First Turn Management LLC cut its stake in Blueprint Medicines Co. (NASDAQ:BPMC - Free Report) by 3.2% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 178,929 shares of the biotechnology company's stock after selling 5,972 shares during the period. Blueprint Medicines comprises about 2.6% of First Turn Management LLC's investment portfolio, making the stock its 14th largest position. First Turn Management LLC owned 0.28% of Blueprint Medicines worth $16,551,000 as of its most recent filing with the Securities and Exchange Commission.

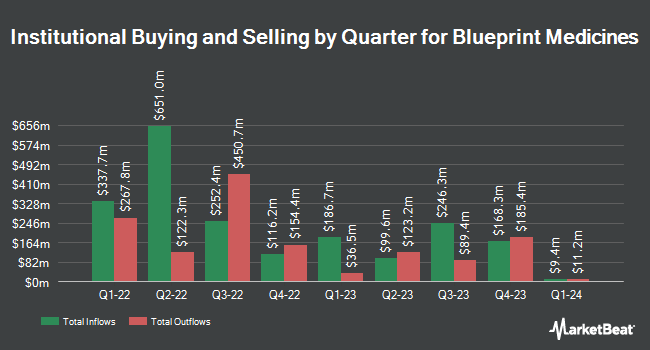

A number of other large investors also recently bought and sold shares of BPMC. Hsbc Holdings PLC purchased a new position in Blueprint Medicines in the second quarter valued at $1,060,000. Comerica Bank lifted its stake in shares of Blueprint Medicines by 2,582.9% in the 1st quarter. Comerica Bank now owns 10,839 shares of the biotechnology company's stock worth $1,028,000 after acquiring an additional 10,435 shares during the period. Federated Hermes Inc. raised its stake in shares of Blueprint Medicines by 27.8% during the 2nd quarter. Federated Hermes Inc. now owns 62,354 shares of the biotechnology company's stock worth $6,721,000 after buying an additional 13,579 shares during the last quarter. SG Americas Securities LLC grew its stake in Blueprint Medicines by 82.8% in the 2nd quarter. SG Americas Securities LLC now owns 21,684 shares of the biotechnology company's stock worth $2,337,000 after acquiring an additional 9,819 shares during the period. Finally, Vanguard Group Inc. lifted its stake in shares of Blueprint Medicines by 3.2% in the 1st quarter. Vanguard Group Inc. now owns 6,309,977 shares of the biotechnology company's stock valued at $598,564,000 after purchasing an additional 195,007 shares in the last quarter.

Blueprint Medicines Stock Up 4.9 %

Blueprint Medicines stock traded up $4.42 during midday trading on Tuesday, hitting $94.60. 779,095 shares of the company's stock were exchanged, compared to its average volume of 693,031. The company has a debt-to-equity ratio of 1.09, a quick ratio of 3.27 and a current ratio of 3.32. Blueprint Medicines Co. has a 12 month low of $63.50 and a 12 month high of $121.90. The firm has a 50-day moving average of $89.84 and a two-hundred day moving average of $98.73. The company has a market cap of $6.01 billion, a PE ratio of -44.83 and a beta of 0.59.

Blueprint Medicines (NASDAQ:BPMC - Get Free Report) last released its earnings results on Wednesday, October 30th. The biotechnology company reported ($0.89) EPS for the quarter, topping analysts' consensus estimates of ($0.97) by $0.08. Blueprint Medicines had a negative net margin of 29.48% and a negative return on equity of 112.30%. The company had revenue of $128.20 million during the quarter, compared to analysts' expectations of $127.56 million. During the same period last year, the business earned ($2.20) EPS. Blueprint Medicines's revenue for the quarter was up 126.5% on a year-over-year basis. As a group, analysts expect that Blueprint Medicines Co. will post -3.61 earnings per share for the current fiscal year.

Analyst Ratings Changes

BPMC has been the subject of several research reports. UBS Group began coverage on shares of Blueprint Medicines in a report on Thursday, October 24th. They issued a "neutral" rating and a $88.00 price target for the company. Needham & Company LLC reiterated a "buy" rating and set a $135.00 price target on shares of Blueprint Medicines in a report on Friday. Guggenheim increased their target price on shares of Blueprint Medicines from $130.00 to $138.00 and gave the stock a "buy" rating in a research report on Friday, August 2nd. Barclays upped their price target on shares of Blueprint Medicines from $75.00 to $105.00 and gave the stock an "equal weight" rating in a research note on Monday, July 29th. Finally, Wedbush reiterated an "outperform" rating and set a $135.00 price target on shares of Blueprint Medicines in a report on Thursday, November 14th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating, twelve have issued a buy rating and two have given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $122.11.

Get Our Latest Research Report on Blueprint Medicines

Insiders Place Their Bets

In other Blueprint Medicines news, insider Fouad Namouni sold 3,633 shares of the company's stock in a transaction on Thursday, October 3rd. The stock was sold at an average price of $89.32, for a total transaction of $324,499.56. Following the transaction, the insider now directly owns 69,070 shares in the company, valued at $6,169,332.40. This represents a 5.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 4.21% of the stock is currently owned by company insiders.

Blueprint Medicines Profile

(

Free Report)

Blueprint Medicines Corporation, a precision therapy company, develops medicines for genomically defined cancers and blood disorders in the United States and internationally. The company is developing AYVAKIT for the treatment of systemic mastocytosis (SM) and gastrointestinal stromal tumors; BLU-263, an orally available, potent, and KIT inhibitor for the treatment of indolent SM, and other mast cell disorders.

Further Reading

Before you consider Blueprint Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blueprint Medicines wasn't on the list.

While Blueprint Medicines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.