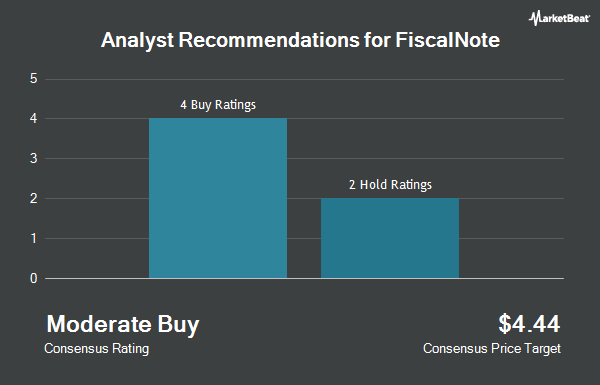

FiscalNote Holdings, Inc. (NYSE:NOTE - Get Free Report) has received an average recommendation of "Buy" from the six ratings firms that are currently covering the company, MarketBeat reports. One equities research analyst has rated the stock with a hold recommendation, four have assigned a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month target price among brokers that have issued ratings on the stock in the last year is $2.66.

A number of brokerages have weighed in on NOTE. Roth Mkm lowered their price objective on FiscalNote from $3.00 to $2.00 and set a "buy" rating on the stock in a report on Friday. D. Boral Capital reissued a "buy" rating and set a $3.75 price target on shares of FiscalNote in a research note on Monday. Finally, B. Riley decreased their price target on FiscalNote from $1.75 to $1.50 and set a "buy" rating on the stock in a research note on Friday.

View Our Latest Stock Report on NOTE

FiscalNote Stock Performance

NOTE traded down $0.06 during trading on Friday, reaching $0.99. The company's stock had a trading volume of 2,269,019 shares, compared to its average volume of 1,420,826. FiscalNote has a 52-week low of $0.75 and a 52-week high of $2.07. The company's fifty day moving average price is $1.31 and its 200-day moving average price is $1.16. The company has a market capitalization of $139.95 million, a price-to-earnings ratio of -4.50 and a beta of 0.40. The company has a debt-to-equity ratio of 1.44, a quick ratio of 0.81 and a current ratio of 0.81.

FiscalNote (NYSE:NOTE - Get Free Report) last announced its quarterly earnings data on Thursday, March 13th. The company reported ($0.10) earnings per share for the quarter, meeting analysts' consensus estimates of ($0.10). FiscalNote had a negative return on equity of 88.72% and a negative net margin of 22.27%. The company had revenue of $29.47 billion for the quarter, compared to analyst estimates of $29.02 million. On average, equities analysts forecast that FiscalNote will post -0.43 earnings per share for the current fiscal year.

Insider Transactions at FiscalNote

In related news, Director Tim Hwang sold 51,137 shares of FiscalNote stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of $1.13, for a total transaction of $57,784.81. Following the completion of the transaction, the director now directly owns 2,655,992 shares in the company, valued at $3,001,270.96. The trade was a 1.89 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders have sold 122,719 shares of company stock valued at $146,099 in the last quarter. 41.75% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors have recently modified their holdings of the stock. SG Americas Securities LLC raised its position in shares of FiscalNote by 83.2% during the 4th quarter. SG Americas Securities LLC now owns 25,285 shares of the company's stock worth $27,000 after purchasing an additional 11,486 shares during the last quarter. Envestnet Asset Management Inc. raised its position in shares of FiscalNote by 27.0% during the 4th quarter. Envestnet Asset Management Inc. now owns 28,621 shares of the company's stock worth $31,000 after purchasing an additional 6,090 shares during the last quarter. Wells Fargo & Company MN raised its holdings in FiscalNote by 58.0% in the 4th quarter. Wells Fargo & Company MN now owns 29,315 shares of the company's stock valued at $31,000 after acquiring an additional 10,765 shares during the last quarter. NewEdge Advisors LLC raised its holdings in FiscalNote by 250.0% in the 4th quarter. NewEdge Advisors LLC now owns 35,000 shares of the company's stock valued at $37,000 after acquiring an additional 25,000 shares during the last quarter. Finally, Mariner LLC raised its holdings in FiscalNote by 85.3% in the 4th quarter. Mariner LLC now owns 35,662 shares of the company's stock valued at $38,000 after acquiring an additional 16,418 shares during the last quarter. 54.31% of the stock is currently owned by institutional investors and hedge funds.

About FiscalNote

(

Get Free ReportFiscalNote Holdings, Inc operates as technology company North America, Europe, Australia, and Asia. It combines artificial intelligence technology, machine learning, and other technologies with analytics, workflow tools, and expert research. The company also delivers that intelligence through its suite of public policy and issues management products, as well as powerful tools to manage workflows, advocacy campaigns, and constituent relationships.

Further Reading

Before you consider FiscalNote, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FiscalNote wasn't on the list.

While FiscalNote currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.