Cortland Associates Inc. MO cut its stake in Fiserv, Inc. (NYSE:FI - Free Report) by 2.4% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 347,381 shares of the business services provider's stock after selling 8,395 shares during the period. Fiserv makes up about 8.1% of Cortland Associates Inc. MO's portfolio, making the stock its 3rd biggest holding. Cortland Associates Inc. MO owned approximately 0.06% of Fiserv worth $71,359,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

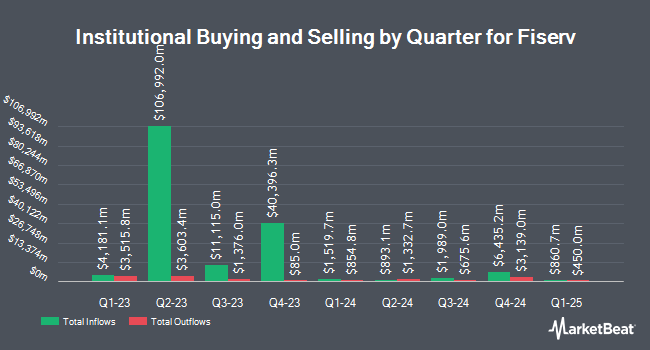

Other hedge funds also recently modified their holdings of the company. B. Riley Wealth Advisors Inc. raised its holdings in shares of Fiserv by 4.6% during the 2nd quarter. B. Riley Wealth Advisors Inc. now owns 18,668 shares of the business services provider's stock worth $2,782,000 after buying an additional 813 shares in the last quarter. EP Wealth Advisors LLC grew its position in Fiserv by 2.0% in the second quarter. EP Wealth Advisors LLC now owns 12,276 shares of the business services provider's stock valued at $1,830,000 after acquiring an additional 235 shares during the last quarter. Truist Financial Corp raised its stake in Fiserv by 1.4% during the second quarter. Truist Financial Corp now owns 279,379 shares of the business services provider's stock worth $41,639,000 after acquiring an additional 3,924 shares in the last quarter. SPC Financial Inc. acquired a new stake in shares of Fiserv in the 2nd quarter valued at approximately $206,000. Finally, 3Chopt Investment Partners LLC acquired a new position in Fiserv during the 2nd quarter worth approximately $320,000. Institutional investors own 90.98% of the company's stock.

Analyst Ratings Changes

FI has been the topic of a number of research analyst reports. Citigroup raised their target price on shares of Fiserv from $230.00 to $233.00 and gave the company a "buy" rating in a research report on Tuesday, January 14th. JPMorgan Chase & Co. increased their target price on Fiserv from $199.00 to $227.00 and gave the company an "overweight" rating in a research report on Wednesday, October 23rd. Jefferies Financial Group boosted their price target on Fiserv from $195.00 to $200.00 and gave the stock a "hold" rating in a report on Tuesday, October 22nd. Morgan Stanley lifted their price target on shares of Fiserv from $220.00 to $258.00 and gave the stock an "overweight" rating in a report on Wednesday, December 18th. Finally, Seaport Res Ptn upgraded shares of Fiserv from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, January 14th. Three equities research analysts have rated the stock with a hold rating, twenty-two have given a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $224.00.

Read Our Latest Analysis on Fiserv

Insider Buying and Selling

In other Fiserv news, CAO Kenneth Best sold 20,821 shares of the firm's stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $214.61, for a total value of $4,468,394.81. Following the completion of the transaction, the chief accounting officer now owns 38,771 shares in the company, valued at $8,320,644.31. This trade represents a 34.94 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. 0.75% of the stock is currently owned by insiders.

Fiserv Stock Performance

NYSE:FI traded up $2.59 during trading hours on Thursday, reaching $215.10. The stock had a trading volume of 1,329,105 shares, compared to its average volume of 2,446,577. The stock has a market cap of $122.37 billion, a P/E ratio of 41.46, a price-to-earnings-growth ratio of 1.37 and a beta of 0.94. The stock has a 50 day simple moving average of $208.86 and a 200 day simple moving average of $190.36. The company has a debt-to-equity ratio of 0.85, a quick ratio of 1.07 and a current ratio of 1.07. Fiserv, Inc. has a 12-month low of $137.13 and a 12-month high of $223.23.

Fiserv Company Profile

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Featured Stories

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.