StockNews.com downgraded shares of First Foundation (NASDAQ:FFWM - Free Report) from a hold rating to a sell rating in a research note issued to investors on Thursday morning.

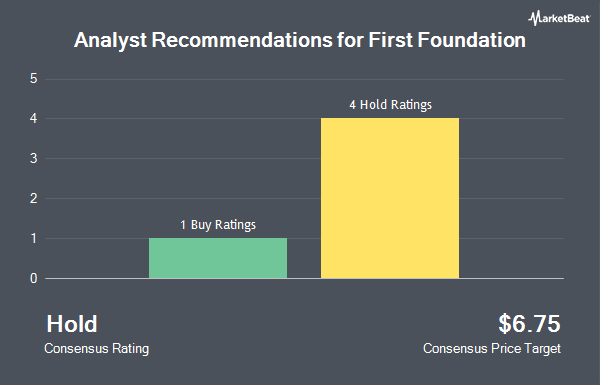

Separately, Stephens cut shares of First Foundation from a "strong-buy" rating to a "hold" rating in a report on Tuesday, October 1st. One research analyst has rated the stock with a sell rating, four have issued a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $7.80.

View Our Latest Stock Analysis on FFWM

First Foundation Stock Down 2.0 %

NASDAQ:FFWM traded down $0.15 during trading hours on Thursday, hitting $7.51. 846,766 shares of the stock traded hands, compared to its average volume of 619,115. The firm has a 50 day moving average price of $6.85 and a 200 day moving average price of $6.34. The company has a current ratio of 1.04, a quick ratio of 1.04 and a debt-to-equity ratio of 1.84. First Foundation has a fifty-two week low of $4.71 and a fifty-two week high of $11.47. The firm has a market cap of $509.55 million, a price-to-earnings ratio of -6.71 and a beta of 1.30.

Institutional Investors Weigh In On First Foundation

Several hedge funds have recently made changes to their positions in FFWM. Creative Planning raised its position in First Foundation by 35.8% in the third quarter. Creative Planning now owns 16,463 shares of the bank's stock worth $103,000 after purchasing an additional 4,336 shares in the last quarter. Caxton Associates LP acquired a new stake in shares of First Foundation in the first quarter valued at approximately $123,000. Hollencrest Capital Management increased its holdings in shares of First Foundation by 76.5% in the third quarter. Hollencrest Capital Management now owns 19,840 shares of the bank's stock valued at $124,000 after purchasing an additional 8,600 shares in the last quarter. Boston Partners acquired a new stake in shares of First Foundation in the first quarter valued at approximately $128,000. Finally, The Manufacturers Life Insurance Company increased its holdings in shares of First Foundation by 8.5% in the second quarter. The Manufacturers Life Insurance Company now owns 20,759 shares of the bank's stock valued at $136,000 after purchasing an additional 1,632 shares in the last quarter. Institutional investors own 73.10% of the company's stock.

About First Foundation

(

Get Free Report)

First Foundation Inc, through its subsidiaries, provides banking services, investment advisory, wealth management, and trust services to individuals, businesses, and other organizations in the United States. The company operates in two segments, Banking and Wealth Management. It offers a range of deposit products, including personal and business checking accounts, savings accounts, interest-bearing demand deposit accounts, money market accounts, and time certificate of deposits; and loan products consisting of multifamily and single family residential real estate loans, commercial real estate loans, commercial term loans, and line of credits, as well as consumer loans, such as personal installment loans and line of credits, and home equity line of credits.

Further Reading

Before you consider First Foundation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Foundation wasn't on the list.

While First Foundation currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.