First Western Trust Bank reduced its stake in Abbott Laboratories (NYSE:ABT - Free Report) by 11.5% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 49,170 shares of the healthcare product maker's stock after selling 6,401 shares during the quarter. First Western Trust Bank's holdings in Abbott Laboratories were worth $5,606,000 as of its most recent filing with the Securities & Exchange Commission.

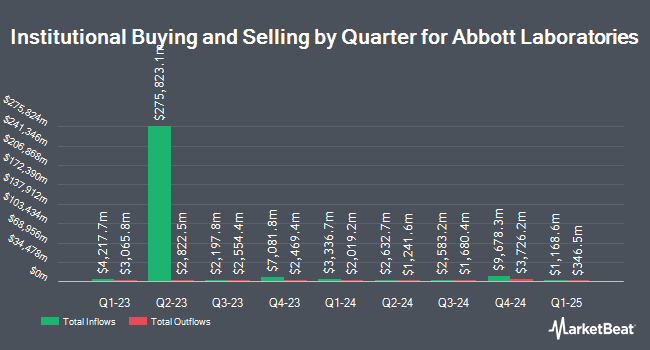

A number of other hedge funds have also recently made changes to their positions in ABT. Unique Wealth Strategies LLC bought a new position in Abbott Laboratories in the 2nd quarter valued at approximately $28,000. Future Financial Wealth Managment LLC bought a new stake in shares of Abbott Laboratories in the third quarter worth about $31,000. Itau Unibanco Holding S.A. bought a new stake in Abbott Laboratories during the second quarter worth approximately $32,000. Peterson Financial Group Inc. bought a new stake in Abbott Laboratories during the third quarter worth approximately $32,000. Finally, Valued Wealth Advisors LLC boosted its position in shares of Abbott Laboratories by 78.4% during the third quarter. Valued Wealth Advisors LLC now owns 289 shares of the healthcare product maker's stock valued at $33,000 after buying an additional 127 shares during the period. 75.18% of the stock is owned by institutional investors.

Abbott Laboratories Price Performance

Shares of ABT stock traded up $1.71 during mid-day trading on Monday, hitting $117.61. 3,111,233 shares of the stock were exchanged, compared to its average volume of 5,690,018. The company has a market cap of $203.99 billion, a PE ratio of 35.23, a price-to-earnings-growth ratio of 2.73 and a beta of 0.72. Abbott Laboratories has a 52-week low of $98.95 and a 52-week high of $121.64. The firm has a fifty day moving average of $115.53 and a 200 day moving average of $109.54. The company has a quick ratio of 1.14, a current ratio of 1.60 and a debt-to-equity ratio of 0.32.

Abbott Laboratories (NYSE:ABT - Get Free Report) last issued its quarterly earnings results on Wednesday, October 16th. The healthcare product maker reported $1.21 earnings per share for the quarter, beating analysts' consensus estimates of $1.20 by $0.01. The firm had revenue of $10.64 billion for the quarter, compared to analyst estimates of $10.55 billion. Abbott Laboratories had a net margin of 13.99% and a return on equity of 20.18%. Abbott Laboratories's quarterly revenue was up 4.9% compared to the same quarter last year. During the same period last year, the company posted $1.14 EPS. Research analysts anticipate that Abbott Laboratories will post 4.67 earnings per share for the current year.

Abbott Laboratories Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, November 15th. Investors of record on Tuesday, October 15th were paid a $0.55 dividend. This represents a $2.20 dividend on an annualized basis and a yield of 1.87%. The ex-dividend date of this dividend was Tuesday, October 15th. Abbott Laboratories's dividend payout ratio is presently 66.87%.

Insider Activity at Abbott Laboratories

In other Abbott Laboratories news, CEO Robert B. Ford sold 141,679 shares of the stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $116.41, for a total value of $16,492,852.39. Following the completion of the sale, the chief executive officer now owns 220,059 shares in the company, valued at approximately $25,617,068.19. This represents a 39.17 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 1.10% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on ABT shares. Edward Jones lowered Abbott Laboratories from a "buy" rating to a "hold" rating in a report on Tuesday, July 30th. Morgan Stanley upped their price target on Abbott Laboratories from $107.00 to $117.00 and gave the stock an "equal weight" rating in a research report on Thursday, October 17th. Royal Bank of Canada upped their target price on Abbott Laboratories from $125.00 to $130.00 and gave the company an "outperform" rating in a research report on Tuesday, October 8th. Mizuho upped their target price on Abbott Laboratories from $115.00 to $130.00 and gave the company a "neutral" rating in a research report on Thursday, October 17th. Finally, Raymond James reissued a "buy" rating and issued a $129.00 target price (up from $122.00) on shares of Abbott Laboratories in a research report on Monday, October 14th. Four research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $130.07.

View Our Latest Stock Analysis on ABT

About Abbott Laboratories

(

Free Report)

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide. It operates in four segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The company provides generic pharmaceuticals for the treatment of pancreatic exocrine insufficiency, irritable bowel syndrome or biliary spasm, intrahepatic cholestasis or depressive symptoms, gynecological disorder, hormone replacement therapy, dyslipidemia, hypertension, hypothyroidism, Ménière's disease and vestibular vertigo, pain, fever, inflammation, and migraine, as well as provides anti-infective clarithromycin, influenza vaccine, and products to regulate physiological rhythm of the colon.

Read More

Before you consider Abbott Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abbott Laboratories wasn't on the list.

While Abbott Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.