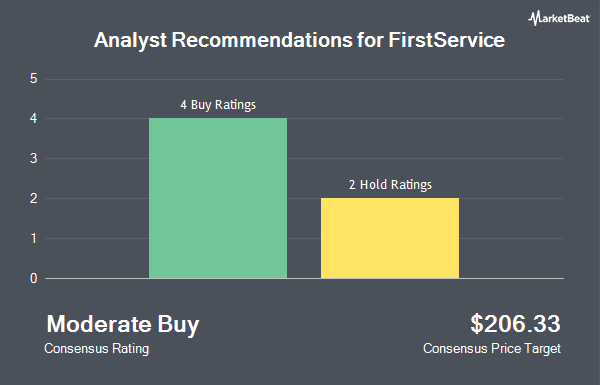

Shares of FirstService Co. (NASDAQ:FSV - Get Free Report) TSE: FSV have been given a consensus recommendation of "Moderate Buy" by the six analysts that are currently covering the company, MarketBeat Ratings reports. Two equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 12 month price target among brokerages that have issued ratings on the stock in the last year is $201.67.

FSV has been the subject of a number of recent analyst reports. StockNews.com raised FirstService from a "hold" rating to a "buy" rating in a research note on Wednesday. Raymond James lifted their price objective on FirstService from $215.00 to $225.00 and gave the stock an "outperform" rating in a research note on Thursday, January 30th.

View Our Latest Analysis on FirstService

FirstService Price Performance

Shares of NASDAQ FSV traded up $0.53 during mid-day trading on Wednesday, reaching $170.30. The company's stock had a trading volume of 153,352 shares, compared to its average volume of 93,778. The firm has a market capitalization of $7.74 billion, a PE ratio of 57.34 and a beta of 1.12. The company has a debt-to-equity ratio of 1.09, a current ratio of 1.75 and a quick ratio of 1.79. The stock has a fifty day moving average of $175.68 and a two-hundred day moving average of $181.66. FirstService has a 52 week low of $141.26 and a 52 week high of $197.84.

FirstService Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, April 7th. Shareholders of record on Monday, March 31st will be given a dividend of $0.275 per share. This is a boost from FirstService's previous quarterly dividend of $0.25. The ex-dividend date of this dividend is Monday, March 31st. This represents a $1.10 dividend on an annualized basis and a yield of 0.65%. FirstService's payout ratio is 37.04%.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the company. Versant Capital Management Inc bought a new position in FirstService during the fourth quarter valued at $29,000. Trust Co. of Vermont purchased a new stake in shares of FirstService during the fourth quarter valued at $46,000. Wilmington Savings Fund Society FSB purchased a new stake in shares of FirstService during the third quarter valued at $53,000. Natixis boosted its stake in shares of FirstService by 5,511.1% during the fourth quarter. Natixis now owns 505 shares of the financial services provider's stock valued at $91,000 after purchasing an additional 496 shares during the period. Finally, State of Wyoming purchased a new stake in shares of FirstService during the fourth quarter valued at $101,000. Institutional investors own 69.35% of the company's stock.

FirstService Company Profile

(

Get Free ReportFirstService Corporation, together with its subsidiaries, provides residential property management and other essential property services to residential and commercial customers in the United States and Canada. It operates through two segments: FirstService Residential and FirstService Brands. The FirstService Residential segment offers services for private residential communities, such as condominiums, co-operatives, homeowner associations, master-planned communities, active adult and lifestyle communities, and various other residential developments.

Read More

Before you consider FirstService, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstService wasn't on the list.

While FirstService currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.