THFF - Get Free Report) issued its quarterly earnings results on Tuesday. The bank reported $1.55 EPS for the quarter, topping the consensus estimate of $1.29 by $0.26, Zacks reports. The firm had revenue of $62.49 million during the quarter, compared to analyst estimates of $62.04 million. First Financial had a net margin of 15.37% and a return on equity of 8.77%.

First Financial Stock Down 1.4 %

THFF traded down $0.68 during trading hours on Friday, reaching $47.31. 39,789 shares of the stock traded hands, compared to its average volume of 53,748. First Financial has a fifty-two week low of $34.61 and a fifty-two week high of $53.60. The company has a market cap of $560.77 million, a price-to-earnings ratio of 11.83 and a beta of 0.41. The company has a debt-to-equity ratio of 0.05, a current ratio of 0.79 and a quick ratio of 0.79. The firm's fifty day simple moving average is $48.01 and its two-hundred day simple moving average is $47.57.

First Financial Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, April 15th. Stockholders of record on Tuesday, April 1st were paid a dividend of $0.51 per share. The ex-dividend date was Tuesday, April 1st. This represents a $2.04 dividend on an annualized basis and a dividend yield of 4.31%. First Financial's dividend payout ratio is currently 51.00%.

Analyst Upgrades and Downgrades

Several equities research analysts have commented on the company. Keefe, Bruyette & Woods restated a "market perform" rating and set a $55.00 price target (up from $52.00) on shares of First Financial in a research note on Thursday, February 6th. Janney Montgomery Scott upgraded shares of First Financial from a "neutral" rating to a "buy" rating and set a $58.00 price target on the stock in a report on Monday, February 24th.

Check Out Our Latest Report on First Financial

Insider Buying and Selling at First Financial

In related news, Director James O. Mcdonald purchased 1,000 shares of the company's stock in a transaction that occurred on Tuesday, March 11th. The stock was acquired at an average price of $48.99 per share, for a total transaction of $48,990.00. Following the completion of the purchase, the director now owns 9,462 shares in the company, valued at approximately $463,543.38. This represents a 11.82 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Mark Allen Franklin acquired 1,100 shares of the firm's stock in a transaction on Wednesday, February 12th. The shares were bought at an average cost of $52.53 per share, with a total value of $57,783.00. Following the completion of the acquisition, the insider now owns 9,845 shares in the company, valued at $517,157.85. This represents a 12.58 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders bought a total of 2,635 shares of company stock valued at $132,784 in the last ninety days. Insiders own 3.69% of the company's stock.

First Financial Company Profile

(

Get Free Report)

First Financial Corporation, through its subsidiaries, provides various financial services. The company offers non-interest-bearing demand, interest-bearing demand, savings, time, and other time deposits. It also provides commercial loans primarily to expand a business or finance asset purchases; residential real estate and residential real estate construction loans; and home equity loans and lines, secured loans, and cash/CD secured and unsecured loans.

Read More

Before you consider First Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Financial wasn't on the list.

While First Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.