First Sabrepoint Capital Management LP boosted its holdings in shares of WillScot Mobile Mini Holdings Corp. (NASDAQ:WSC - Free Report) by 17.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 238,143 shares of the company's stock after acquiring an additional 35,492 shares during the period. WillScot Mobile Mini accounts for approximately 2.6% of First Sabrepoint Capital Management LP's investment portfolio, making the stock its 12th biggest position. First Sabrepoint Capital Management LP owned about 0.13% of WillScot Mobile Mini worth $8,954,000 as of its most recent SEC filing.

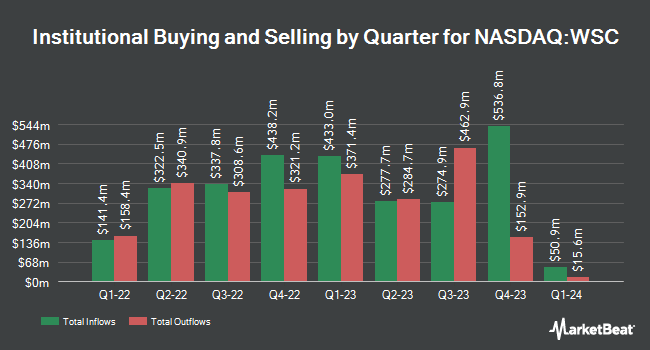

Other hedge funds also recently bought and sold shares of the company. V Square Quantitative Management LLC acquired a new position in shares of WillScot Mobile Mini during the 3rd quarter valued at about $25,000. Hexagon Capital Partners LLC boosted its holdings in WillScot Mobile Mini by 200.0% in the 3rd quarter. Hexagon Capital Partners LLC now owns 900 shares of the company's stock valued at $34,000 after purchasing an additional 600 shares during the last quarter. Financial Management Professionals Inc. purchased a new stake in shares of WillScot Mobile Mini in the 3rd quarter valued at approximately $36,000. Summit Securities Group LLC purchased a new stake in shares of WillScot Mobile Mini in the 2nd quarter valued at approximately $56,000. Finally, CWM LLC increased its holdings in shares of WillScot Mobile Mini by 80.3% during the 2nd quarter. CWM LLC now owns 1,635 shares of the company's stock worth $62,000 after buying an additional 728 shares during the last quarter. Institutional investors and hedge funds own 95.81% of the company's stock.

WillScot Mobile Mini Stock Down 4.0 %

WSC traded down $1.54 during trading hours on Tuesday, hitting $37.06. 1,533,854 shares of the company's stock were exchanged, compared to its average volume of 2,276,845. The company has a current ratio of 0.90, a quick ratio of 0.82 and a debt-to-equity ratio of 3.42. WillScot Mobile Mini Holdings Corp. has a 12-month low of $32.71 and a 12-month high of $52.16. The firm has a market cap of $6.85 billion, a P/E ratio of 350.94, a price-to-earnings-growth ratio of 2.37 and a beta of 1.38. The firm has a 50 day moving average of $37.41 and a 200 day moving average of $37.98.

WillScot Mobile Mini (NASDAQ:WSC - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The company reported $0.38 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.48 by ($0.10). WillScot Mobile Mini had a net margin of 1.05% and a return on equity of 23.97%. The company had revenue of $601.43 million during the quarter, compared to analyst estimates of $617.83 million. During the same quarter in the previous year, the business posted $0.46 earnings per share. The firm's revenue was down .6% on a year-over-year basis. Analysts predict that WillScot Mobile Mini Holdings Corp. will post 1.53 EPS for the current fiscal year.

Insider Buying and Selling

In other WillScot Mobile Mini news, CEO Bradley Lee Soultz acquired 5,000 shares of the stock in a transaction dated Wednesday, September 18th. The stock was acquired at an average cost of $38.97 per share, with a total value of $194,850.00. Following the transaction, the chief executive officer now owns 149,686 shares in the company, valued at $5,833,263.42. The trade was a 3.46 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CAO Sally J. Shanks sold 14,059 shares of the firm's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $34.69, for a total value of $487,706.71. Following the sale, the chief accounting officer now directly owns 26,113 shares in the company, valued at $905,859.97. This trade represents a 35.00 % decrease in their position. The disclosure for this sale can be found here. Insiders bought 20,000 shares of company stock worth $728,750 over the last 90 days. 3.30% of the stock is owned by insiders.

Analysts Set New Price Targets

WSC has been the subject of several analyst reports. Baird R W lowered WillScot Mobile Mini from a "strong-buy" rating to a "hold" rating in a research report on Thursday, October 24th. Barclays lowered their price target on WillScot Mobile Mini from $44.00 to $40.00 and set an "equal weight" rating for the company in a report on Friday, November 1st. Robert W. Baird reduced their price objective on shares of WillScot Mobile Mini from $42.00 to $38.00 and set a "neutral" rating on the stock in a report on Thursday, October 31st. Finally, Deutsche Bank Aktiengesellschaft lowered shares of WillScot Mobile Mini from a "buy" rating to a "hold" rating and lowered their target price for the stock from $46.00 to $35.00 in a research note on Thursday, October 31st. Six equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, WillScot Mobile Mini has an average rating of "Hold" and an average target price of $45.00.

View Our Latest Analysis on WillScot Mobile Mini

WillScot Mobile Mini Profile

(

Free Report)

WillScot Holdings Corporation provides workspace and portable storage solutions in the United States, Canada, and Mexico. It operates in two segments, Modular Solutions and Storage Solutions. Its modular solutions include panelized and stackable offices, single-wide modular space units, section modulars and redi-plex, classrooms, ground level offices, blast-resistant modules, clearspan structures, and other modular space; and portable storage solutions, such as portable and cold storage containers, as well as trailers.

Read More

Before you consider WillScot Mobile Mini, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WillScot Mobile Mini wasn't on the list.

While WillScot Mobile Mini currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.