First Horizon Advisors Inc. lifted its holdings in Emerson Electric Co. (NYSE:EMR - Free Report) by 5.2% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 204,109 shares of the industrial products company's stock after purchasing an additional 10,029 shares during the period. First Horizon Advisors Inc.'s holdings in Emerson Electric were worth $22,324,000 at the end of the most recent quarter.

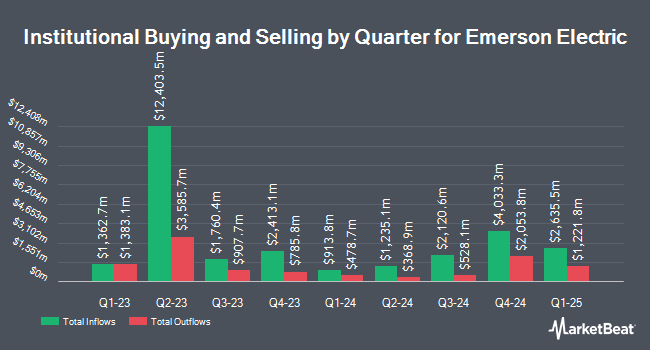

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in EMR. Newport Trust Company LLC acquired a new position in shares of Emerson Electric during the 2nd quarter worth about $574,908,000. Pathway Financial Advisers LLC grew its position in shares of Emerson Electric by 10,993.2% during the third quarter. Pathway Financial Advisers LLC now owns 2,070,428 shares of the industrial products company's stock worth $226,443,000 after acquiring an additional 2,051,764 shares during the last quarter. Van ECK Associates Corp grew its position in Emerson Electric by 107.2% in the 3rd quarter. Van ECK Associates Corp now owns 3,896,889 shares of the industrial products company's stock valued at $422,852,000 after buying an additional 2,016,075 shares during the last quarter. Swedbank AB grew its stake in shares of Emerson Electric by 127.3% during the 3rd quarter. Swedbank AB now owns 2,544,439 shares of the industrial products company's stock worth $278,285,000 after purchasing an additional 1,424,800 shares during the period. Finally, Perpetual Ltd lifted its holdings in Emerson Electric by 57,336.1% in the 3rd quarter. Perpetual Ltd now owns 1,206,158 shares of the industrial products company's stock valued at $131,918,000 after purchasing an additional 1,204,058 shares in the last quarter. 74.30% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

EMR has been the subject of a number of research analyst reports. Oppenheimer increased their target price on shares of Emerson Electric from $120.00 to $125.00 and gave the stock an "outperform" rating in a research report on Thursday, September 26th. StockNews.com upgraded Emerson Electric from a "hold" rating to a "buy" rating in a research note on Thursday, November 14th. Morgan Stanley initiated coverage on Emerson Electric in a report on Friday, September 6th. They set an "underweight" rating and a $105.00 price target on the stock. Royal Bank of Canada dropped their price target on Emerson Electric from $139.00 to $138.00 and set an "outperform" rating on the stock in a research note on Wednesday, November 6th. Finally, Wells Fargo & Company raised their price objective on Emerson Electric from $128.00 to $135.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 6th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and thirteen have issued a buy rating to the stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $130.00.

Get Our Latest Stock Report on Emerson Electric

Emerson Electric Stock Performance

NYSE EMR traded down $0.46 during trading on Wednesday, hitting $129.10. The company's stock had a trading volume of 2,277,271 shares, compared to its average volume of 2,742,457. The firm has a market cap of $73.61 billion, a P/E ratio of 37.69, a price-to-earnings-growth ratio of 2.13 and a beta of 1.30. The company has a quick ratio of 1.40, a current ratio of 1.77 and a debt-to-equity ratio of 0.26. Emerson Electric Co. has a 52 week low of $87.55 and a 52 week high of $131.56. The firm has a 50 day moving average price of $112.34 and a 200 day moving average price of $110.32.

Emerson Electric Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 10th. Investors of record on Friday, November 15th will be paid a $0.5275 dividend. This is a positive change from Emerson Electric's previous quarterly dividend of $0.53. The ex-dividend date is Friday, November 15th. This represents a $2.11 annualized dividend and a yield of 1.63%. Emerson Electric's payout ratio is currently 61.70%.

Insider Activity at Emerson Electric

In other news, SVP Michael H. Train sold 21,525 shares of the company's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $125.96, for a total transaction of $2,711,289.00. Following the transaction, the senior vice president now owns 262,408 shares of the company's stock, valued at $33,052,911.68. This represents a 7.58 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. 0.25% of the stock is owned by insiders.

Emerson Electric Company Profile

(

Free Report)

Emerson Electric Co, a technology and software company, provides various solutions for customers in industrial, commercial, and consumer markets in the Americas, Asia, the Middle East, Africa, and Europe. It operates in six segments: Final Control, Control Systems & Software, Measurement & Analytical, AspenTech, Discrete Automation, and Safety & Productivity.

Read More

Before you consider Emerson Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Emerson Electric wasn't on the list.

While Emerson Electric currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.