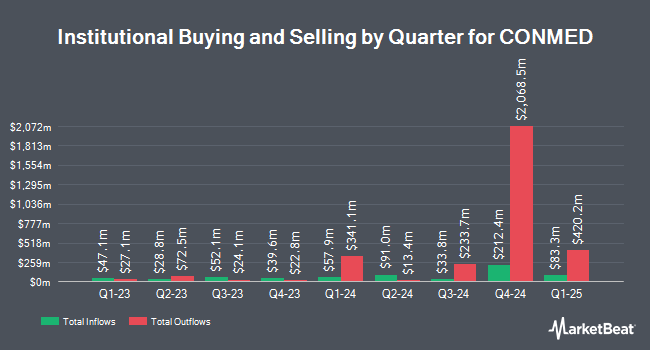

Fisher Asset Management LLC lifted its holdings in shares of CONMED Co. (NYSE:CNMD - Free Report) by 5.5% in the third quarter, according to its most recent filing with the SEC. The firm owned 295,290 shares of the company's stock after acquiring an additional 15,512 shares during the period. Fisher Asset Management LLC owned approximately 0.96% of CONMED worth $21,237,000 as of its most recent filing with the SEC.

Other institutional investors have also made changes to their positions in the company. Public Employees Retirement System of Ohio raised its stake in CONMED by 29.1% during the first quarter. Public Employees Retirement System of Ohio now owns 47,595 shares of the company's stock worth $3,811,000 after acquiring an additional 10,736 shares in the last quarter. Kempner Capital Management Inc. bought a new position in CONMED during the 2nd quarter valued at about $6,480,000. Confluence Investment Management LLC acquired a new position in CONMED in the second quarter valued at about $3,526,000. M&G Plc bought a new stake in CONMED during the second quarter worth about $9,117,000. Finally, Fifth Third Bancorp increased its holdings in shares of CONMED by 44.9% during the second quarter. Fifth Third Bancorp now owns 26,163 shares of the company's stock worth $1,814,000 after buying an additional 8,112 shares in the last quarter.

Wall Street Analyst Weigh In

Several research analysts have recently commented on the company. Needham & Company LLC reissued a "buy" rating and issued a $97.00 target price on shares of CONMED in a report on Thursday, October 31st. StockNews.com lowered CONMED from a "buy" rating to a "hold" rating in a research note on Friday, November 8th. Stifel Nicolaus cut their price target on CONMED from $88.00 to $76.00 and set a "buy" rating for the company in a report on Thursday, August 1st. Wells Fargo & Company decreased their price objective on shares of CONMED from $77.00 to $71.00 and set an "equal weight" rating on the stock in a report on Thursday, August 1st. Finally, Piper Sandler lowered their price objective on shares of CONMED from $95.00 to $80.00 and set an "overweight" rating for the company in a research report on Thursday, August 1st. Two research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $79.80.

Get Our Latest Research Report on CNMD

CONMED Trading Down 1.0 %

Shares of NYSE:CNMD traded down $0.73 during midday trading on Thursday, hitting $73.16. The company had a trading volume of 288,467 shares, compared to its average volume of 485,857. The company has a current ratio of 2.27, a quick ratio of 1.06 and a debt-to-equity ratio of 1.01. CONMED Co. has a 12 month low of $61.05 and a 12 month high of $117.27. The firm has a fifty day simple moving average of $69.51 and a 200 day simple moving average of $70.52. The stock has a market cap of $2.26 billion, a price-to-earnings ratio of 17.38, a PEG ratio of 1.00 and a beta of 1.45.

CONMED (NYSE:CNMD - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $1.05 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.99 by $0.06. The firm had revenue of $316.70 million for the quarter, compared to analysts' expectations of $318.46 million. CONMED had a return on equity of 13.84% and a net margin of 10.23%. On average, analysts predict that CONMED Co. will post 4.03 EPS for the current year.

About CONMED

(

Free Report)

CONMED Corporation, a medical technology company, develops, manufactures, and sells surgical devices and related equipment for surgical procedures worldwide. The company offers orthopedic surgery products, including BioBrace, TruShot with Y-Knot All-In-One Soft Tissue Fixation System, Y-knot All-Suture Anchors, and Agro Knotless Suture Anchors, which provide clinical solutions to orthopedic surgeons for the augmentation and repair of soft tissue injuries, as well as provides supporting products that enable surgeons to perform minimally invasive sports medicine surgeries.

Featured Articles

Before you consider CONMED, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CONMED wasn't on the list.

While CONMED currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.