First Sabrepoint Capital Management LP lifted its holdings in Walker & Dunlop, Inc. (NYSE:WD - Free Report) by 100.0% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 150,000 shares of the financial services provider's stock after buying an additional 75,000 shares during the quarter. Walker & Dunlop makes up about 4.9% of First Sabrepoint Capital Management LP's holdings, making the stock its 3rd biggest holding. First Sabrepoint Capital Management LP owned 0.44% of Walker & Dunlop worth $17,038,000 at the end of the most recent quarter.

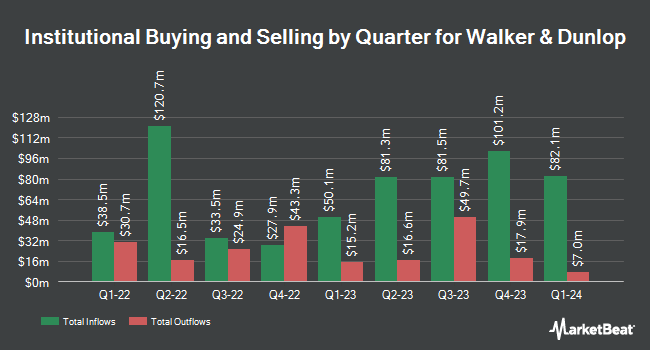

Several other institutional investors also recently modified their holdings of the business. SG Americas Securities LLC raised its stake in Walker & Dunlop by 144.3% during the second quarter. SG Americas Securities LLC now owns 9,192 shares of the financial services provider's stock valued at $903,000 after buying an additional 5,430 shares during the last quarter. AlphaMark Advisors LLC boosted its stake in Walker & Dunlop by 20.6% in the 2nd quarter. AlphaMark Advisors LLC now owns 3,308 shares of the financial services provider's stock worth $325,000 after purchasing an additional 566 shares in the last quarter. Louisiana State Employees Retirement System grew its position in Walker & Dunlop by 2.4% during the 2nd quarter. Louisiana State Employees Retirement System now owns 17,000 shares of the financial services provider's stock valued at $1,669,000 after purchasing an additional 400 shares during the last quarter. Spinnaker Investment Group LLC increased its stake in Walker & Dunlop by 8.5% during the 2nd quarter. Spinnaker Investment Group LLC now owns 15,021 shares of the financial services provider's stock valued at $1,475,000 after purchasing an additional 1,180 shares in the last quarter. Finally, Bank of New York Mellon Corp raised its holdings in Walker & Dunlop by 0.8% in the second quarter. Bank of New York Mellon Corp now owns 377,417 shares of the financial services provider's stock worth $37,062,000 after buying an additional 2,815 shares during the last quarter. 80.97% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on the stock. Wolfe Research raised shares of Walker & Dunlop to a "strong-buy" rating in a research report on Tuesday, September 24th. Wedbush lifted their target price on Walker & Dunlop from $105.00 to $110.00 and gave the stock a "neutral" rating in a report on Wednesday, September 25th.

View Our Latest Report on Walker & Dunlop

Walker & Dunlop Trading Down 0.7 %

WD stock traded down $0.77 on Tuesday, hitting $106.35. The company had a trading volume of 90,041 shares, compared to its average volume of 196,042. Walker & Dunlop, Inc. has a 12-month low of $87.20 and a 12-month high of $118.19. The stock has a market cap of $3.59 billion, a price-to-earnings ratio of 38.17 and a beta of 1.53. The stock's 50-day simple moving average is $110.46 and its 200 day simple moving average is $104.84.

Walker & Dunlop (NYSE:WD - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The financial services provider reported $1.19 EPS for the quarter, missing the consensus estimate of $1.29 by ($0.10). Walker & Dunlop had a return on equity of 9.81% and a net margin of 8.91%. The firm had revenue of $292.30 million during the quarter, compared to the consensus estimate of $294.24 million. During the same period in the previous year, the firm earned $1.11 EPS. The business's revenue was up 8.8% on a year-over-year basis. Research analysts forecast that Walker & Dunlop, Inc. will post 5.18 earnings per share for the current year.

Walker & Dunlop Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, December 6th. Investors of record on Friday, November 22nd were issued a $0.65 dividend. This represents a $2.60 dividend on an annualized basis and a dividend yield of 2.44%. The ex-dividend date of this dividend was Friday, November 22nd. Walker & Dunlop's payout ratio is 92.86%.

Walker & Dunlop Company Profile

(

Free Report)

Walker & Dunlop, Inc, through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States. It operates through three segments: Capital Markets, Servicing & Asset Management, and Corporate.

Read More

Before you consider Walker & Dunlop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walker & Dunlop wasn't on the list.

While Walker & Dunlop currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.